Fintech app development Tips : Capital One hacks and Zimperium says US-based FinTech apps have security issues, Security Threats & Techniques to decode those threats

What do you do with the ripped wallet which doesn’t store the banknotes steadily? You throw it away and purchase a new wallet, right? Same way, if your FinTech app fails to keep the valuable assets of the users safe and private, users will straightaway swap your app with another FinTech app.

If you have just checked your ‘wallet’, welcome to the most secured blog!

In this blog, you will get to know,

- Latest report which shows the least secured IT infrastructure of top USA-based FinTech apps.

- Top data breaches in the FinTech industry.

- Top reasons why your FinTech app can be the next target of hackers.

- Which are the top security threats in the FinTech industry and how Coruscate decodes each of them?

Latest report which shows the least secured IT infrastructure of top USA-based FinTech apps.

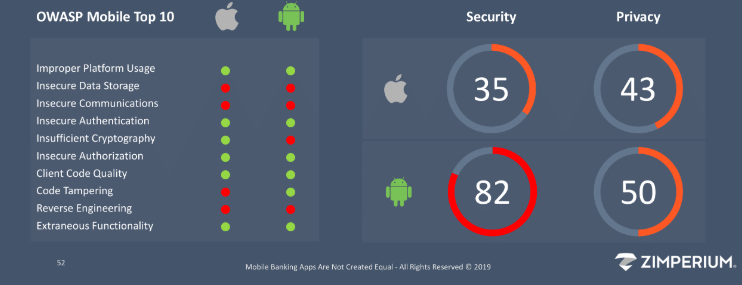

A security firm named Zimperium which recently downloaded a couple of banks’ IOS and Android apps and then scanned for finding out the security and privacy issues, published a finding report. According to the finding, most of the apps failed to meet security standards. Those apps had issues like old open-source libraries and poor coding practices. Researchers also found that half of the apps allow advertisers to access the data of users. One of the apps which aren’t validating HTTPS certificates in a proper way is attracting hackers to perform a man-in-the-middle attack. Another app increases the risk of data leaking with its capability to take the screenshot.

Though they didn’t declare the name of the banks, following image depicts how much one of the scanned apps scored and which are the vulnerabilities it holds.

Now, let’s quickly know top data breaches FinTech app provider companies have witnessed because of the FinTech app development mistakes.

Top data breaches in the FinTech industry

Fintech is the most favorable industry of hackers as it posses very valuable details and it can satisfy the financial purposes of the hackers behind the hacking.

Over the years, FinTech companies have involved in some of the biggest data breaches which cost them in millions or perhaps in billions. Equifax is one of the recent victims of the data breaching that affected 100 million people.

Updated on : 1st Aug 2019

Another recent victim of the data breaching is the USA-based one of the largest banks, Capital One. A news published in Techcrunch says that hackers stole the data of roughly 100 million individuals in the USA and 5 million individuals in Canada. The stolen data includes all personal details of account holders as well as their self-reported income, credit score, credit limits, balances, and payment history. The company believes that the data breach affects the users who have applied for credit card between the years 2005 and 2019.

However, the suspect was arrested by the FBI. He is a Seattle-based Software Engineer named Paige A. Thomson.

Following are the other victims of releasing private and confidential information to an untrusted environment.

» CheckFree

CheckFree is an electronic bill payment service provider. It was hit by cybercriminals in 2009. They have redirected the site traffic of CheckFree to a malicious site. With this hacking technique, they got the data of 5 million users who tried to login in CheckFree and attempted to pay the bill.

» KB Kookmin Bank, Nonghyup Bank, and Lotte card

In 2014, an employee who was working in the Korea Credit Bureau secretly copied all details of customers. He has stolen information of 20 million customers which is 40% of South Korea’s entire population. This attack revealed how poorly they have distributed the integrity control across the banking network.

» JPMorgan Chase

JPMorgan Chase is the largest bank in the USA and ranked the sixth largest bank in the world. In 2014, data of its 7 million small businesses and 76 million households have been compromised. JPMorgan data breach case shattered the illusion that the banks use heavy-duty security metrics to keep the data of users private and secure.

Top reasons why your FinTech app can be the next target of hackers.

FinTech institutions like insurers, lenders, banks and mobile app startups, are collecting and storing more and more sensitive data about user behaviors and interests to shape strategic business plan or to make a financial judgment of users. They sometimes collect the data from sources which are far beyond the scope of finance. But when it comes to storing this heap of very sensitive data, they follow very inappropriate techniques like they don’t separate the databases and web servers, they don’t encrypt the files and they don’t use web application firewall.

What makes FinTech apps more vulnerable is the fact that multiple actors like bank, credit card company, mobile wallet provider company, merchant app and Google involve with the payment. Because of a minor bug, they all can view the details of users. This can be considered as one of the biggest failures of a FinTech app development company.

Here it is worth to mention that those FinTech companies which we have discussed earlier, managed to survive cyber attacks because of strong user base and reserved fund. But if a FinTech startup comes across a cyber attack, possibilities to bless with second life are very less. Thus, it is advisable to know possible FinTech app development mistakes which increase the vulnerabilities and ways to develop a secure FinTech app.

Which are the top security threats in the FinTech industry and how Coruscate decodes each of them?

Coruscate is the top FinTech app development company which has developed 5+ FinTech apps and earned expertise to develop a secure FinTech app. We own a dedicated team of cyber experts who work parallelly with developers to offer the ultimate security features in the app.

Over time, we found out all possible loopholes which are the gate of heaven for intruders. But most impotently, we have figured out the ways to fill those loopholes.

Following are the top security challenges in the FinTech industry and what are our approach to overcome it.

» Data sharing

As we have discussed, while a user is making a payment, his details along with card details are shared with other parties in a limited manner. In the data sharing process, the possibilities of data breaching are higher.

Coruscate builds a FinTech app which shares a unique number with the other parties rather than real information of users.

» Data ownership

As a FinTech company, you have to tie up with other financial institutions to complete some tasks. In this kind of scenarios, sharing all details of the users with other companies is the only possible way to keep your FinTech company running efficiently.

As a top FinTech app development company, we have discovered the possible solution to this problem. We establish data ownership with the help of access control which applies selective restriction on important resources.

» Cross-platform malware contamination

FinTech app development companies utilize many API of multiple enterprises to develop a robust app. However, this practice can cause the cross-platform malware contamination problem which is nothing but the negative effect on the FinTech app or site by used API due to poor isolation.

We, at Coruscate, follow a checklist to avoid such challenges. We knuckle down to keep all functions and technologies of FinTech app isolated.

» Real-time risk analysis

Generally, a cyber attack is identified after its occurrence. But with the AI techniques, a FinTech app development company can deploy the system which scans the network to identify the possible cyber attack.

A few skilled developers of Coruscate Solutions have developed a genetic algorithm-based and AI-enabled intrusion detection engine which scans the all incoming packages and if it finds any malicious package trying to enter into the network, it either notifies the admin or drops the malicious package. This is one of the next-gen solutions to fight against FinTech security threats.

As additional security features, we accommodate biometric access control method in the user app and admin app. We encrypt all the data before sharing or even saving. We also use the firewall to build the safest IT architecture for your FinTech startup.

To know more about the features of FinTech app and cost of development, visit our FinTech app development page. We also provide a free demo and consultation. So, feel free to ask for it.