FinTech app development: Know how to develop a FinTech app like Revolut which is working diligently to build global branch-free banking infrastructure.

A FinTech company has always been a worthy choice for investors to invest. The blend of a whopping amount of investment and advanced FinTech app development techniques makes it possible for FinTech companies to slow down the rotation of the earth with their revolutionary products. A UK-based FinTech company Revolut is challenging the already established banking infrastructure with its tiny mobile app which is capable to execute all financial services like a brick mortar bank.

In this blog, you will get to know,

- Investment trend of FinTech industry

- FinTech models

- How Revolut is building a global branch-free banking infrastructure with a mobile app?

- Features of Revolut mobile app which you can consider to develop FinTech app.

- How Coruscate can help you to develop a FinTech app like Revolut under $10K and within 45 to 55 business days?

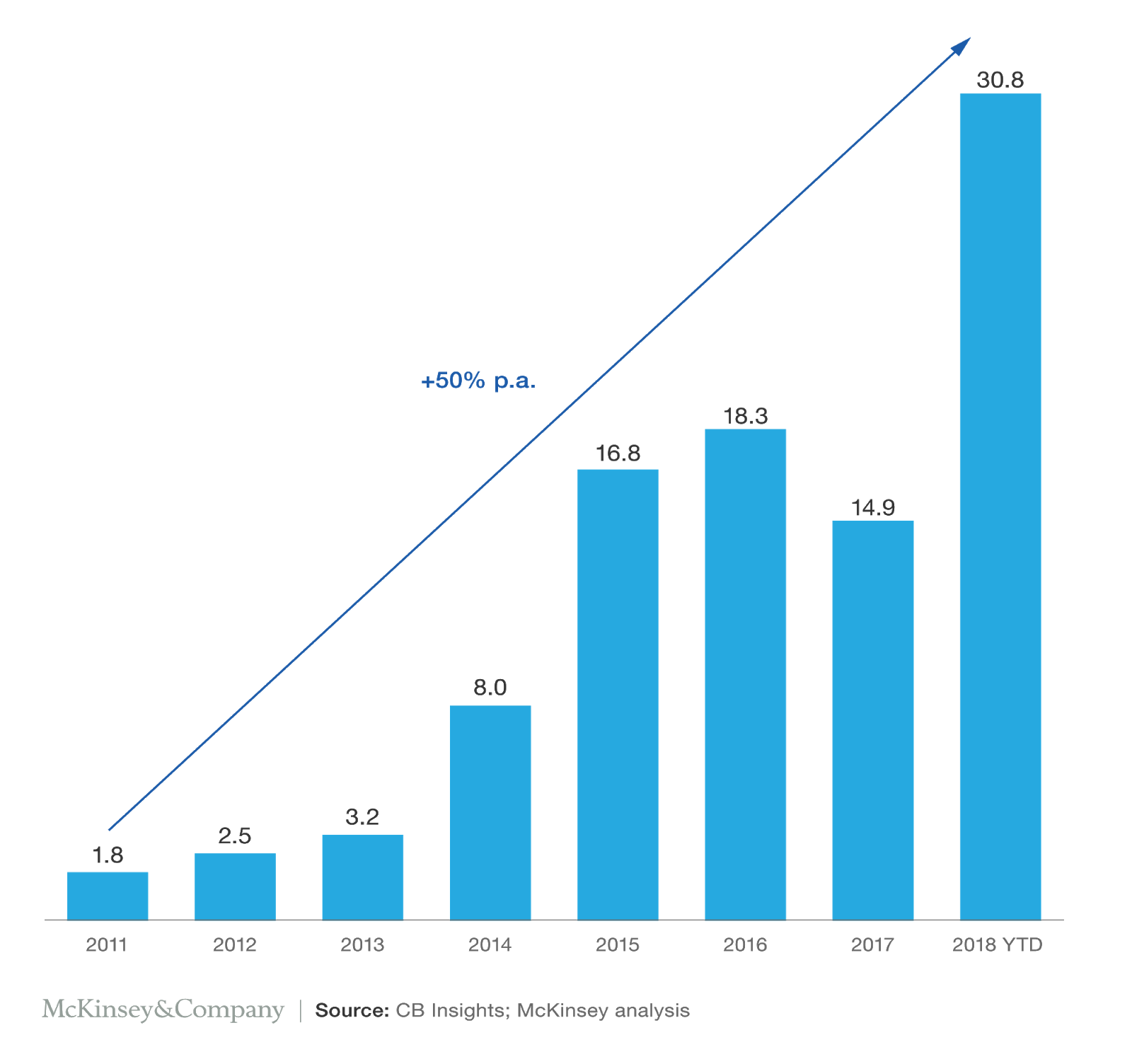

Investment bulletin of the FinTech industry

FinTech is one of the fastest growing industries. All major financial institutes are embracing FinTech startups either as investors or as strategic partners. According to McKinsey Panorama, more than 80% of the financial institutes have entered into the FinTech partnership. Talking about the FinTech investment, it has already reached around $30 billion in 2018. Following graph clearly depicts that how rapidly FinTech startups have managed to be the ultimate bet of the investors.

4 most popular FinTech Models you need to know before going for FinTech app development

FinTech is an enormous industry. It covers the range of different models. These are FinTech as startups, FinTech as financial institutes, FinTech as ecosystems and FinTech as an infrastructure provider.

The first model which is FinTech as the startup is followed by entrepreneurs who are looking to commence financial services using latest FinTech app development technologies and new approaches. They are motivated to build economic models like banks and often work on one or two products. Acquiring customers while making sure the limited customer acquisition cost is the prime challenge of this group. However, this model is most successful FinTech model.

In FinTech as financial institutes model, financial institutes invest in technology and startups to capture the investment, improve the efficiency and to get benefits from FinTech opportunities.

FinTech as the ecosystem is such a model which is entertained by large companies to enhance the already-developed platforms. (e.g., Amazon Pay for Amazon e-commerce platform)

Many companies have developed payment gateways and payment processors in order to help other financial institutions and FinTech startups to implement it in their services to satisfy a specific task. These companies are following FinTech as infrastructure provider model.

Now, in the second part of this blog, let’s quickly be familiar with Revolut which is following FinTech as startup model. We will study how Revolut is building a global branch-free banking infrastructure with just a tiny yet robust mobile app.

How Revolut is building a global branch-free banking infrastructure with a mobile app?

Revolut is the UK-based FinTech company which offers multiple banking services like debit card, real-time currency exchange, P2P payment, international transfer and cryptocurrency exchange through a mobile app. It was founded by Nokolay Storonsky and Vlad Yatsenko in June 2015. Since its initial launch, Revolut has managed to acquire more than 4 million users who are paying a flat fee of £6.99 and £12.99 per month to utilize two different premium services of Revolut. Revolut also offers a few basic services at the free of cost.

Revolut has raised more than $336 million in total funding to date and thanks to it, this FinTech startup was valued at $1.7 billion in 2018.

However, in February 2019 when a magazine named Wired exposed the company’s work culture, Revolut witnessed a high degree of criticism for its employment practices, which promote unpaid work.

Which are the revolutionary services Revolut is providing with its mobile app?

- Revolut users can transfer money globally in 29 currencies with the inter-bank exchange rate.

- Users can create vaults in the app. A vault is basically a virtual locker where users can add money to save it for future use or to meet any financial goals.

- Budgeting is one of the most popular services of the Revolut. With the budgeting service, user can set the spending limit on things like restaurants and groceries.

- Perks is the newly launched service of the Revolut. It was introduced to distribute the easiest way to get a reward for every spending.

- Cryptocurrency service of the Revolut allows the users to convert any of 29 supported currencies into Bitcoin, Bitcoin cash and XRP.

- Revolut also offers global mobile phone insurance from £1 a week.

- Like mobile phone insurance, users can also purchase the pay-per-day overseas medical insurance which uses geolocation, so users only get charged for the number of days they are actually abroad.

How Revolut has fitted all these services in a single mobile app? Or,

FinTech app features you need to consider while FinTech app development.

For any FinTech startup, an app plays a significant role as it is the only channel to justify your ambition of starting a FinTech startup. Talking about the Revolut app, it is the best example of how a FinTech app should look and work like. Following are some of the UI and UX secrets of the Revolut app which you can implement in your FinTech app development project.

- Users can sign up by just entering their mobile numbers. It is the easiest and soothing way of welcoming users for the first time on your FinTech app.

- Process of setting up Revolut user account is fastest among the industry.

- The app presents most of the details like spending analysis, currency rate analysis in the graphical format for better understanding.

- While sending money to the abroad, a customer can see the real exchange rate and how much he owns in his account. He can even schedule international payment.

- The app lets users request money from friends and family members.

- Spending details of the debit card is recorded automatically in the app.

- User can anytime view the history of his debit card spending. He can top up the debit card and even withdraw the money from it.

- Scheduling recurring payment is very easy.

- Users can convert the money in different currencies within the app.

- Notifications notify the users after every card payment.

- From the app itself, users can talk with customer representatives if they come across an issue.

How Coruscate can help you to develop a FinTech app like Revolut?

According to the outcome report of investment summit – “Deal Day”, future FinTech industry will be driven by technologies like block-chain, AI and crypto. We, at Coruscate, have already earned expertise to develop FinTech app based on these technologies. In fact, we have developed 5+ successful FinTech apps which have created small turbulence in the FinTech industry. Our designers and developers work on our ideology of solving real-world problems by applying technologies.

We are one of the few FinTech app development companies which have completed API integration for Nordic banks.

We integrate payment gateway and payment processor precisely to eliminate all possible errors. With our rapid app development technique, we deliver the app within 45 to 55 business days. To know more about the features and cost of developing FinTech app, visit our FinTech app development page. We also provide a free demo and consultation. So, feel free to ask for it.