Get complete insights into flourishing Latin American shared-mobility market and steal the market by developing an app like Tembici

Tembici is a Brazilian e-bicycle startup that owns almost 80% of the market share in Latam and has now raised USD 47M funding in Series-B round.

Tembici is operative in Latin America’s leading urban markets including Porto Alegre, Recife, Rio de Janeiro, Salvador, São Paulo in Brazil, as well as now with the fresh funding it will be also available in Buenos Aires in Argentina and Santiago in Chile. The fresh capital will also be further invested in R&D.

Funding round was led by Redpoint eventures and Valor Capital Group. The new funding round marks the entry of the International Finance Corporation (IFC), the subsidiary of the World Bank Group into the micro-mobility market, and also Joá Investimentos participated in the round.

During the pandemic, global tech startups have seen a massive decline in operation as well as funding has also declined by 20%, Tembici has seen increased ridership in São Paulo and other Brazilian cities with 2 million rides per month and raised funding of $47M with its strong position.

The global micro-mobility market has shown unusual patterns throughout the first half of 2020. On the one hand, you have startups like Lime and Grow Mobility struggling to keep operations afloat and Uber who handed off Jump to Lime, and on the other hand startups like MUVO and Tembici that have raised significant equity.

Let’s take a closer look at the thriving Latam micro-mobility market:

Latam micro-mobility market insights:

Latin America comprises 36 countries with a population of more than 517 million, of which 30% live in urban areas. São Paulo solely consists of 12.1 million inhabitants and 8.7 million motor vehicles, which makes it the world’s fourth most gridlocked city, according to a survey by INRIX.

Unfortunately, the public transport systems of Latam have not followed this fast-paced growth, which is why shared-mobility has gained popularity in the region. Now it pushes Latam’s traditional urban mobility to the brink of massive change, particularly ride-hailing services and bike-sharing services expected 100% growth by 2023, according to Frost & Sullivan research firm.

The same research firm forecasted the annual electrified car and light commercial vehicle (LCV) sales to jump to 158,300 units by 2025 in Latam.

Considering the current situation, Mexico is ideal for implementing an electrified fleet in the region and is expected to have some of the strongest demands and lowest price offerings for EVs in the near future.

The ride-hailing market of Latam:

Unlike many countries of the world, Latin America is still tied to the traditional idea of car ownership. However, the trend is changing with the younger generation opting for on-demand transportation options including shared-mobility instead.

As per the data published by Statista, the revenue generated from ride-hailing in Latin America is expected to grow to USD 1017 million by 2023. This flourishing market has now become a new commercial hotspot for ride-hailing companies including Uber, 99, Easy Taxi, Cabify, Beat, and Nekso.

Beyond this rising demand for alternative transportation options, Latam is the world’s 2nd fastest-growing mobile market. Approx 63% of Latin Americans have access to the internet, via mobile technology.

Carpooling is also very popular within the region. Companies that offer these services include ALD Sharing, BlaBlaCar, and Bynd.

The main ride-hailing service providers within Latam are:

| Company | Founded | Coverage in Latin America |

| Uber

|

2009-USA

2013-Launched in Latam HQ: San Francisco, USA |

Currently present in 16 Latam countries

Largest markets in Latam are Brazil and Mexico |

| 99 (Earlier 99Taxis)

|

2012-Brazil

HQ: São Paulo, Brazil |

Brazil |

| Easy Taxi | 2011-Brazil

HQ: São Paulo, Brazil |

Currently present in 20+ Latam countries

Largest markets in Latam are Argentina, Bolivia, Brazil, Chile, Mexico, Panama, and Peru, |

| Cabify | 2011-Spain

2011-launched in Latam HQ: Madrid, Spain |

Currently present in 10 Latam countries |

The car-sharing market of Latam:

Geographically, Latin America is the 2nd largest shared mobility region in the world. Goldman Sachs has also forecasted that the car share industry in Latam will grow eightfold to $285 billion by 2030.

Latin America has 5 car-sharing systems in operation, however, car-sharing service providers face many challenges while introducing this service to smaller Latam cities that consist of a large population with low to middle incomes.

In certain areas of Latam, car-sharing can be less cost-effective for people for longer leisure or tourism trips than traditional transit. Furthermore, high car crime rates in parts of the region also disincentivize companies to set up a car-sharing business within Latin America.

However, the earliest adopter of the car-sharing service was Brazil not only in Latam but among the whole developing countries. Zazcar was the first car-sharing system in Latam, founded in 2009 and is still in operation within Sao Paulo along with two other companies, GlubGT and Vamos.

Another country with a growing car-sharing market in Latin America is Mexico. The car-sharing system emerged in Mexico in mid-2012. The Carrot was the first to launch it with just three vehicles and grew to a fleet of 20 within the first two months of operation. From the very beginning, Mexican car-sharing operators have benefited from the support of local governments.

Other car-sharing companies operating in the Latam include Auto in Chile and Urbano LDSharing in Brazil.

E-bike and e-scooter sharing market of Latam:

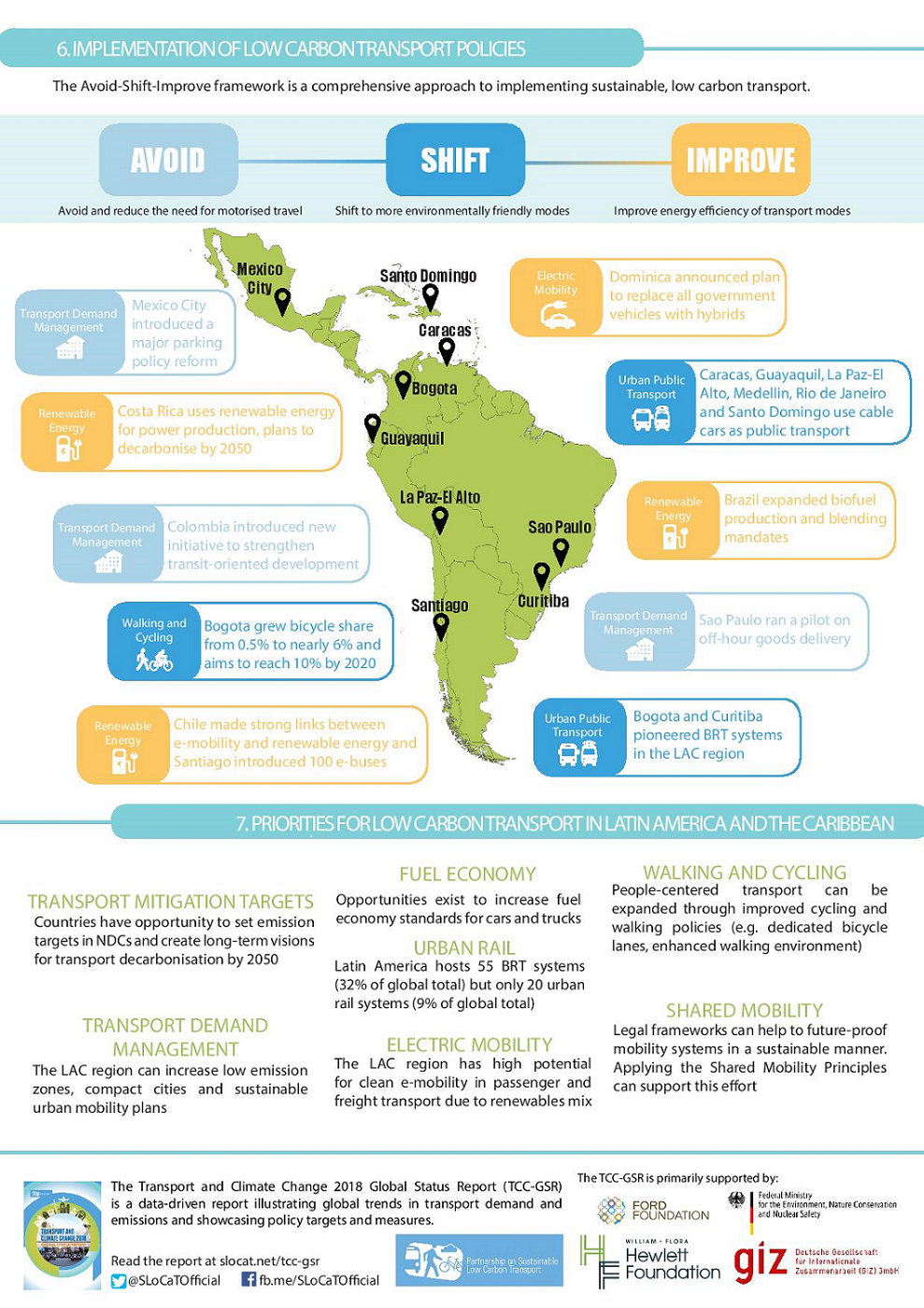

The transition to the bike-sharing services in Latam has not been smooth due to the government regulations in the industry and the forever changing competitive landscape. However, growing each city into a more sustainable environment has now become the objective for most of the Latam governments, therefore bike-sharing has recently welcomed in the region with open hands.

Bike-sharing in Latin America was launched in 2008 in Brazil and Chile followed by Argentina and Colombia. Then with passing years Colombia, Venezuela, Ecuador, Uruguay, and Mexico have also played host to new bike-sharing within the region.

PBSC Urban Solutions is the largest bike-sharing service provider in Latam and has deployed bike-sharing systems in 6 major cities of Brazil with the ultimate goal of deploying a fleet of 8,000 bikes across the entire country.

Yellow bikes provide dockless bikes and are also popular in the streets of São Paulo. The company works on a subscription-based payment model by which customers pay for a month of service at once.

Bird has rolled out its fleet of e-scooters into Mexico City by deploying 100 scooters in the popular areas of Mexico city including La Condesa, Napoles, Polanco, and Reforma neighborhoods without any explicit permission from the local government. Now the company is hoping to expand its services in other parts of Latam.

Grin is a popular Mexico-based electric scooter company and has big plans for expansion across the region. The company is merging with Sao Paulo-based company Ride, in efforts to strengthen its position in the market.

Autonomous vehicles market in Latam:

Autonomous vehicles are certainly not a priority within the Latam transportation industry. However, 70% of Latin Americans expressed willingness to use AVs in one of the surveys conducted in the region by Nissan. People in Latam believe AVs could improve mobility and safety on the streets of Latin America. These statistics display that the region is open to new mobility technologies in the future.

How the local governments are helping businesses to boost the changing landscape of Latam mobility?

Considering how expensive the EV market is, apart from private investors, the governments of Latin American countries have intervened in the market to expand EV facilities and sales in the region. This evolution might speed up by adequate policies of the governments such as reduction of manufacturing costs, the increasing concerns about climate change, etc.

Many local governments of Latam are providing direct or indirect financial incentives to promote the use of EV more in the region such as:

- Exemptions from import taxes in Colombia, Costa Rica, Ecuador, Uruguay while Argentina and Brazil have lowered the import taxes.

- Exemptions from value-added taxes (VAT) in Colombia, Ecuador, and Uruguay.

- Revenue-neutral financial incentives are also available in certain countries such as rebates on circulation taxes, insurances, Parking fees, tolls, etc. while reduced electricity tariffs for charging of EVs apply in Chile and Mexico.

Some indirect financial aid is also available in many countries such as:

- Mandating a minimum percentage of parking spaces reservation for EVs in public parking lots, as implemented in Mexico, and recently in Ecuador.

- Exempting EVs from traffic restricted zones implemented in Colombia and Mexico.

- Many Latam countries have launched programs to encourage the construction of charging infrastructures and obliging new construction sites and public buildings to install charging stations as implemented in Colombia, Costa Rica, Mexico, and Uruguay.

- In many countries National Utility Companies are obliged to install charging points throughout the cities such as Nissan in Brazil, PPP models are also common for this purpose in many countries of Latam such as Petrobras and Nissan in Chile, Edesur, and Renault in Argentina and Mexico.

How can Coruscate help you to make an app like Tembici?

Coruscate is the leading e-scooter app development company across the globe. We have successfully delivered 10+ e-scooter apps for the leading global market.

To know more about our development process, features, pricing structures, and personalized quotations, please feel free to contact us. Our one of the senior business experts will provide a free consultation to you with the free e-scooter app demo.