Reasons to get ready with FinTech app development, and how ZestMoney is providing cardless EMIs

This blog is for the startups who are looking forward to bring their idea of FinTech to life with the help of FinTech app development.

FinTech has always been a part of the discussion these days. But what exactly is FinTech and what do the startups need to know regarding the growth of FinTech and why is it being told to gear up and hire Fintech app developers to embrace the new world of FinTech?

Due to the continuous growth of mobile and the internet in the past few years, the thought process of the businessmen and entrepreneurs has changed in a lot of ways. They are thinking like never before. Customer is the main focus of the ideas in the new era and everyone is working towards providing customer satisfaction. The entrepreneurs in the financial sector are embracing technology in order to provide the customers with the ease of accessibility and solve the problems faced by the users during their daily transactions. People these days are trying to disrupt the traditional methods in the finance sector by implementing the technology.

The technology, like never before is trying to compete and emerge victoriously when it comes to delivering the financial services.

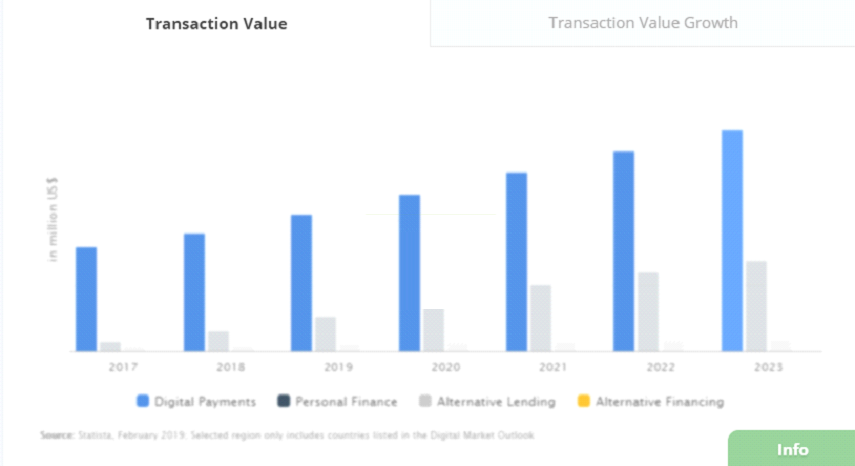

There are many FinTech apps coming up in the market daily with some ideas to improve customer service with their newly launched technology. Here is a graph from Statista showing the growth in digital payments over the year.

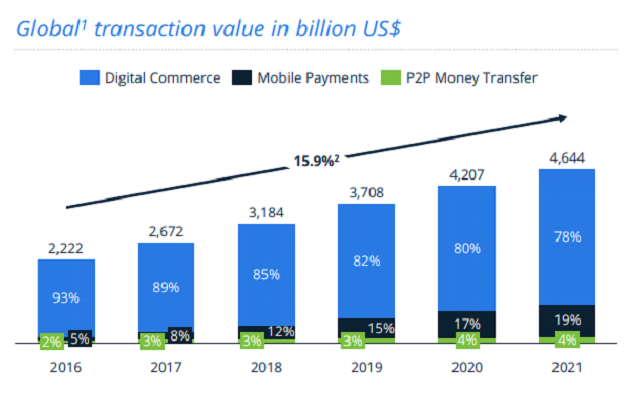

Here is a chart from a Statista report showing the global transaction value until the year 2021.

After the last decade witnessing a considerable disruption in the traditional banking industry, there has been tremendous digitalization in the areas of payments, lendings, wealth management and even the retail banking. The change has not been limited to the FinTech industry only but it has been welcomed by the e-commerce industry as well.

Various countries are adopting and accepting the new ways of digital payments, lending businesses, and mobile wallets. There are a lot of lenders coming up with the growing technology in the developed and the emerging nations as well. These lenders make money by charging a fixed service fee from the borrowers or charging the partner banks with some transaction fee.

According to a report in Statista, both the domestic and international digital transfers is growing day by day be it in the US, the UK, India or China. There is an increase expected in this sector of the market from US$151 billion to UD $381 billion in the year 2022. The blockchain fundings are also going up with 144 startups managing to raise US$640 million in the year 2017.

That been said, in the continent of Asia, Fintech is still hot and rising. New startups are making their way in the competition and going up the chart. ZestMoney, an Indian startup is the latest example in support of the point. According to a report in Techcrunch, ZestMoney has raised $20 million funding in its Series B round to grow its digital lending services. The recent funding takes the startup’s funding to a total of $42 million.

What is ZestMoney?

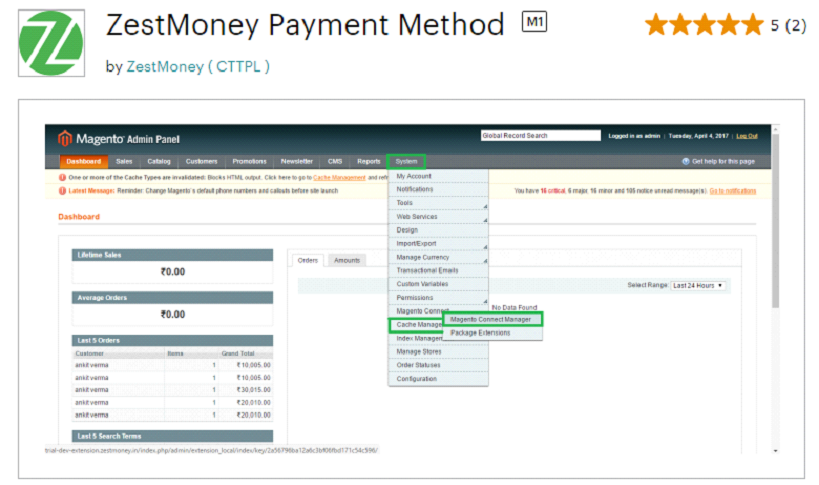

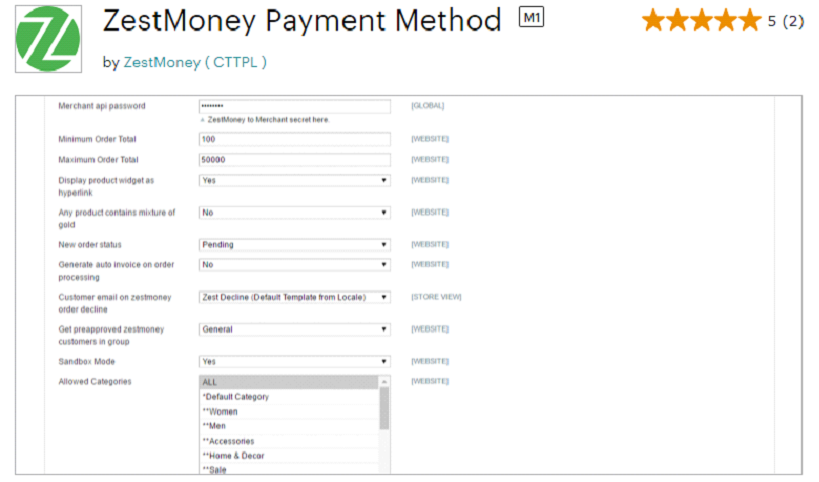

Precisely, ZestMoney is a payment platform in India. It allows the customers to buy items on EMI without actually using a credit card.

ZestMoney was founded by Lizzie Chapman along with Priya Sharma and Ashish Anantharaman in 2015. Lizzie is the current CEO of the company with Priya being CFO and COO and Ashish is the CTO of ZestMoney startup. They met when Lizzie moved to India from the UK, working at Wonga. The previous venture, however, ended up.

ZestMoney, unlike Wonga, is absolutely customer-oriented loans company. The company works with customers who do not have any credit card or have a limited credit history. They work with the consumers who often have limited assessable data and help them to build a profile which makes them credit-worthy. ZestMoney was selected as the Fintech Startup of the year in the India FinTech Awards (IFTA) 2017 which were organized by India FinTech Forum.

Working of ZestMoney

The number of debit and credit cards is increasing day by day but most Indians still prefer debit over credit cards. According to a report by Reserve Bank of India 661.8 million people used debit cards whereas only 24.51 people used credit cards. Customers are unable to buy the online products on EMI more often as they do not have a credit card.

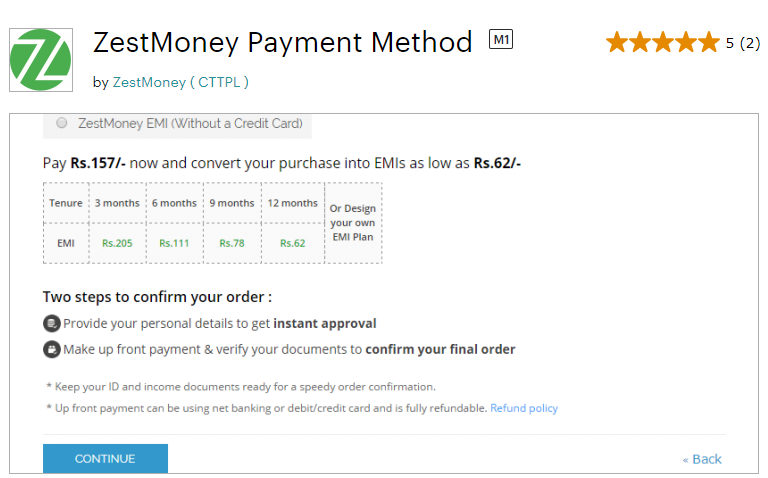

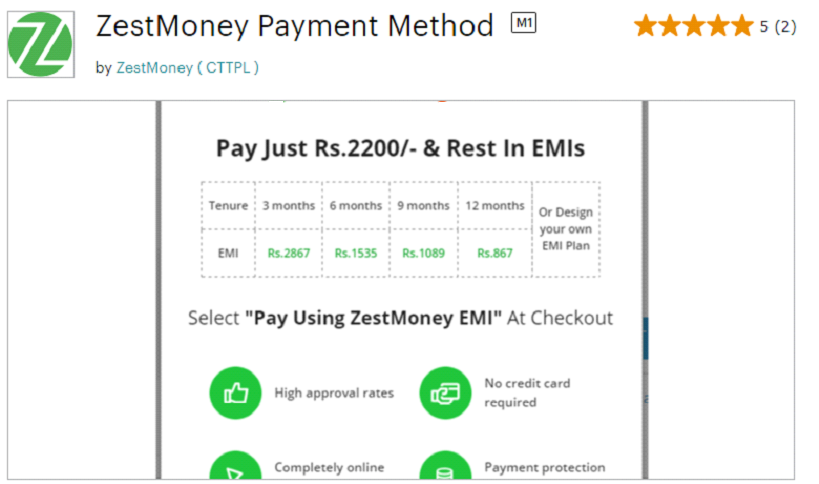

To resolve this issue, the ZestMoney platform aims to provide a cardless EMI option for such users. The platform allows users to buy smartphones, electronic gadgets, jewellery, and other such high-priced products from the partner merchant’s website. These EMIs can be paid in easy without the involvement of a credit card.

The process usually begins with small loans which when repaid successfully, the loan grant amount grows. There are more than 800 merchant partners which include Flipkart and Amazon as well. Generally, the transactions are carried out online. However, Xiaomi is another partner helping ZestMoney to go for offline transactions too.

Banks are not usually benefitted with small loans but when some FinTech startups like ZestMoney are involved, these startups manage to aggregate the smaller customers to make them an attractive partner at Bank scale.

Scope of FinTech app development

According to the CEO of ZestMoney, the new age FinTech industry is really optimistic and offers good opportunities. Being a startup, if you need an idea for getting your feet wet in a business venture, think about the rising FinTech market in Asia and the US. This might prove an opportunity to make it big in the money market. All you need is to hire expert FinTech app developers who can help you build a good online presence with an app with unique features keeping in mind the details of your business.

We have entertained over 5000 FinTech app development queries and have proved that we are the best when it comes to mobile app development by developing over 200 + successful projects. Connect with us for further discussions regarding the cost and ask for a free demo of the Fintech app.