How to build a profitable payment infrastructure which processes millions of payment transaction requests in a day, like Uber?

Taxi app development is a complex task. All modules of the taxi app should be reliable, scalable and flexible to deliver an impeccable experience to the users. Top ride-sharing companies are regularly updating their apps and powering apps with the cutting edge technologies which support high speed and high scalability at the same time.

One of the most important modules of the taxi app is its payment module. Building a robust payment infrastructure demands the highest ever accuracy. Multiple payment methods and the need for more scalable payment infrastructure are making it more difficult. However, with the proper use of APIs, SDK and payment processors, taxi app development companies can put together an almost error-free payment infrastructure for the taxi app. One of the top ride-sharing companies, Uber is handing more than 15 Millions payment transactions in a single day, thanks to its next-gen payment platform.

In this blog, we will discuss the importance of the precisely integrated payment module in the taxi app, the problem associated with the payment infrastructure, and how Coruscate Solutions can engineer a scalable and reliable payment infrastructure for your taxi app.

Why payment infrastructure of the taxi app should be as error-free as possible?

As we have discussed earlier, the payment module demands the highest ever accuracy. Even a small bug in the payment module of the taxi app can lead to a big financial loss. A top taxi app development company like Coruscate Solutions can build payment infrastructure in such a way that it prevents lack of payment, duplicate payment, incorrect currency conversion, incorrect payment, and dangling authorizations.

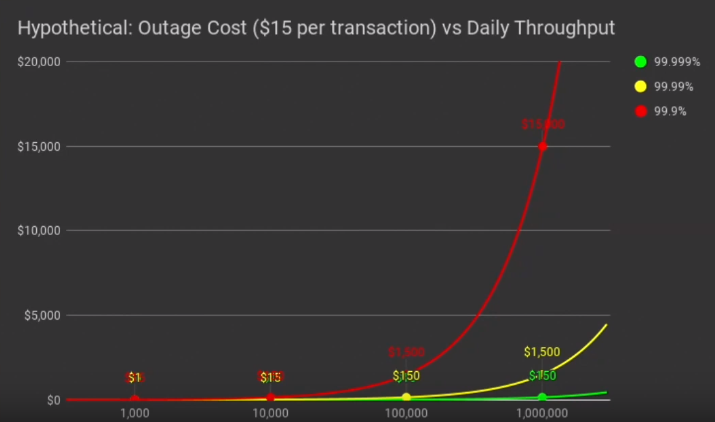

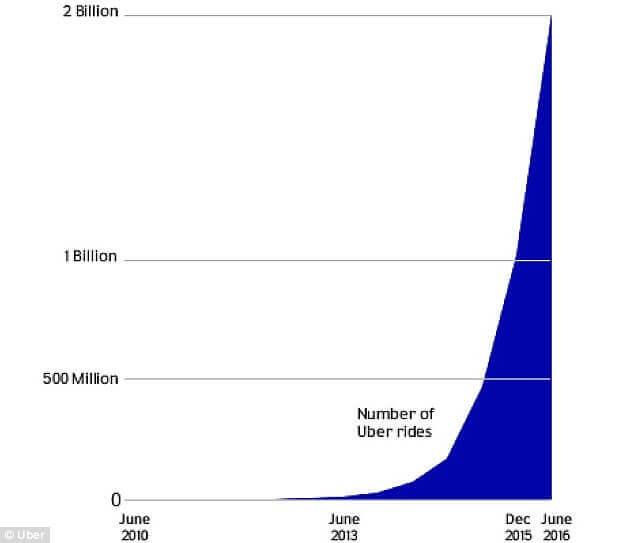

Following is the graph from the Uber’s Payment Platform Engineering Team, which clearly depicts how a small bug in your taxi app’s payment module can harm you financially.

The graph represents three scenarios. After studying these scenarios, you will get to know why it is devastating even if a taxi app development company narrowly missed an approach to build a payment infrastructure which is as error-free as possible.

What is the major problem associated with the taxi app payment infrastructure and what is the solution for it?

What is the major problem associated with the taxi app payment infrastructure and what is the solution for it?

To understand the major problem associated with the taxi app payment infrastructure, we will first understand the concept of PSP and payment gateway. PSP (Payment Service Provider), which we generally refer as Payment Processor, is nothing but the processor which handles payment from the various channels like credit cards, debit cards, Apple pay and Google pay. On the other hand, payment gateway transfers the payment related data to the payment processor from the server of the taxi app. Though a single payment processor does its task perfectly, a few ride-sharing companies prefer to establish payment infrastructure with more than one payment processor.

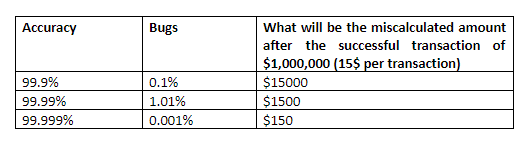

The problem associated with the taxi app payment infrastructure is related to the duplicate payment. For example, you attempt to pay $15 by credit card. Payment gateway A sends that data to Payment processor A and Payment processor A processes the payment. But due to the connection error, the acknowledgment message can’t reach to you. Since you haven’t received any acknowledgment message, you try to pay again, by using Android pay method. You pay the money, payment gateway B sends the data to payment processor B and payment processor B processes the payment. In this way, you are charged twice, which is, of course, not a pleasing moment for anyone.

However, a few top taxi app development companies know how to fix this problem. To solve the duplicate payment problem, they are bringing in the storage option. The memory unit stores each and every payment request. It also tracks every request and response before making the call for another request. In this way, it prevents the call for the second payment request until the payment gateway doesn’t get the status of the first request from the payment processor.

Now, let’s understand how Coruscate builds a complete payment infrastructure like Uber which offers high scalability and handles more transaction requests than others?

How to build a complete payment infrastructure for taxi booking app?

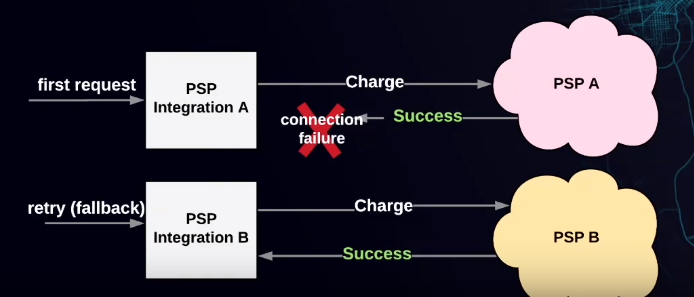

In order to get insight into Coruscate’s expertise, assume a scenario where a user pays by using Google pay method. To make it simpler, let’s divide the payment process into two – the client-side processes and server-side processes.

Talking about the client side processes, when a user installs the taxi booking app, the app asks for the personal details. With the personal details, the app also asks for the preferred payment method. Once the user adds the payment method, the app creates the payment profile of the user which contains the data of the preferred payment method and a unique ID. Now, whenever a user attempts to book the ride, app crawls through payment profile and many other processes. But it all happens on the server side.

When a user books the ride, the app fetches the payment profile. App has the payment profile in the form of ‘nonce’ which is a one-time usage token. In the next step, it sends the pick-up request with the data of payment profile to the server. The server contains payment gateway which exchanges the payment information with the payment processor, Braintree. It sends a token back to the server. It also confirms the user’s credit and shares the credit report with the server. If the user has enough credit to pay the fare, the server confirms the pick-up request. Here, Braintree, a payment processor is the deciding factor. It is responsible for transferring the amount from the user’s bank account into the taxi app owner’s bank account. Braintree is one of the most popular payment processors. Companies like Uber and Airbnb are using Braintree payment processor to streamline their payment processes. The payment processor is not only making the payment process efficient but avails app owners to earn more revenue. To justify it, let’s understand which challenges Uber has overcome after migrating to Braintree.

How Braintree helped Uber to be a billion dollar company?

There was a time when Uber’s payment infrastructure was not enough capable to convert currencies in the real time. Due to this limitation, users of the European countries had to pay in US dollar, rather than in Euros. This lack of compatibility was annoying the users. But after Uber adopted Braintree payment processor, Uber witnessed a magnification in the number of users like never before. Following graph depicts the unbelievable increase in the number of users after Uber rebuilt its payment infrastructure.

Braintree payment processor supports all popular payment methods like Google pay, Apple pay, Bitcoin, Paypal, all credit cards and debit cards. It also endows the ability to charge in 130 different types of currency.

Apart from the Braintree, there are many other payment processors too.

An overview of the top payment processors which you can use for your taxi app

As we have discussed earlier, the payment processor plays a big role in the success of the app. It does not only make the payment process productive but also helps app owner to earn more revenue. However, choosing an equitable payment processor is always a hard task. But a genius taxi app development company like Coruscate Solutions will surely come to aid and choose the best suitable payment processor which suits your needs.

Stripe

Stripe is the USA based company which allows individuals and businessmen to make and receive payments over the internet. It offers fraud prevention and banking infrastructures which are required to run an online payment system. It supports different payment channels like cards, wallets, and local payment methods. It also offers an easy invoicing feature. The transaction fee of the stripe is 2.9% + 30 cents per transaction.

Paypal

Paypal is another USA based company which is providing a secured payment processor and payment gateway for the online transaction. Paypal is charging the same amount as Stripe, but it charges extra for the services like international cards, recurring billing, advanced fraud protection, and micro-payments.

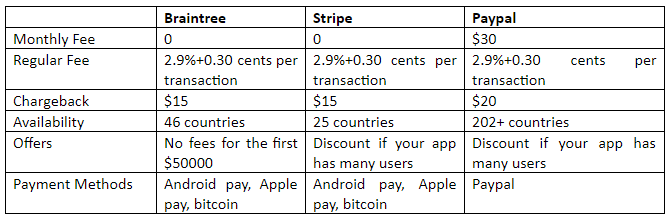

To get the idea of top payment processors in a more comprehensible way, please refer the following table which represents all important details that you should know.

What are the benefits you can derive from the payment processors?

What are the benefits you can derive from the payment processors?

The payment processor is certainly the driving force behind popular mobile applications. There are many business advantages of the payment processors which you as an app owner should never neglect.

- A payment processor enables users to pay through different methods.

- Users will get payment receipts directly to their inbox.

- Payment processor also makes the online money transaction secured.

- With the proper payment processor, you can charge the customer in their local currency.

- Users can also pay, using international credit or debit cards.

- A refund can be easily performed.

- You can maintain and track all of the payment details in a more structured way.

So, if you are looking for the taxi app development company to develop a payment integrated taxi app, contact us today for the free consultation.