Fintech App Development Solution

Scale up your finance business with FinTech app development.

Want to know more?

We deliver end to end solutions for a wide range of Businesses

The year 2017 has been a turning point in the mobile payment systems and apps with integrated mobile wallets. These methods of digital payments have become fastest-growing means of payments. The experts are predicting that the revenue of the mobile payment app will be around 1 trillion by the end of the year 2019. The reports state that the mobile payment apps and business apps with integrated FinTech payments are on high demand.

Being an entrepreneur, if you want to create FinTech payment app, allowing people to transfer/receive money and cryptocurrency, make sure that you consider hiring the best FinTech app developers who can develop an app that can help you earn more and more profits. We have a team of experts developers, designers, and innovators who can build game-changing FinTech apps for your FinTech startup to grow their audiences through developing top-notch web and mobile applications.

Get free app demoMarket Analysis

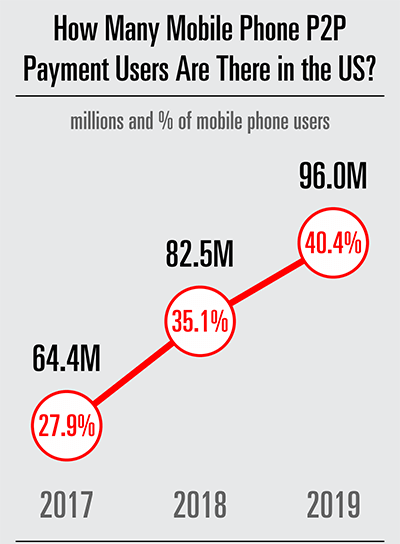

If we look at the market scenario of P2P money transfers, according to the report in Statista, there have been the following findings:

- Transaction value in the P2P Money Transfers amounts to $111,955 million in 2019.

- Transaction value is expected to grow by 15.6 % until the year 2023.

- In the year 2019, the average transaction value per user in the P2P Money Transfers segments amount $543.3 in 2019.

Who uses P2P in the US?

In the year 2019, there will be 82.5 million mobile phone peer-to-peer (P2P) payment users in the US. According to the estimates, the figure is over a third of the mobile phone population. By the end of 2022, mobile phone users will have at least one P2P transaction.

Here is a graph showing the millions of increased users in the US in the last Three Years

Scope of P2P FinTech App Development

The debit and credit cards have become a new norm in cashless transactions. But there has not been any set standard for making payments on a peer-to-peer level. The needs like splitting rents and bills and sharing money for the birthday gifts use the highest P2P payments.

Here is a chart from Statista showing the increasing growth of transaction value in the financial sectors:

The scope of FinTech in the coming years is enormous. This is not just because of the growth of this particular industry but because it has a direct or indirect impact of all other industries. FinTech is improving the current scenario of financial services by using the latest technology. It can be used to reduce the costs of a company by speeding up the financial processes or automate any process by cutting down manpower.

The Fintech industry has also led to the growth and formation of new industries like RegTech, WealthTech, and InsurTech.

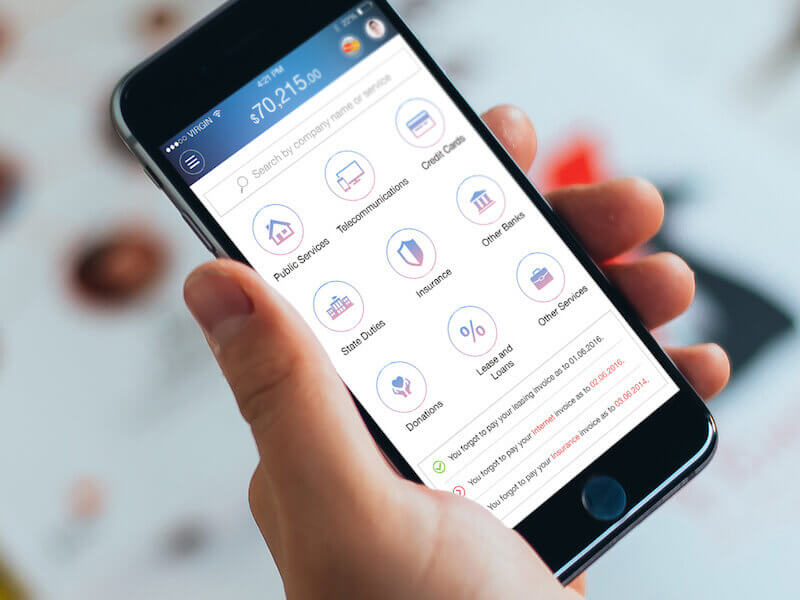

Types of apps you can develop in the FinTech App Development Category

- Personal Finance

- Banking and Credit Card Transactions Processors

- Account Tracking

- Multiple Account Support

- Data Protection

- Payers and Payees Management

- Robust Financial Statistics and Custom Reports

- P2P Lending FinTech, Crowdfunding

Our Projects

Coruscate has expertise in developing FinTech apps for various categories. We have developed many successful apps for various clients. You can read some of the case studies to know our approach and the technologies used to develop these FinTech apps.

Things to consider for FinTech App Development

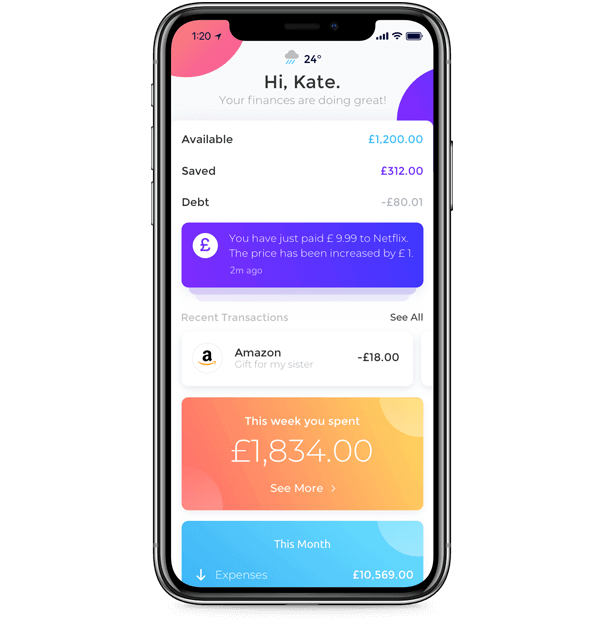

The Simplicity of Data Analysis

FinTech is developed to make things simple, so the high functional and advanced FinTech services allow the uninformed users to perform their financial operations differently. The quest for simplicity is not just to make the service problem-free but it also means to streamline the whole process of the apps making it more enjoyable.

Wide Functionality and Integration

The mobile application should be perfectly integrated with many platforms. Fintech is wide sector and so while you consider FinTech app development, you need to design applications that seek varied solutions for different necessities of the customers. Mobile payments, crowdfunding, and financial resource management are the most demanded requirements. So, the applications need to be compatible enough to exchange information.

Blockchain Allows New Business Models

Blockchain went through innovations recently yet it did not reach the widespread adoption. But the blockchain technology is used more and more in various FinTech apps. A blockchain is actually a series of blocks that record data in hash functions with the timestamps so that it cannot tamper. This gives blockchain technology an upper hand in providing trust within the FinTech apps.

Personalization

Understanding customer needs is the basic principle that governs the market. Even in the case of FinTech app development, this principle is to be kept in mind. The FinTech app must have personalized features in order to evoke the feeling of uniqueness. The FinTech apps can be integrated with social media to establish the strongest possible relationship with the users.

FinTech App Development Cost

The cost for FinTech app development is decided on the basis of hours needed to complete the design, completion of development, and testing of the app. The cost is also dependent on the features that are included in the P2P lending FinTech by the FinTech app developers. Here is the hourwise breakdown of the development process:

Want to see the Demo?

Put your business skills in the right direction, grow your business, and raise operational efficiency while our software solution takes cares of the dispatches and bookings.