How Upstart, a Fintech lending platform raised $50 million with the help of AI and machine learning technology?

The effortless credit is based on risks. Want to know why? It is the credit that really matters. Money is the most important part of life and affordable credit has always been a central idea to unlocking mobility and opportunity.

Peer to peer lending has come a long way since the financial meltdown and its not just a coincidence. It came around the time when the banks decided not to lend money to anyone. The decision brought many opportunities to the free market to provide the potential borrower with another way for people to borrow money. That is how the P2P phenomenon gained popularity. There are various technology platforms which help the consumers avail credit facilities.

One of the most popular platforms is Upstart which is the first platform using AI and machine learning to identify potential borrowers.

What is Upstart?

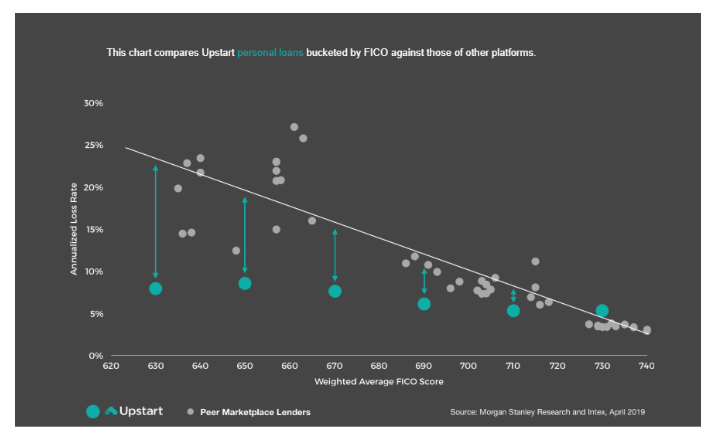

The company was founded by ex-Googlers including Dave Girouard, Paul Gu, and Anna Counselman. It was launched in April 2012. Upstart is the first online lending platform to leverage artificial intelligence and machine learning for providing personal loans with the help of non-traditional variables like education and employment for predicting creditworthiness of a potential borrower. They have an income and default model to determine the creditworthiness of a borrower. In addition to traditional criteria involving the FICO score, credit reports, and income they use academic variables before lending money. They identify high-quality borrowers even if they have limited credit and employment history by using their background check like schools attended, area of study, and work experience.

The company offers fixed interest loans for three or five years to pay off credit cards, consolidate debt, to do huge shopping and to invest in vocational education. The platform is not just a direct-to-consumer lending platform but it also provides technology to banks, credit unions, and other partners through its software as a service model powered by Upstart.

Upstart has completed around seven years. In these seven years, the company has grown its business impressively. According to a new report in Venture Beat, CEO Dave Girouard said that more than $3.3 billion have originated from the platform in loans. The startup makes most of its revenue from the borrower’s fee or service charges. They have been a profitable business since the second half of the year 2018.

Upstart is among the growing companies which deal with peer-to-peer lendings. The platform matches borrowers with those willing to lend. A lot of other companies that are in competition with Upstart are Funding Circle, Prosper, and SoFi. Each of these fintech companies come from typical mortgages and home equity loans that are secured against significant collateral.

Upstart is different from the other existing fintech platforms because it uses machine learning and AI technologies to make credit decisions. People benefitted by the company are largely college students aged 28 to 35 and those who have an average of $12000 in credit card debt. The use of AI has also helped the startup to eliminate fraud and automate its verification processes. The person applying for a loan does not need to provide any documentation. The whole lengthy process of sitting through screening is eliminated as well.

Upstart considers itself a technology platform instead of a finance company. It has a deal with Customers Bank and its BankMobile division as a technology partner. So, it is one of the best combinations of finance and technology.

Upstart has made its AI platform available to other lenders as “Powered by Upstart” – a white label solution for a lending application to power their own lending platform. This service allows banks and other lenders to enforce their own credit policy and lending terms at the same time being benefitted from Upstart’s patent-pending risk modeling and automation.

Funding of Upstart

The company had a total of six funding rounds until today. The last funding round was held on 8th April 2019 in which the company has raised $50 million. This takes the total raised amount to $144.1 million. The CB rank of the company is 12,293.

Future of the Lending industry

Machine learning and AI are the existing technologies which are creating and carving a new future for the lending industry. The improvement in software that learns on itself and gets expected results is soon going to conquer the industry.

If you are a startup or entrepreneur, gear up to launch the fintech P2P software with AI to keep up with the new trends and earn more profits.

How?

Whenever in doubt, depend on the experts. You need to hire fintech app developers who can help you stay in the competition and win it too. We are here to help you with the new technologies. Our developers have expertise in AI and machine learning and they have created a lot of amazing apps and websites for our clients. We can proudly say that our clients have almost doubled their business after we launched the websites and apps for them. We have a 100% success rate for all our projects. We have made P2P applications according to the requirements of our client business that are running successfully.

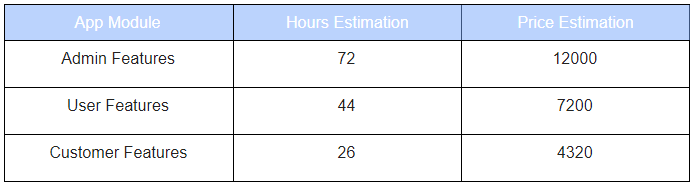

If you are interested to know the basic cost and time required to build a basic P2P platform, here is an overview of the price chart.

We can help with the fintech app development according to your personalized business requirement. We can also help you out while selecting different features that are needed for your platform or app. Contact us for a free demo and any further queries.

Also read :