Mobile Banking App Development: Top Trends and Strategies to Consider

At least 28% of the consumers use mobile banking via smartphones and tablets. 25% of the top global banks have gone mobile and offer quality mbanking solutions to their customers.

These numbers tell a lot about how m-banking has evolved from just being another mobile solution to a necessity for the growth of the banking and finance industry.

Why is there a growing need for mobile banking solution?

Visibility has become an issue for banks, with an increase in the number of banks and a growing number of banking solutions.

Banking websites don’t offer a seamless solution to the users and make it very difficult for them to complete their transactions.

These challenges need to be addressed, else they will impact the revenue, and damage the customer experience. The best way to address these challenges is by developing a mobile solution for the banking industry.

The mobile devices reduce the overall cost to the bank for serving a customer. The profits increase as a result.

With immense opportunities and untapped potential available, mobile banking solutions are indeed a must for modern customers.

Let’s begin with how to develop a mobile banking solution? This includes the things to consider as well as the top tips.

Successful Mobile Banking App Solutions

Want successful mobile banking app development? Here are a few tips that should help you get through.

Get to know the target: Have you defined the target audience for your banking app? If not, then you ought to begin with this before you plan the solution.

- Customers interact with the banks at least 15-20 times in a month.

- 45% of the baby boomers use mobile banking solutions.

There are millennials who are not satisfied with the mobile banking solution that is being offered to them at present. The ones who are using the mobile app frequent the solution for particular features, while the ones who don’t use are bothered by the lack of usability and the sub-par user experience made available in these applications.

When you are developing a mobile app for the target audience you have defined, it is important to understand why they are using the application, and what are the barriers they are facing. A clear understanding of the features they need and the app usage behavior will help you know the mobile banking solution you ought to develop for them.

Before launching the mobile app, create a beta app, include the features that you believe the target market uses, and release it to the market. Check the usage behavior and you will understand what they actually like or dislike about the application.

The data and credit card breaches are definitely affecting the banking industry majorly. It is important that you have this covered in the mobile app solution you are offering to the market. When planning a mobile app solution for the banking industry, make sure you incorporate the security policies.

- Enforce the existing security policies to your mobile solution as well and make sure they are technologically enforced and are aligned to the user compliance.

- Your application servers should be configured in a way that they don’t allow phishing emails and prevent from sending spam emails to the devices.

- Incorporate an encryption program to your application to ensure high-level digital security and compliance to latest standards.

- Make sure you have incorporated the latest digital signature technologies for high-level security within the app.

- Check for the password strength. Make sure you have incorporated an in-built checker that notifies the password strength immediately to you.

When developing mobile banking solution, you also need to educate the customers about the possible issues that they might face and the plausible risks. Make sure you guide them through using the mobile app, and what things they should take care of in order to keep the app updated and thorough.

It is important you keep the app as simple as possible. A complex mobile app can lead to poor mobile logins, unintuitive app solution, lack of search features and can offer too many functions at a go, as against what is needed by the app solution.

Instead of complicating the usage, and throwing users away from your app, keep it simple and include just as many features as the user would use. Keep the loading time to the minimum in order to ensure quick and easy loading of the app. You can either build different apps for different functions or, keep the app as simple as possible.

The UX design should be minimalistic. Don’t try to add too many elements within the app but, make sure that you make space for the following in your application.

- Include an intuitive navigation for the application so that the users don’t need a guide and are not thrown off guard with the app usage.

- Provide shortcuts for certain features within the app for easy usage.

- Understand the risk involved with the app usage, and underline your security arrangements accordingly.

- Devise a prototype for the app before you begin with development. Make sure you include all the possible gestures before you actually finalize the application.

- Design for the different devices and operating systems. The users within the target audience may not use the same kind of device or would not be logged into the same OS. The cache sizes as well as resolutions and other factors for the different devices differ, and you need to take that into account when developing your mobile app solution.

- Start with defining your app design for as many resolutions and device form factors as possible.

- Run the tests that are needed to know whether the application is in running condition or not.

- Install mobile app analytics to study the key metrics and to understand the overall functioning of the app.

Finally, you need to plan for the mobile app development, which majorly involves planning for the cost of development. It is important that you are aware of how much you have for the mobile application, and what all features and gestures you can include in the budget.

Before you start planning for the mobile app, talk to a few mobile app banking developers, who can help you with the actual cost of mobile app development, and what all features will be included in the cost mentioned.

Must-Have Features in your Mobile Banking App

If you have gone through the tips are ready with a plan, include these must-have features as part of your plan for completeness of the solution.

1. Account:

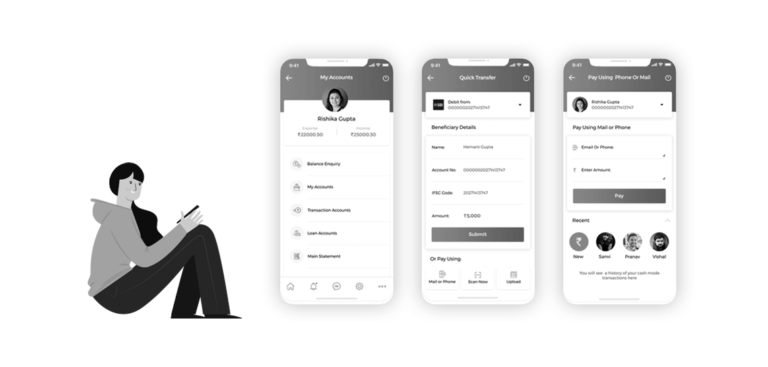

This feature will take you to your account and show you the balance amount in the account. If you have more than one account, then you can switch between the accounts. You can get your mini statement, as well as the statement for the duration mentioned with this feature.

2. Funds Transfer:

For quick transfer of money from your account to another account, in the same bank and otherwise, can be done easily with the help of this feature. You simply need to select the option, the payee and the amount. Within seconds, the amount is transferred into the other account. You also get options such as NEFT, IMPS etc. to transfer the funds.

3. ATM Locator:

If you want to withdraw cash but, don’t know where the nearest ATM is for your bank, then use the bank’s app to locate the ATM. The GPS incorporated within the app will help you locate the ATM.

4. Personalized Notifications:

The app can notify you about the new banking solutions, about the various features made available as well as the latest occurrences according to your interest. This feature will help personalize the notifications for the user.

In some of the new banking apps, biometric authorization has become a must-have feature, wherein the fingerprint or face scan can be used to recognize the person and allow them to use the mobile app. This has increased the security level.

Mobile app banking is being adopted largely by the banks and financial institutions to offer seamless and similar user experience across all channels. The m-banking solutions aim to reduce the service costs and the overall cost to the bank.

Coruscate offers mobile app solutions for the finance and banking industry with incorporation of security compliances thoroughly into the solution. We study the market before offering a solution.

Get a free estimate to discuss further opportunities for your banking app idea.