P2P lending app development: How Kenya-based P2P lending app, Branch becomes 2nd ranked most popular finance app. Know the business model of P2P lending app to earn millions.

You may have heard a lot about some thousand-dollar of million-dollar business and personal loans. But what if you come to know that there is a Kenya-based lending company named Branch which is lending just $2 and earning really well!

In this blog, we will get to know,

- P2P lending market

- Why Branch is bothering with such a small amount of lending amount?

- The business model of P2P lending app.

- Things to consider while P2P lending app development.

- Cost of P2P lending app development

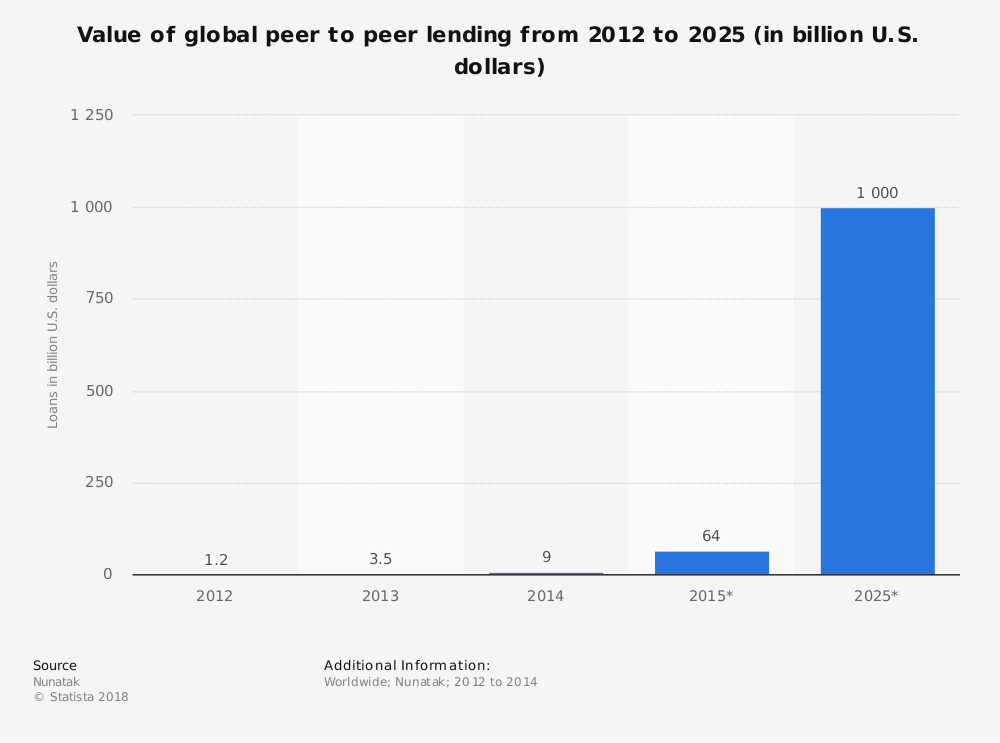

- P2P lending market size and opportunities

P2P lending has been a buzz phrase in recent time. Factors like business-friendly consumer behaviour, rapid technological advancement, and favourable regulatory environment come all together to fuel the P2P lending market. Also, the blend of FinTech revolution and advanced P2P lending app development techniques makes it easy for entrepreneurs to offer a very straightforward solution of money lending to the people. Looking at its impressive growth, in one of the research papers on digital lending, The Boston Consulting Group has written that there are $1 trillion opportunities over the next 5 years in the P2P lending market. Following graph of the Statista clearly depicts how rapidly global P2P lending market is expected to grow. Here it is worth to mention that there is no other industry which is predicted to grow as swiftly as P2P lending industry.

Insight into a top-rated P2P lending app, Branch which has inspired many entrepreneurs to target the markets of developing countries

Kenya and other African countries are known for its quick adoption of FinTech technologies. A few successful FinTech apps like M-Pesa e-wallet and Branch P2P lending app, have been deployed in the African market to solve their prolonged problems.

Matt Flannery, who previously confounded micro-lending platform named Kiva founded Branch in 2015. While running Kiva, Matt realized that the spread of smartphone and digital payments in Africa are creating a win-win situation for any FinTech startup. So, with the ambition to raise serious capital and lend money to small business owners, he started Branch.

How does it work?

The Branch is the money lending platform. They have developed an app which analyzes user’s information on the user’s phone, determines the credit score of the users and based on the user’s credit score, provides them with the loan. Branch allows users to lend money as low as $2 at a time and they charge 15% interest on it. Their largest loan is of $1000 and users need to pay 15% APR over a 12-month period.

To evaluate the credit score of the users, they rely on a few factors. They check the user’s history of ATM transactions. They also verify whether a user pays all bills on time or not. Based on these details, they document a credit report. They compare the credit report with the amount of loan a user has asked and if a user is identified as a genius user who will pay back, Branch deposits the amount of the loan directly into user’s bank account.

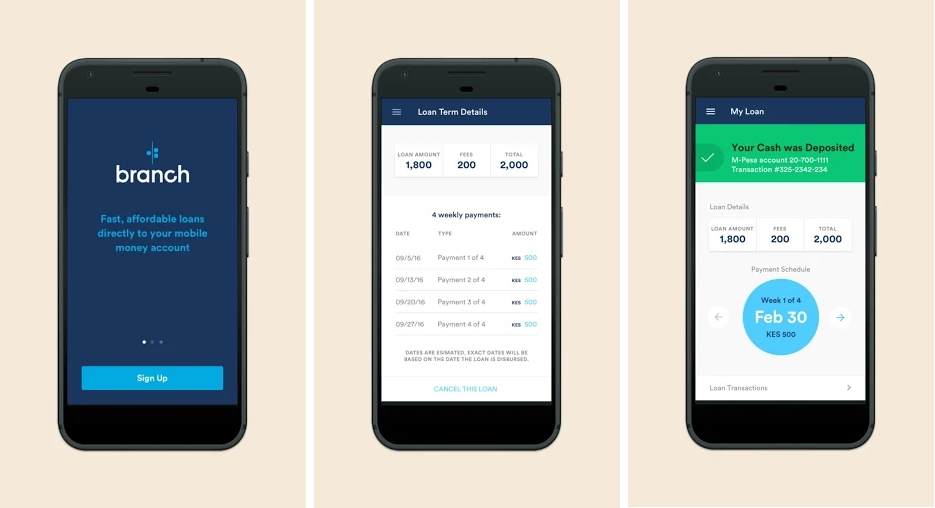

Branch, P2P lending mobile app features

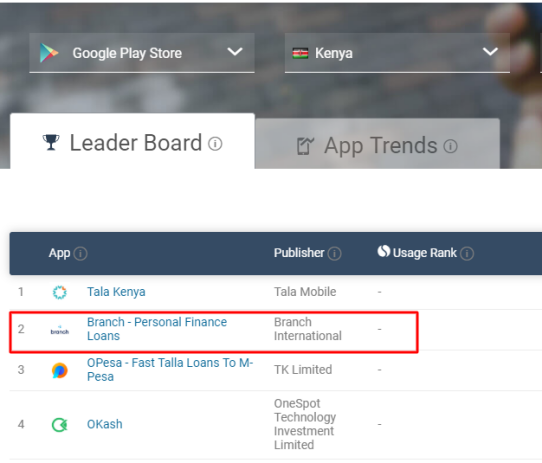

Branch is providing a robust app to its users to request personal and business loan, to check the credit score and to pay the instalments. This simple looking P2P money lending app is so feature-packed that it is the second-ranked most popular finance app in Kenya.

Source: Similar web

Now, let’s quickly discuss the features of the Branch mobile app. These features are very significant if you are planning to develop a P2P lending app like Branch.

- Users can see a history of notifications and loans.

- Users can select in which bank account they wish Branch to deposit the money.

- Users can see the loan amount, interest rate and total amount, which they will need to pay back.

- User can also know the details of weekly payments.

- A reminder reminds the user to pay a weekly instalment.

- Different notifications notify users about any new activity.

The business model of the online P2P money lending companies

Undoubtedly, online money lending companies are earning well. They earn a major percentage of the revenue from the annual percentage rate on the issued loans. However, lending a small amount doesn’t help them to earn a huge amount. Thus, they follow the business model of an airline industry where top airlines put more emphasis on selling business class seats than economy class seats as 5 business class passengers avail airlines to earn more than 25 economy class passengers. Branch loses money on the $2 loan but they keep lending $2 to acquire those users who want its larger loans.

Another way top money lending companies are making money is the referral program. A Canada-based one of the top money lending companies named Borrowell recommends products to the users based on their credit score, and if someone buys the recommended product, that company pays Borrowell.

After reading so far, if you are triggered to develop a P2P lending app like Branch, consider these three very important things while developing P2P lending app.

Three things to consider to develop P2P lending app like Branch

P2P lending market is intensifying with countless P2P lending apps. By raising a decent amount, entrepreneurs think themselves well-armed to start a P2P lending business. They neglect the importance of a next-gen P2P lending mobile app and fail.

A team of Coruscate Solutions has researched and found out three modules of P2P lending mobile app development where you need to pay extra heed. These are credit scoring engine, payment gateway, and business intelligent enabled admin panel.

Credit scoring engine

If you are planning to develop P2P lending app like Branch, accommodating credit scoring engine in the app is the crucial requirement as paying some other financial institutions to evaluate the credit score of your users makes the process complex and messy. An inbuilt credit scoring engine evaluates the credit score of the users in a few seconds and helps you to issue more loans in lesser time. Coruscate Solutions has developed 5+ FinTech apps and scalable credit scoring engines. Our team of developers knows the craftsmanship to precisely integrate an error-free credit scoring engine in your P2P lending app.

Payment gateway and processor

A FinTech app is hard to imagine without payment integration — a payment processor and gateway transfer the fund between the different bank accounts. If you end up choosing a wrong payment gateway and processor, not only you will fail to provide an ultimate user experience to the users, but you will do yourself a financial injury. A team of Coruscate Solutions is always ready to help you in finding an affordable and reliable payment gateway which satisfies all requirements of P2P lending app.

Business intelligent enabled Admin Panel

Admin panel is the heart of your online P2P money lending business. With Admin panel, you can track all money lending requests, the status of it, received, pending and failed payments and many more. But a BI enabled admin panel is the cherry on the cake. Features of business intelligent present you the historical and real-time performance of your business in a graphical way. It stores, gathers, validates and analyzes the data to help you to take future business decisions.

What is the cost to develop a P2P lending app like Branch?

Being a transparent P2P lending app development company, we would like to elucidate that a FinTech app development is not a one time process. Since governments make regular changes in the legal norms of online money transfer platforms, your app needs to be updated with every little change in legal norms. However, our customized pricing module makes sure that you will be charged the lowest and only for your requirements.

We, at Coruscate, work on the latest technologies and delivers the unsurpassed P2P lending mobile app. Our team of developers and designers have 5000+ hours of combined experience in different FinTech app development projects. We precisely design and develop P2P lending app like Branch in such a way that you will surely dominate the market. To know the pricing and features of P2P lending app, visit our FinTech app development page. We even provide a free consultation. So, feel free to contact us.