E-scooter app development trends: E-scooters display a prosperous future

2019 has been an amazing year for e-scooters with the upward growing graph in terms of e-scooter adoption everywhere in the world. The emissions regulations throughout the world are toughening, and new electrification targets focus 2030, it is becoming simpler to see a world which is dominated by electric vehicles. In the parts of the world where bikes are seen as ‘family car’- India, Indonesia, Vietnam etc. The transition to e-scooters and e-bikes looks very significant as the transition to electric cars elsewhere.

The bike companies like Yamaha, Kawasaki, Harley Davidson, Honda, TVS and many more have been in the analysis and development stage for a few electric scooters and e-bikes for the most beneficial part of a decade.

With the declining prices of the batteries, it is expected to generate promising opportunities for the businesses. The growing need for fuel-efficient wheels due to growing anxieties over carbon and Greenhouse Gas (GHG) effusions is expected to push the demand for electric scooters (e-scooters) in the years to come.

There has been an incorporation of regenerative braking, low noise levels, comparatively economical maintenance costs, and high production facility are also driving the product demand. Furthermore, e-scooters are fuel-efficient, eco-friendly, simple to handle, and compressed in size, which is also raising their demand.

The growing adoption of e-scooter sharing services in countries like France, Germany, the U.S., and Spain, has also encouraged the demand for e-scooters. The e-scooter companies like Bird, Lime, Spin, Jump, and Razor extending these e-scooter rental services are obtaining e-scooters primarily from the manufacturers, such as Ninebot-Segway, Gogoro, Inc., and Xiaomi. These services are active in more than 90 cities and various universities across the globe.

The growing financial and non-financial considerations are also promoting the product choice. The increasing need for modernized transportation and sustainable public mobility are encouraging the transition from traditional to electric modes of transport. Electric scooters are foreseen to have concrete implications on air quality and energy security, providing the renewable energy segment more prominence in the power sector.

The governments all over the world are concentrating on increasing product penetration through various programs, such as R&D drives. For example, the Canadian government is promoting a policy to overcome the country’s GHG emission consequences and improve the number of zero-emission vehicles. Likewise, in the U.S., the Corporate Average Fuel Economy (CAFÉ) models are generating the selection of energy-efficient vehicles by forming regulations for the decrease of fossil fuel exhaustion and improving utilization of alternative fuel vehicles. This, in turn, produces a highly favourable environment for market growth.

In the last couple of years, opinions have started to change: the number of investments being made by OEMs into start-ups has picked-up, and declared of new plans for electric models tends to be a weekly / monthly occurrence rather than an annual one.

They are not just focusing on high power models. But the low speed and power bike sales are growing more. Especially in Europe where over a third of the market comes from Germany, the bicycles are retrofitted with a battery on the frame. The progress has been fired by imports from China and Taiwan, making prices to drop. The innovative new business models like e-cargo delivery and dockless e-bike sharing services have been other things to push the e-scooters.

2019 highlights for the e-scooter market:

- VOI raised $85 million in the seed funding round

- Singapore’s Neuron mobility raised $18.5 million

- Bird raised $2.5 billion valuation

- Berlin-based e-scooter startup TIER raised €55 million Series B funding round

- E-scooter rental service Bird raised $275 million and doubled its valuation to $2 billion in 4 months.

- E-scooter startup Zypp raised INR 15 crore

- Unagi Scooters scores $3.15 million

- Bajaj invested $8 million in e-scooter company Yulu.

- Electric Scooter manufacturer Ather Energy raised $51 million

E-scooters have manifested themselves as a lost treasure. Of course, there have been some improvisations in the original model to promote transportation along with user experience. The on-demand model in the transport market has been drawing entrepreneurs due to its pragmatic functions. Its quick acceptance by industries and public evenly is a result of the rusticity of the idea.

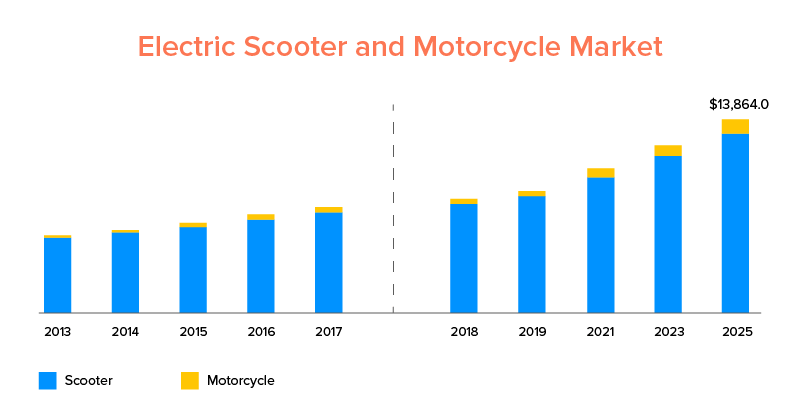

- Electric Scooter market is anticipated to approach USD 41.98 billion by 2030

- Throughout the 2030 forecast period, Asia Pacific is foreseen to drive the market

- Asia Pacific e-scooter market will reach USD 26.25 billion

- By 2025, the electric scooter and e-bike market will be worth $13, 864.0 million

- By the year 2028, 129 million units of e-scooters and e-bikes will be running on the roads as anticipated by the various reports.

- The e-scooter market is expected to account for 8% of all the two-wheeler vehicles on the road.

Players of E-Scooter Industry

Let’s discuss the major players or startups making it big in the e-scooter industry.

⇒ Bird

Bird, an e-scooter market was valued at $2 billion in its initial four months. As of October 2018, the expected income earned by Bird company was around $250 million. The gross income is calculated at 19%. The wealth growth Bird was marked at $65 million as of May 2018, making it one of the quickest and most important E-Scooter companies.

⇒ Lime

Lime was the e-scooter industry trend-setter. The company walked behind Bird and crossed the valuation mark of $1.1 billion in only 18 months of its launch. The lime e-scooters were immediately adopted by the users and by the end of the year 2018, the company managed to collect $500 million as revenue.

What is the future of e-scooter app development?

The e-scooter model is being adopted on a large scale across the globe and is expected to improve in the coming time. Entrepreneurs can expect huge opportunities in the industry with the rising demands and increasing awareness among common man. People are switching to electric vehicles and e-scooters are deemed as the easiest way to travel for daily commutation. 2020 trends will take the e-scooter models to the next level with enhanced features and looks.

If you are interested to grab the chance and make profits, you need an e-scooter app to join the competition. Rohak provides you with an unparallel opportunity to earn huge profits with fewer investments.

Connect with us to know more about the e-scooter app development and our white label solution- Rohak.