Know why Finance management apps like Credit Karma prove to be profitable investments for tech startups

If you are a tech startup or entrepreneur, this blog can provide you with an idea of developing a finance management app that can help your customers to manage their personal finances in a better and synchronized manner.

Sam gets his salary on the 2nd of every month. He knows what are his necessary expenses and where he can save money. But as soon as the first weekend of the month approaches, he realizes the bitter truth about his unnecessary spending. No matter how many times he did and regretted the same budgeting mistake, he repeats it again as there is no one to help him with managing his finances.

This is the case of every working individual. You are aware of managing the spendings but when it comes to budgeting, it leaves you drained out of energy. There was nothing that could be done for this situation in the past. However, with the advancement in technology, managing finances has been also made easier with the best apps for financial management available in the market.

There are many good money management apps trending these days like Credit Karma, Mint, Personal Capital, Acorns, Pocket Guard, etc. to help you with your budgeting. More and more people are turning to these apps to get their budgeting done without a loophole.

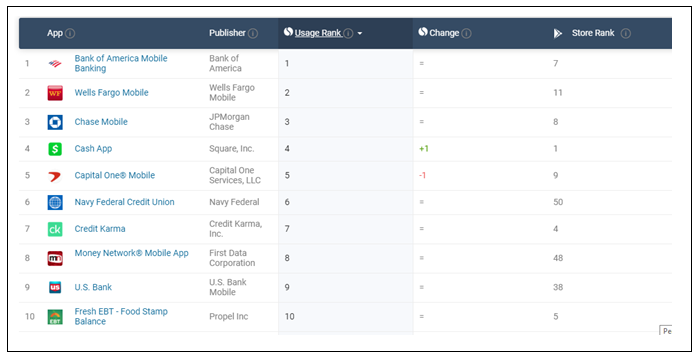

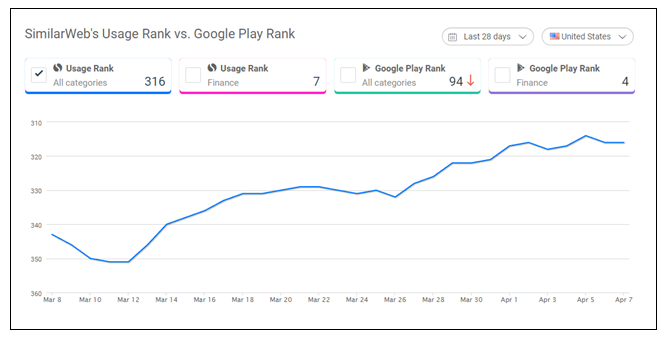

When we tried to check on Similarweb for the ranking of the app in Finance category, Credit Karma was the only finance management app that secured its place in the first 10 apps in the search. Here is a table that shows the app ranking:

However, Credit Karma is an app that has found a special place in the smartphones of more than 80+ million people.

According to a report on Similarweb, it ranks 4th in the Google Play store and 7th in the Finance category. The below graph shows the upward rising trend of Credit Karma and its popularity.

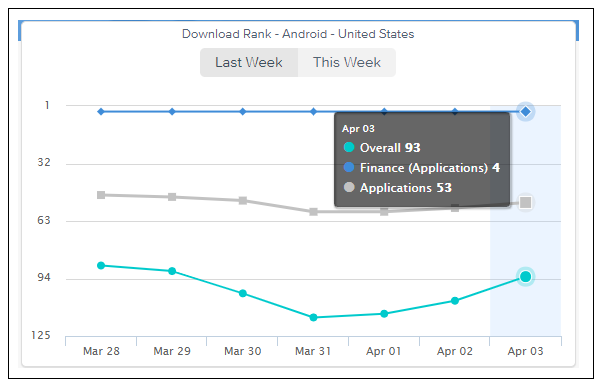

Another weekly report at Apps Annie shows that the Credit Karma app ranks 93rd in overall apps, and 4th in the Finance category. It has secured the 53rd position amongst all the android applications.

The above graphs leave no doubt in the minds of users about the growing popularity of the Credit Karma app in the US.

Wondering what makes this finance management app so popular? Let’s discuss a little about the foundation of Credit Karma and the features that make this app unique from all the other finance management apps.

Credit Karma is an American multinational company founded in March 2007. The founders Kenneth Lin, Ryan Graciano, and Nichole Mustard founded this free credit and financial management platform. They also included the features like tax preparation, monitoring unclaimed property and a tool to identify and dispute credit report errors. Most of the Credit Karma app earning come from lenders when it recommends the customers to lenders successfully.

Credit Karma has done many acquisitions till now including mobile notifications app developer Snowball, AFJC Corporation, owner of OnePriceTaxes.com, money reclamation service Claimdog, and personal finance company Penny. The latest acquisition was that of mortgage platform Approved in the year 2018. Since then, there is no looking back. It has raised $868 million of funds till today.

Some exciting features of Credit Karma app that you can consider while developing finance management app

1. Retrieve your credit report score:

The main attraction of the Credit Karma app is that it lets the users download their credit reports and scores from two credit reporting agencies. The users can log in anytime to check their scores and keep an eye on their credit reports without fearing about the lowering of scores.

Using the Credit Karma app the reports and scores update can be accessed once every week. You can keep tabs on the errors if any in your credit reports and you get to check your credit scores for free which are not provided by any other method.

2. Tax filing made simple in the app

The finance management app allows filling the state and federal taxes free of cost from start to finish. The Credit Karma app also provides the maximum refund guarantee when you file the tax. They also provide audit defense and dedicated support to each member on the app.

When you decide to file your taxes through the Credit Karma app, you cannot help but be amazed by its user-friendly interface. The app has a comprehensive and easy-to-use questionnaire for users. It also offers forums and chats services to get you out of any issues that you face.

3. Spot potential ID theft and find the money that belongs to you

Identity theft is nothing but someone else trying to steal another person’s personal information such as name, address or Social security number in order to commit fraud. Identity theft is mostly done with the purpose of financial gain.

Credit Karma alerts you by displaying potential identity thefts as alerts on anyone reviewing a credit report. This alerts creditors and lenders that they should perform more thorough screening through calls and verify the identities of the customer before extending the credit in their names.

You can even find the unclaimed money by checking the database. Many users of the Credit Karma app were able to find the unclaimed funds in their names. According to a report, 600000 users were able to find $75 million just in California through the Credit Karma app.

4. Get money-saving recommendations and review credit tips:

Credit Karma app recommends its users with tips to qualify them for lower interest rates and better credit card rewards. According to the user’s profile, the user receives matching recommendations and tips for better money-saving and financial management.

Apart from the above features, Credit Karma is absolutely free to use and there are no installation charges for this app. While setting up an account it doesn’t demand your credit card details. Hence, the users can be assured that the app will never ask for any sneaky charges.

Now that you have gone through the features of the finance management app, Credit Karma, you as a tech startup must gear up to have your own app ranking among the best finance management apps. Think of an app with extraordinary features to provide the target audience with accurate financial advice on which they can rely.

With the passage of time, people are relying more and more on the technologies for doing each little tasks for them. The finance management seems tedious task for every individual and they keep searching for a way out for their credit reports, tax filing, and investments etc.

Creating an app with the features like never before to solve the issues faced by people month after month for managing finances and making some savings has a wide scope in the market.

We can help you dive into the unknown waters of finance management app. We have the experience of creating many successful Fintech apps for our clients. Contact us for further consultation regarding the features that you wish to have in your finance management app and the cost of such an app. We can help you with the development of a finance management app that will give your business boosts and take it to the next level.