Mobile Wallet App is a Major Category of the FinTech. Know How You Can Hammer the FinTech Industry by Developing a Mobile Wallet App Like M-Pesa?

FinTech is the emerging industry which is using cutting edge technologies to bring automation and efficiency into financial activities. FinTech is making financial services more accessible to the people by allowing them to perform finance related activities using smartphones.

FinTech is the vast industry which includes financial services like lending, payments, international money transfer, personal finance, equity financing, insurance, and consumer banking. Every day, a lot of new FinTech apps are being launched in the market which caters dedicated financial services to the people. But FinTech app development is the tip of the iceberg. Only a few top FinTech app development companies like Coruscate Solutions know the hidden problems and its solutions.

In this blog, we will study the way FinTech is embodying the mobile payment landscape with mobile wallet apps like M-Pesa. We will also analyze how M-Pesa has enriched the payment infrastructure of the few African and Asian countries, what is their business model and what are the features you should ask the mobile wallet app development company to integrate into your next mobile wallet app to make sure it justifies your financial goal.

What is the mobile wallet app?

A mobile wallet or the digital wallet allows you to carry details of the credit cards and debit cards in a secure digital form on the mobile devices. Thanks to its next-gen payment technologies, you can pay anywhere for any kind of services in a very secure way. It avails you to get rid of carrying physical credit and debit cards. Moreover, it does not publish any data of the credit and debit cards to the merchants in order to provide you the ultimate data security.

The popularity of mobile wallet apps.

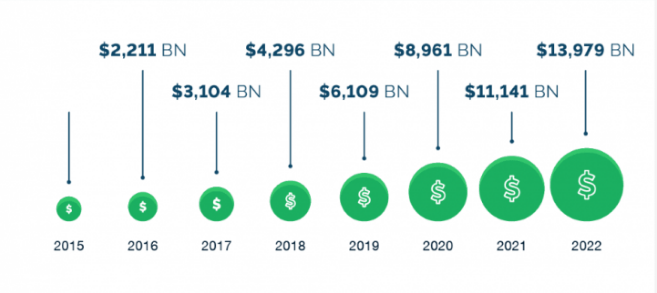

Mobile wallet apps are replacing the traditional methods of the payment. The blend of secured payment technologies and advanced mobile wallet app development techniques furnishes the supreme user experience. Hence, the number of people who are preferring mobile wallets to pay for their services is increasing by leaps and bounds. In the United Kingdom, 24% of smart-phone users are using mobile wallets regularly. In 2017, 400 million people have used Alipay mobile wallet and 210 million people have used Paypal. With a huge user base, the mobile wallet market is estimated to reach about $14000 billion by 2022.

Why mobile wallet apps are attracting users in million?

Why mobile wallet apps are attracting users in million?

Because of the major three reasons, People are adopting mobile wallets more than ever.

It is FinTech, yet easy to use.

Generally, an app which runs on the FinTech technologies is very complex to understand and use. But that is not the scenario with the mobile wallet apps. Mobile wallet app development companies are designing and developing the mobile app in a precise manner that you don’t need to burn the candles at both ends to understand and use the mobile wallet. In order to start paying from the mobile wallet, users just need to link the bank account with the app. Once the bank account is linked with the mobile wallet, users can pay by just scanning the QR code or by just tapping if the mobile app supports NFC payment transfer. We will understand the role of NFC technology in mobile wallet app later in this blog.

It is a safe bet.

Mobile wallet apps are satisfying the most requested need of the users which is a safe and secure transaction. When a user pays for the services, rather than sending the card details to the merchant, it creates a unique ID number and shares only that number with the merchants. Additionally, a user can use biometric capabilities of his mobile phone to make the access of the mobile wallet restricted.

Anytime, anywhere!

As payment made through mobile wallets are safe and secure, more merchants are integrating mobile payment option in their payment methods. Not only small businesses but all major e-commerce sites are letting their customers pay via mobile wallets to do quick checkout.

Which are the few most popular mobile wallet apps?

Except for a few mobile wallet apps which are being used worldwide, all major mobile wallet apps are targeting local markets as different countries have different rules and regulations to follow in order to create an online platform for the money transfer. This is why we always encourage you to study the government policies before going for the mobile wallet app development, or, you can ask us for help. A team of Coruscate Solutions always keeps the eagle-eyes on the changes different governments make in their rules and regulations for building online payment infrastructure.

In the USA, UK, and Australia, mobile wallets like Apple pay, Google pay and Samsung pay are more popular. While in India, Paytm ranks on the top. Alipay and Wechat-pay are the most popular mobile wallets in China. Meanwhile, Asia pay and AImazing are the top mobile wallets in Singapore. If we talk about the African continent, then M-Pesa is among the most popular mobile wallet apps in all major countries of Africa. M-Pesa is not only changing the online payment infrastructure of the African countries but surprising entrepreneurs and economists with its rapid growth. The study of the M-Pesa and it’s outcome will surely fuel your ambition to develop a mobile wallet app. You will jump out of your skin after knowing how people of developing countries have adopted FinTech in the form of the mobile wallet.

Insight into M-Pesa.

In 2007, Vodafone launched an online platform to enable mobile-based money transfer. It lets users to create virtual accounts in their mobile phones and to deposit money in it. It also allows users to pay to other users, including merchants. Unlike other mobile wallets, M-Pesa users don’t have access to link their M-Pesa account with a bank account. However, M-Paisa has started its own banking service which is branch-less. By using this service, the user can deposit and withdraw money from the registered M-Pesa agents.

The rapid growth of the M-Pesa

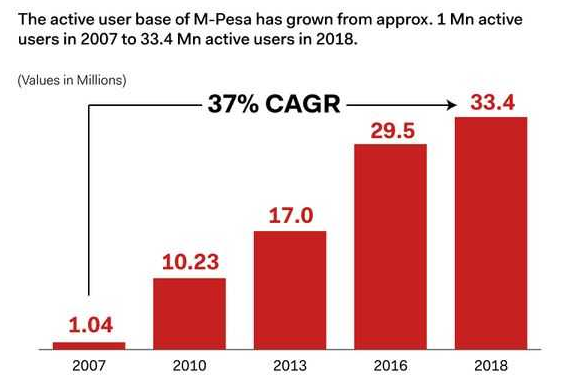

After its initial launch in 2007, the first time it attracted the attention of the world was in 2010 when it becomes most successful mobile-phoned-based financial service. By 2012, M-Pesa managed to get 17 million users only in Kenya. By 2016, it has spread quickly and acquired 7 million users in Tanzania. Following graph clearly depicts the rapid growth of the M-Pesa and its user base.

As the number of users is increasing, M-Pesa is also increasing the agents. In 2010, there were only 17600 agents, while in 2018, that number reached 206,940.

As the number of users is increasing, M-Pesa is also increasing the agents. In 2010, there were only 17600 agents, while in 2018, that number reached 206,940.

After dominating the markets of African countries, M-Pesa has extended its business reach to India, Afghanistan, and Romania.

What kind of services M-Pesa is offering?

M-Pesa is providing complete mobile wallet solution by enabling its users to pay for almost any kind of services. Users of the M-Pesa mobile wallet can pay for prepaid recharges, postpaid bill payments, merchant payments, utility payments, remittance, and DTH recharge. It also allows customers to send money to any mobile numbers and bank accounts. Moreover, M-Pesa is working with a few Kenyan banks to provide additional services like interest-bearing accounts, loans, and insurance.

The business model of the M-Pesa

M-Pesa has precisely crafted their business model. They have added their every service into the revenue stream to maximize the profile.

User transaction fees

M-Pesa takes some percentage of the commission on every payment a user makes. This commission varies from 2% to 10% based on for which services the user has paid.

Paybill service

M-Pesa also supports the paybill service which is nothing but the SMS based payment service. The user who is transferring or paying money with this service is also charged 2% to 10% extra.

Cross-network M-Paisa services

Cross-network M-Paisa service is the major source of the M-paisa’s revenue. With the payment capability, users can transfer funds between M-Pesa mobile wallet and other mobile wallets. When users do so, they are charged.

After reading so far, if you are triggered to develop mobile wallet app, it is advisable to know about that one feature which makes your mobile wallet app similar to Google pay and apple pay mobile wallet.

What features you should consider while developing e wallet app like m pesa? or

Or What is that one feature which stands out your mobile wallet app?

User registration, banking account authorization, fund transfer, payments for the bills, discount coupons are very common features all mobile wallet app development companies can accommodate in your app. But to survive in the market for the longer term, your app should have some unique features which take the user experience to the next level. Coruscate Solutions always thinks outside the box and implements a few game-changing features.

Capability to pay by using NFC technology of the phone is one of the rarest features you can find in mobile wallet apps. With the NFC technology, users can pay by just tapping the mobile to the POS (Point of sale) systems of the merchants. Allowing users to pay with NFC technology means you are giving the highest level of convenience to your users.

However, compatibility is the major issue in NFC enabled mobile wallets. User should able to pay in just one attempt. We at, Coruscate, have achieved a robust payment mechanism for the mobile wallet app which works accurately even on the NFC technologies.

It is the undeniable fact that the current version of the mobile wallet apps are technologically advanced and performing all tasks with the highest ever accuracy. But still, a few hidden problems are also there. These problems are tiny in the scale but hold an aptitude to harm you financially.

Problems associated with the e wallet app development.

If you want to target the global market with your mobile wallet app, real-time currency conversion is the must feature. With the real-time currency conversion, you permit the users to see the currency rate before performing the oversee transaction. Payment gateway and payment processor are responsible for showing the real-time rate of the different currencies. Hence, choosing the right payment gateway and payment processor is always the deciding factor of the mobile wallet app success.

As we have discussed NFC technology can boost the functionality of the app. But if the mobile wallet app development company narrowly missed an approach to achieve the highest compatibility, problems likes duplicate payments, incorrect payments and dangling authorization can rise.

Security is a major concern when it comes to FinTech. A very popular mobile wallet app, Google pay was hacked in 2012. The payment module of the Starbucks app was also hacked in May 2015. When experts examined the reasons, they found out small vulnerability issues in the app. Coruscate Solutions always puts more emphasis on security and develops a secured mobile wallet app by using an SSL certificate. SSL certificate binds a cryptographic key to the all sensitive details of the users and makes it impossible to breach.

What is the cost to develop e wallet app?

Any app which works based on the FinTech technologies demands an exceptional level of the app development knowledge. It also urges regular updates as governments are changing the rules and regulation of the online payment infrastructure quite often. This is why it is worth to mention that the cost structure of the mobile wallet app development is different than any other app development.

Coruscate Solutions has entertained a numerous amount of the queries related to FinTech app development and mobile wallet app development. We work on a few prominent technologies to provide a reliable and scalable app. Our rapid agile app development technique delivers the app without missing any deadlines. We also know the craftsmanship to craft mobile wallet app with paramount features which always keeps you one step ahead in the market. So, feel feel to contact us for a free consultation.