Lessons from Nigeria- Offer Secure Loans Through Fintech-enabled Platforms

Peer-to-peer lending is a way of debt financing that allows people to borrow and lend money without the use of an official financial organization as a mediator. P2P lending is also recognized as social lending or crowdlending. It also occupies more time, effort and risk than the general brick-and-mortar lending situations.

In Nigeria, P2P lending is a way to borrow without using a traditional bank or credit union. If you are the one who has a loan requirement you can positively look at a few P2P lenders as you shop around. If you have got enough credit the P2P loan rates can be really low. Even if you don’t have enough credit, you still have got a shot at getting approved for an affordable loan with these online lenders.

Advantages of P2P:

P2P loans in Nigeria have some uncommon features that make them competitive.

- Low costs: you can often acquire loans at comparatively low rates using P2P loans. The only thing that the borrower needs to do is to pay the interest to compensate the lender.

- The borrower can expect an up-front origination fee of 1% to 5% of the amount of the loan to get the loan financed with a P2P lender.

- The fees can be high compared to a personal loan at a bank. However, they can come in lower when compared to a second mortgage.

African economic development is a significant area of possibility for investors. Microloans have long been recognized as a device for institutions to fuel economic development. The difficulty, however, is that few entities have been thriving in bypassing the widespread fraud and corruption that is the norm across the continent’s banking system.

We are achieving a solution to this problem through a blockchain-based, P2P lending model.

The Global financial unwaveringly springing with the ownership of mobile phones and access to the internet aiding the process. The Global Findex record was organized by the World Bank with surveys of over 150,000 adults aged 15 and above from more than 144 economies. This article found that 69% of adults or 3.8 billion people all over the world have an account at a bank or with a mobile phone provider.

Coruscate has created a blockchain-based system for P2P loans that accommodates to banking activity on-the-ground. We will supervise initial smart contract development and maintain partnerships with on-the-ground service providers. Third-party service providers can control their own services while profiting from the liquidity of our broader system.

Peer to peer lending in Africa:

South Africa and Kenya are the most active and growing smartphone markets in the world. If we check out the data from 2015, the research statistics state that 88% of African did not have a bank account. However, what they did have was a smartphone.

Later in the year 2015, more than 183 million people in Africa had a mobile wallet. This number was 3 times the number of digital wallet users in the U.S. The mobile wallet users in Africa kept expanding at 3 times the annual growth rate. And if the trend keeps continuing it is not an exaggeration to say that every African will have a mobile wallet by 2020.

The numbers clearly state that fintech startups have a tremendous opportunity gawking at them.

Growth of P2P lending in Africa and develop P2P loan app in Nigeria, Africa:

The Alternative Finance Benchmarking Report for Africa and the Middle East states that Kenya and South Africa are leading the P2P business lending market in Africa. But it is remarkable that

90% of online alternative lending started from platforms headquartered outside of Africa. The third-largest alternative lending was a P2P business lending which underwent enormous growth from a humble $2 million in 2014 to $14 million in 2015. Kenya and South Africa were the market leaders in the year 2018. They were amassing $86.7 million and 715 million, respectively.

The largest market share of the African alternative finance market is with the East African region. East Africa estimated 41% of the total African market share in the year 2015. Whereas the estimates of West Africa were 24% and Southern Africa was 19%.

As the market is still in its budding stage, there is no regulatory policy for the alternative finance industry. But in recent times positive efforts have been made to develop a regulatory ecosystem that will help in improving this developing industry in the region.

Africa is not a uniform market. It is necessary for alternative lending startups to know the diverse cultural distinctions so they can develop products that have utility. As the country maintains its socioeconomic upliftment, more people are in need to reach financial services. All if this makes Africa an interesting market for alternative lending in years to come. Most of the African population is underserved and unserved when it comes to banking services.

Hence, many new fintech startups are flourishing in Africa by generating innovative products to accommodate the needs of the community.

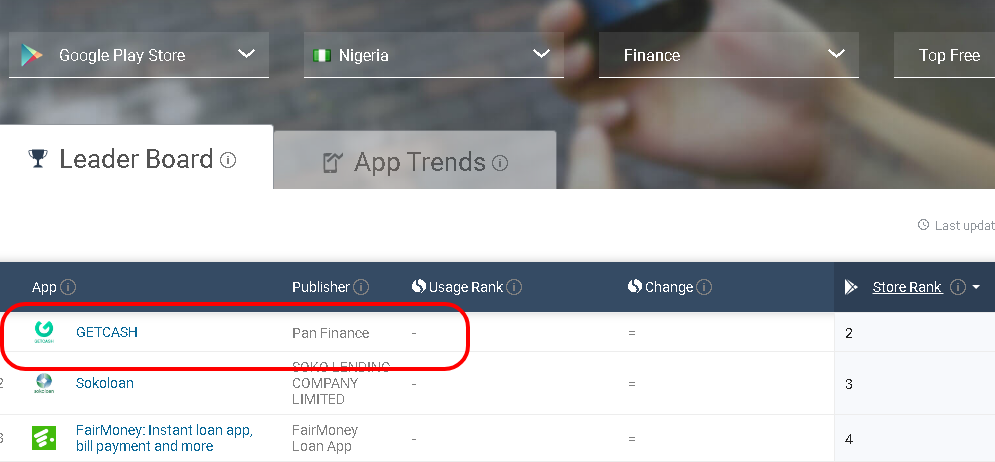

According to Similarweb, the top finance app in Nigeria is GETCASH. The Nigerians who are aged more than 25 years old are eligible to apply for a loan from Getcash. The borrowers can repay the amount within 91 to 180 days.

Vital advantages:

- Instant Approval

- Transparent Charges

- Friendly Choices to Repay

RATES AND FEES

The company provides a quick loan from ₦5,000 to ₦100,000. The interest of Getcash is the least among all the loan app. It is from 5% to 27% and APR is from 26% to 334%.

Likewise, looking at all these scenarios in the African continent, the market might interest you for investment. We can help you jump and get started in the African market with our power-packed white label solutions.

To know more about the cost and features of the P2P lending white label solutions, connect with us and get a detailed market analysis before getting started.