COVID – 19 Impacting the E-Learning market in China and the U.S.

China and the US dominate the global ed-tech landscape, each with eight unicorns out of 18 private companies with a valuation of over $1 billion.

China’s global education venture capital flow however reached $19.8bn, more than double the US’s $9.5bn since 2010, according to HolonIQ.

China is one of the fastest digitizing markets — with over 171 million digital learners already.

So how did the strength held by the nation that gave the world such enormous names as Coursera and Duolingo move on worldwide ed-tech startup bargains?

China profits by having 283 million students from pre-kindergarten to advanced education. By examination, the US advertisement is roughly 77 million students, in spite of the fact that the US is still observed as more grounded in advanced education.

Before Covid-19, it had the biggest online degree showcase, with in excess of 3,000,000 students concentrating completely on the internet, speaking to more than a $20bn market and developing quickly.

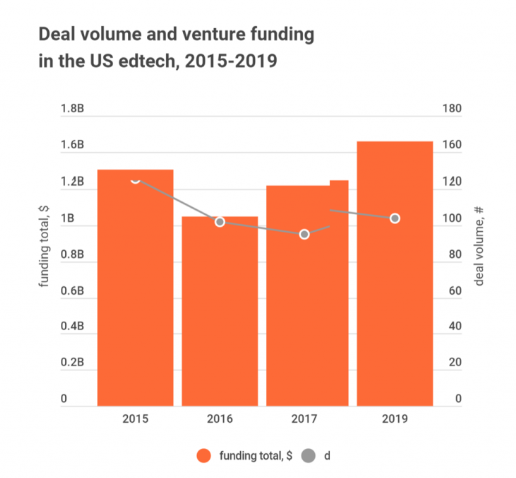

HolonIQ reports that the US began the most recent decade the quickest development in the ed-tech venture, which topped when LinkedIn procured web-based learning organization Lynda.com for $1.5bn in 2015.

In any case, following the most prominent exit in ed-tech history, the general US ed-tech speculation, not restricted by investment, began to contract.

“Speculators went to ed-tech however then immediately worked out that it was a totally different division than standard innovation,” says Patrick Brothers, a prime supporter of HolonIQ.

The reorientation of American financial specialists towards different areas corresponded with the venture blast in China and India. Differentiations between the US and Chinese markets added to the expanding speculation hole.

The Key Contrasts Among Chinese and American E-Learning Markets

Interest in China comes principally from local firms, despite the fact that they likewise empty cash into the US ed-tech.

For instance, in 2018, NetDragon, a Chinese gaming business, procured Californian education platform Edmodo. Simultaneously, cases, when a US organization enters the Asian market through procurement, are a lot rarer.

“Asian ed-tech markets are difficult to break into for the Western organizations,” says Steve Southwick, budgetary counsellor and CEO at Pointful Education, an organization that makes online educational plans for auxiliary students.

Among the principal impediments, Southwick brings up China’s notorious extraordinary firewall, the strength of print materials over computerized and high parental desires.

Demeanour towards spending on education additionally has a task to carry out. “Chinese and Asian guardians are considerably more ready to pay for their youngsters than western guardians,” says Patrick Brothers from HolonIQ.

He includes that the centre school and scholarly accomplishment in Asia is considerably more extreme.

Overall, over $132,000 from elementary school right through to college.

The US comes fourth with $58,000, and China 6th with around $43,000, revealed HSBC. Simultaneously, Chinese guardians could go through a similar measure of cash just to set up their kids for college.

Another highlight is that ed-tech in the US has been increasingly fruitful in advanced education, while in China, a large portion of the new businesses is K-12, concentrating on gaining from kindergarten to the twelfth grade.

“Up until the most recent couple of years, K-12 was where ed-tech overwhelmed, yet in the course of the most recent two years it has become post-optional centred,” reveals Brothers The PIE.

The circumstance is changing, and the interest turns towards the occupations and non-certify aptitudes side where the US has preferences.

One of the greatest late exits was selling New York’s coding training camp, General Assembly, to the world’s second-biggest HR supplier Adecco for $413m in 2018.

Another model is the US organization Guild Education that interfaces colleges and bosses. A year ago it turned into a unicorn, pulling in the most noteworthy measure of investment in the nation.

“Every class [in ed-tech] will advance towards profession training,” says Steve Southwick from Pointful Education. He sees the developing interest in functional projects and aptitudes procurement.

Nonetheless, US advanced education new companies face developing rivalry from charitable post-auxiliary online suppliers. During the pandemic, bunches of American colleges made their materials free.

In any case, Brothers accepts that both advanced education and K-12 “will have another gratefulness for web-based learning and computerized innovation”.

Obviously, social contrasts likewise assume a fundamental job in the selection of each innovation.

“China is aspiring to execute man-made consciousness (AI) in K-12, which just wouldn’t go on without serious consequences in the US,” says Brothers.

“It would be thought unseemly and penetration of security, while in China, it is thought of as an experimentation chance to discover strategies to advance the children beyond.”

Different contrast specialists name incorporate shifting degrees of access to gadgets and web and a more noteworthy direction on language learning in China, which isn’t the concentration in the US.

In spite of some unmistakable focal points that China has, financial specialists have not deserted the US showcase. An incredible inverse – adventure interest in US ed-tech organizations in 2019 was at a five-year high.

Regardless of the compression in the number of arrangements, adventure interest in US ed-tech organizations in 2019 was a five-year high in esteem, as per information from EdSurge.

The US pulls in financial specialists with its development centre points in Silicon Valley and Boston and a high grouping of world-driving colleges.

Asian organizations enter the US market to get to extraordinary innovation, educational programs and different applications that have been made in the US. The US profits by progressively developing innovation and ability in incorporating and understanding enlarged and augmented reality.

“The US had more opportunity to create and incorporate,” says Southwick. “Organizations here have demonstrated they had the option to succeed, to fund-raise, to chance capital.”

In any case, the coronavirus scourge will prompt movements in the US ed-tech market, and longer-term impacts stay questionable.

Worldwide endeavour store and seed quickening agent 500 Startups, the top financial specialist in advanced education ed-tech in the US, envisions a negative effect of Covid-19 on beginning phase speculation movement in 2020.

Simultaneously, it accepts that the current conditions have demonstrated that the world needs better systems inside the instruction area.

“500 stays keen on the ed-tech to advertise, especially as new practices come to fruition inside the area,” says Neha Khera, accomplice at 500 Startups, to The PIE.

Be that as it may, she stresses that clients’ capacity to pay might be decreased because of the current monetary atmosphere.

Alongside medicinal services and far off work arrangements, ed-tech is viewed as probably the most secure division in the coronavirus condition.

“Guardians and educators will be searching for arrangements,” trusts Steve Southwick from Pointful Education. “I think there is a gigantic measure of chances.”

Patrick Brothers from HolonIQ has no uncertainty the US ed-tech market will create in future yet questions about the positive effect of the pandemic.

“The inquiry in the US is whether Covid-19 will quicken the craving to utilize advanced or will it delay or hinder computerized selection,” includes Brothers.

Factors driving the E-Learning Landscape

- A Huge Learner Market

- The Willingness To Spend On Education

- Technological Advancements

- Room For Constant Cultural Change

- Increased Access

- Government Policies And Reforms

- Access To Capital

Create an Impact on the Global Market

Software solutions are changing the landscape of the education industry entirely. Although there are many great EdTech solutions available in the market, still many problems are there that need to be addressed.

We can help identify and validate the great idea and help develop an ed-tech solution from scratch. With our experience in the ed-tech industry and expertise in developing app solutions that fulfill your business goals.