Hassle-Free Loans At Your Doorstep With Loan Studio

LoanStudio’s single line vision was to make loans accessible and applying for loans hassle-free

for their target market. They came to Coruscate with an idea about how they envisioned digital

lending. A challenging proposition with complex algorithms needed a simple solution that is

both functional and accessible.

Business Problems

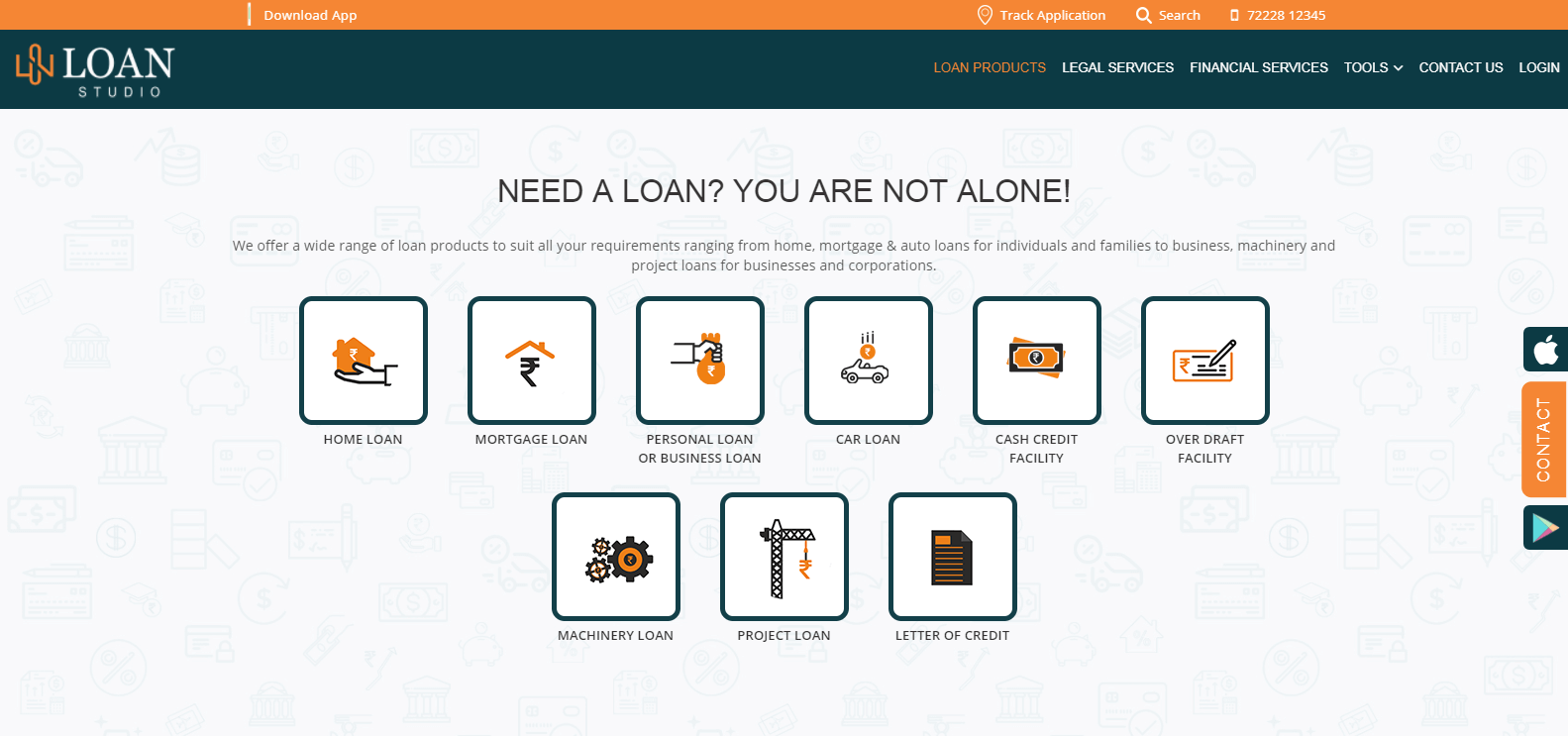

- TA simple process for the 7 different types of loan addressed by loan studio should be followed, updated, managed and verified by the application.

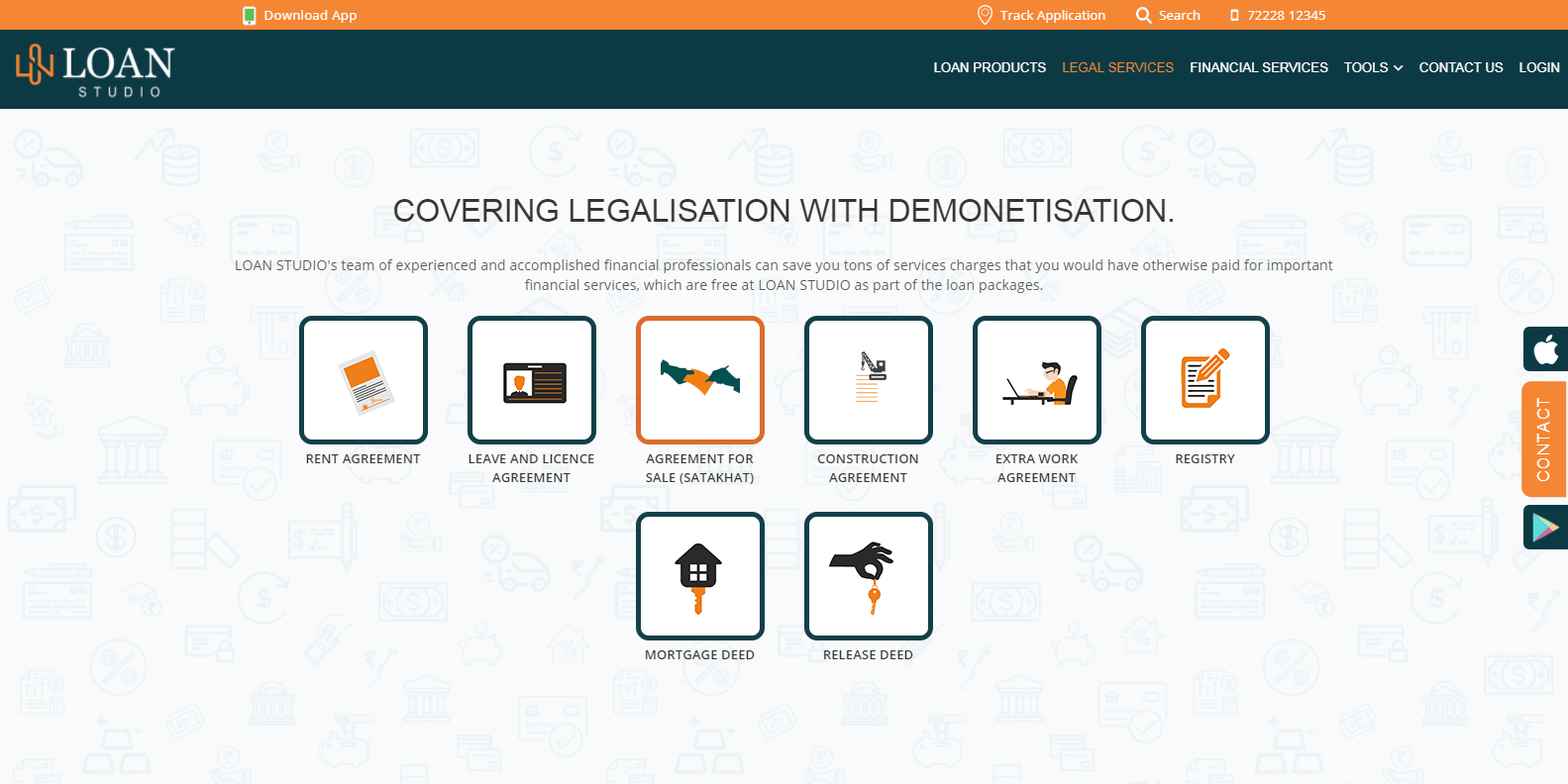

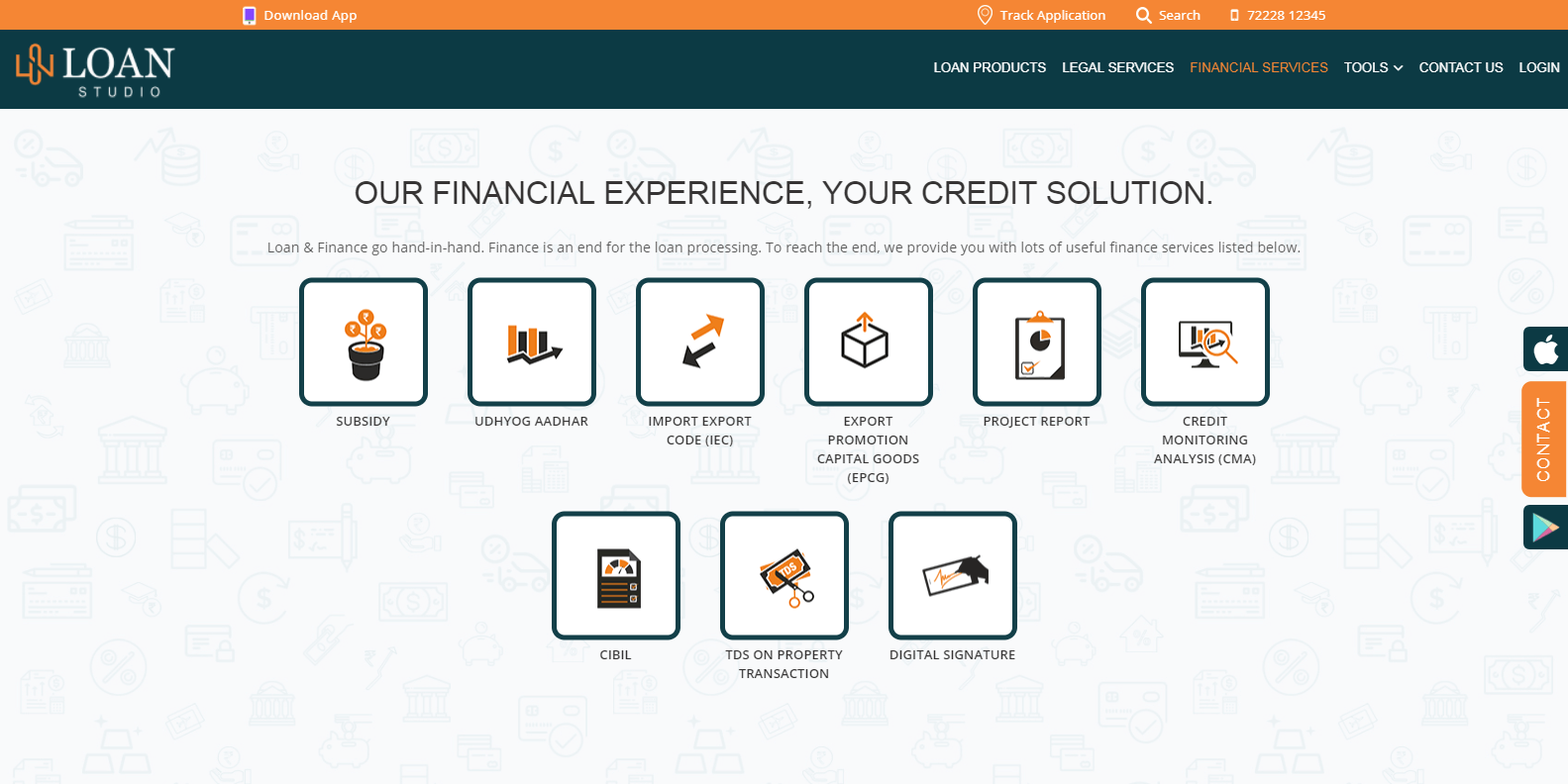

- Everything from managing documents to verifying against CIBIL score, and getting in touch with the banks should be done by the LoanStudio.

- The applicants should be able to view all the possible permutations and combinations with respect to bank, for their loan requirement.

- The applicants should be able to track their loans.

- The applicant should be able to apply for the loan at any time, and they should be able to calculate their interests and other necessary liabilities, without human intervention.

- The processes pertaining to start and end of the loan should be dynamic.

Challenges faced

- Initially a static application was created for the loan studio. It was only later that they asked for a dynamic website. This meant changes during the development phase. So, the entire plan and the development process had to be changed accordingly

- Admin permission for the different loan products as well as the checklist were different. These needed to be mentioned during the development phase itself. There was no product available for reference in this case, which made the whole design and development slightly challenging

Results

- The client saw an increase in the number of queries being raised with the new website.

- Each week the client was faced with at least 100 queries.

- The MoM conversions increased 2x times since the website was developed.

How our website solution helped loan studio achieve its mission?

We offered them a user-friendly, usable and functional website that would educate the borrowers, help them with the loan processes, etc. making their lives easy. A pre-defined checklist would be drawn on the website for each loan type, and the user would need to upload the documents accordingly. The solution offers a single-click upload to the users, making document uploading and managing or viewing the loan application easy.

Checklist

The loan studio, in sync with the bank, has prepared a comprehensive checklist that has noted down all the documents you might require. This reduces the hassle of connecting with the bank, and missing out on important documents right before you apply for the loan.

Three-step Process

Applying for loans is no longer hard. The three step process allows you to fill out a form, submit the documents, and link the preferred bank account.

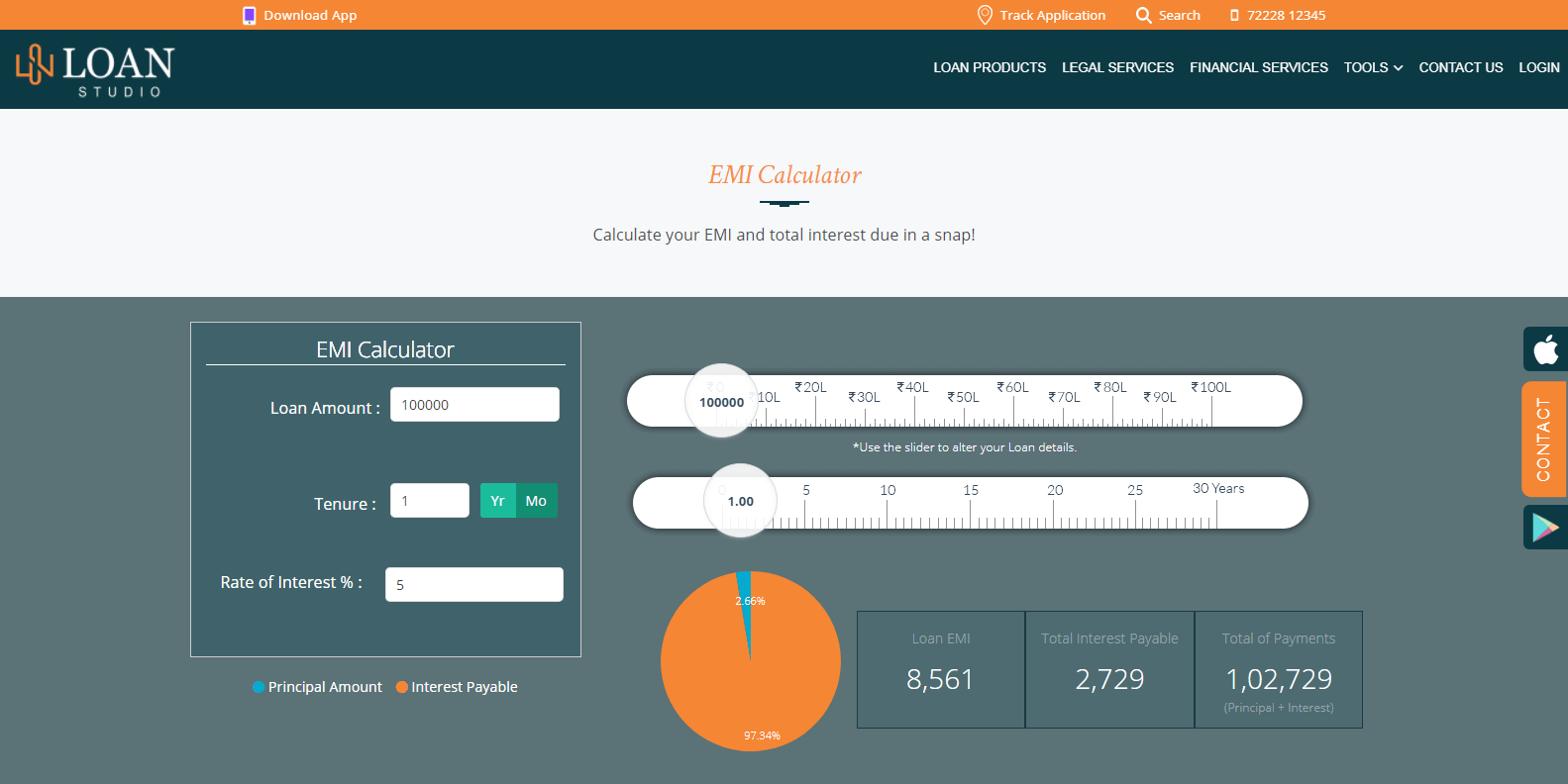

EMI Calculator

Know the EMI you might have to pay against the loan with this EMI calculator. You don’t have to rely on someone else to do it for you

Jantri Calculator

At any point of time, based on the Dastavej value of the property any user can easily calculate estimated Jantri rate applicable on the property.

Tracking

The users can easily track where their application is at present with this feature. They would know if the application would be accepted, or they would need to submit documents from this website tracking feature.