Scope for Fintech App Development and Fintech startups : Know Fintech startups like MoneyLion and Zeta’s success story

As conventional banks are being much slower make to help the increasing financial needs of their customers, there are a huge number of fintech startups that have risen over the years across the globe to fill the gap.

These “neo banks” are helping small and medium-sized businesses automate their finances and access many additional features in different parts of the world including the US.

A new fintech startup has emerged in the U.S. which is step by step moving closer to the unicorn status. MoneyLion is headquartered at the New-York City provides its customers with financial advice and access to loans and other services. Its branches are spread at San Fransisco, Salt Lake City, and Kuala Lumpur MoneyLion describes itself as a mobile bank. It operates as part lending, part savings, and part wealth management app. The all-in-one platform of MoneyLion enables users to join all their bank accounts and credit cards. They also allow the users to receive personalized advice on how to better spend their money and secure loans from within the app.

According to a report in TechCrunch, the startup generates most of its revenue from subscription services. These subscription services cost $19.99 per month for the customers as told by Dee Choubey, CEO and founder of MoneyLion. The subscription offers bundles banking, core investment management and access to financing for the customers who buy it.

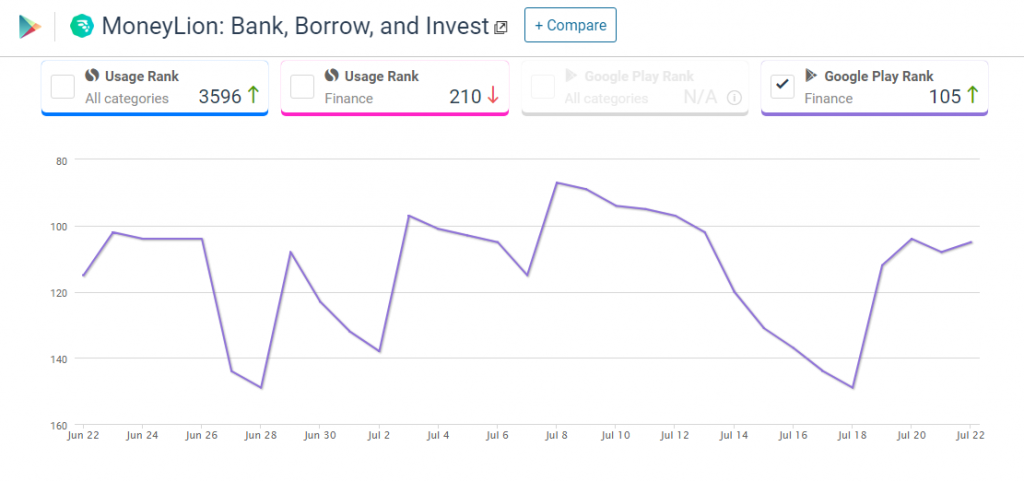

Here is a graph from Similarweb showing the app ranking of MoneyLion in the Google Play store:

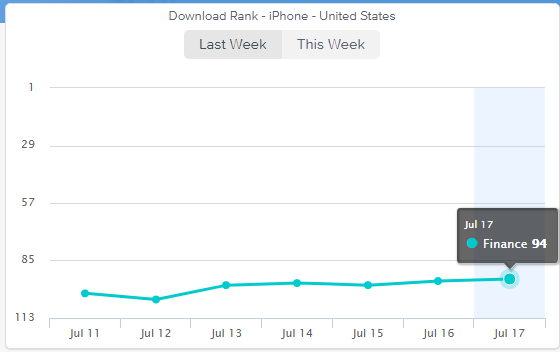

Another graph from App Annie to show MoneyLion’s app ranking in the last week. The app ranked 94th in the Finance category.

MoneyLion is basically making money more approachable for its users to help them in having better control over their finances. According to the information available on their website, since the launch in 2013, they have more than $5+ million savings, 200,000 loans originated, and more than 1 million bank accounts linked.

There are more than 5 million customers using the MoneyLion app that includes free users, who are able to access some core banking features at no cost.

The company has recently raised $100 million in a new round to accelerate its growth in the U.S. market. The company has also raised $60 million in venture capital and debt in Q2 2018. The MoneyLion has raised more than $200 million till today. The current round has made the value of the startup up to $1 billion.

MoneyLion will use the newly raised money to refine its subscription offerings, finance model and add new features to keep its existing users attracted to the platform. Last year, the MoneyLion app bandied out over $12 million in cashback rewards to its members. 70% of users of the MoneyLion app also saw their credit score climb up by 30 points.

The company aims to invest heavily in broker-dealer capabilities, training capabilities and stock investing capabilities. They are planning to approach the financial services like Netflix approaching content in order to keep the users hooked to the platform.

Another reason for you to go for fintech app development: Zeta’s success

The startups which are looking to expand the reach of financial services continue to receive a nod from investors. Another example of such fintech firm is Zeta that runs a full-stack neo-banking platform. The company also offers enterprise payment solutions. The company was recently funded by Sodexo BRS. According to a TechCrunch report, the raised amount was less than $60 million. It is the first time for the company to raise money from an outside source.

Zeta currently operates in Asia and Latin America. The company has its potential clients companies and banks looking to bring retail and corporate fintech products. The Zeta cloud-native neo-banking platform supports the issuance of credit, debit and prepaid products.

The company’s enterprise solutions feature work with TnE cards, P-cards, expense management, salary disbursement, and corporate gifting.

The company has now accumulated over 2 million users, and three different banks and financial institutions. This also includes Sodexo, which use Zeta’s platform, and more than 14,000 corporate clients along with Amazon.

Various banks in India are using Zeta’s corporate gifting service. The newly raised capital will be used to expand the financial business for the company in regions like the United States, United Kingdom, Europe, and Southeast Asia, Turakhia and Ramki Gaddipati. The company has signed contracts with many partners to aid the expansion in the next six months. Zeta employs about 450 people currently. It also plans to grow its team and set up offices in many more places across the globe.

Zeta is planning to disrupt the traditional banking structure. They are building a new and innovative technology stack that enables interesting use cases for banks and other bank-line financial institutions that want to issue credit, debit, or prepaid products. Through these products, they want to provide their customers with better functionalities.

Sodexo has been an important partner of Zeta since the year 2017 and they have a vision about how it could bring more value to Zeta. This investment will enable the Sodexo group to profit from Zeta’s complete suite of solutions and offer a seamless payment experience to the users. Zeta and Sodexo are working together on expanding Zeta’s platform across several Sodexo subsidiaries in various regions around the world.

The growth of these fintech startups depicts the scope the fintech industry has in the time to come. If you are an entrepreneur or a startup looking for a new business venture, finance could be the sector you can go for. You can depend on Coruscate as your technology partner and guide as we can help you out with the detailed market research and latest technology to power up your business. Connect with us for any further details regarding the Fintech app development.