Top 4 P2P lending apps of 2019 and their business models to study for your FinTech app development

Find top P2P lending apps of 2019 and also get to know about their business models and their source of revenue.

Peer-to-peer lending extends to grow in prevalence. It is getting a much more viable option for people who require the money and for people who want to invest their money.

With the changing times, the way we borrow money and the way we invest money is changing. In the previous era, if a loan was required to pay off your car or credit cards, the best possible option was to go to a bank or a credit union. People were forced to sit down with a loan officer and wait for them to tell whether the loan could be approved or the numbers needed to be crunched. The traditional investing always included a broker whether it be online or in-person.

But since there has been an advancement in technology and digitalization being embraced in every field, people prefer going to each other instead of going to banks and brokers. Peer-to-Peer lending is all about helping each other rather than relying on big banks with huge interest rate.

Peer-to-Peer lending has skyrocketed with the creation of Prosper around 2005. According to a study, since the year 2006, P2P lending has seen an annual growth of about 110 percent. And we do not find it slowing down either. With more and more marketplaces leaping every year, the prospects have become overwhelming.

Let’s study some of the best Peer-to-Peer lending apps and the takeaways from these apps for your business venture:

1. Prosper

Prosper app is one of the oldest one dealing with P2P lending in the market. The Prosper platform was founded in 2005. They were the very first peer-to-peer lending marketplace in the U.S. They claim to have coordinated over $12 billion in loans to more than 770,000 people.

» Borrowing with Prosper

The borrowers can get personal loans up to $40,000 with a fixed-rate and a fixed-term of three to five years. The monthly amount is fixed for the term of the loan. You can even pay off the loan early without getting penalized. You can get an immediate look at what your rate would be. Once your loan is approved, the money gets transferred directly into your bank account.

» Investing with Prosper

If you are an investor, there are many options on loans to choose from. There are seven distinct risk categories to select from with their own calculated returns and level of risk.

2. Lending Club

Another P2P lender similar to Prosper is Lending Club. They started two years later than Prosper, in the year 2007.

» Borrowing with Lending Club

There are four different types of solutions offered by Lending Club for borrowers:

- Personal loans: Lending club offers loans up to $40,000 which can be used for any of your personal agendas like clearing off debt or paying off credit cards.

- Business loans: A business loan up to $300,000 is offered. There is a fixed term of one to five years without any prepayment penalties. The only condition to qualify is to be in business for at least 12 months, have at least $50,000 in annual sales, having a good business credit, and own at least 20 percent of the company.

- Auto refinancing: The Lending Club app also makes it possible for you to go for an auto refinancing loan.

- Patient solutions: The app also works with doctors all over the country. They help you to finance your medical bills. You can get up to $50,000 for all sorts of bills and surgeries—including hair restoration, fertility, and weight loss surgery.

3. Peerform

The P2P platform Peerform was founded in the year 2010. The founders were a group of Wall Street Executives who had experiences in both finance and technology. They had a perfect combination to start a P2P lending platform. They wanted to provide their borrowers with a positive experience and with a loan process that was clear, fast and fair.

» Borrowing with Peerform

Borrowers are offered loans from $4000 to $25000. The rate of interest is fixed at 5.99 percent. There is an origination fee of 1 to 5 percent when the person receives a loan but that is just for one time.

» Investing with Peerform

The investors are allowed to choose between two different types of products with Peerform. They are Whole loans or fractional loans. You can also customize your investment with the customization options that are available so you can get the most diversified selection possible.

4. Upstart

Upstart is another innovative Peer-to-Peer lending platform. This platform was founded by 3 ex-Google employees. Along with the P2P lending platform, they have created a spontaneous software for banks and financial institutions.

The unique thing about Upstart is how they determine risk. They have created a system that uses Artificial intelligence to assess the risk of the borrower. This strategy of usage of technology has significantly lower loss rates than some of its peer companies.

» Borrowing with Upstart

Upstart offers loans from $1,000 up to $50,000 and their rates as low as 8.85 percent. The terms are between three to five years and there is no prepayment penalty also.

Upstart uses its artificial intelligence to not just look for your FICO score and years of credit history, but they also consider borrower’s education, area of study, and job history before concluding your creditworthiness.

» Investing with Upstart

Unlike other P2P platforms, investing with Upstart allows you to set up a self-directed IRA using the investments from P2P lending. All investors are attracted to this unique feature.

Scope of P2P lending and Coruscate as your technology partner

Now is a great time to invest in the development of P2P lending. The global P2P lending industry is valued at $3.5 billion in the year 2013. After 2 years, in the year 2015, it was valued at $64 billion. The P2P market size is expected to be worth $1 trillion by 2050. So, P2P lendings are going to be part of our lives for a longer period of time and the soon this is understood by the startups the more profits they will earn.

If you are planning to develop a FinTech application, we can help you out with the best selling features in the market and an app with an amazing user interface to attract your users.

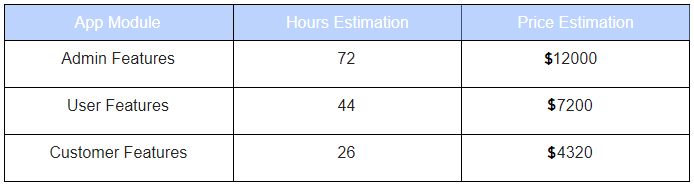

Here is a chart showing the cost of FinTech app development having basic features:

We are happy to help you with any further queries regarding P2P lendings and FinTech app development. Feel free to connect with us via contact us form and you can also ask for a free demo.