Develop FinTech app like Cleo : AI-enabled chatbot can keep your FinTech startup alive even during apocalypse

In this blog know how to develop FinTech app like Cleo which tracks users’ balance with awesome AI technologies.

A London-based FinTech startup named Cleo which has taken AI to heart and developed a money management app which works fully on AI-enabled chatbot. How? Let’s find out.

In this blog, you will get to know,

- What is Cleo?

- How does Cleo work?

- How Cleo provides bank-level safety?

- Roles of AI technologies and AI-enabled chatbot in the FinTech app.

- How much does it cost to develop a FinTech app like Cleo?

What is Cleo?

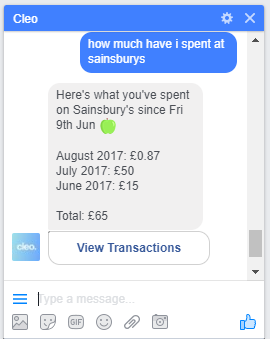

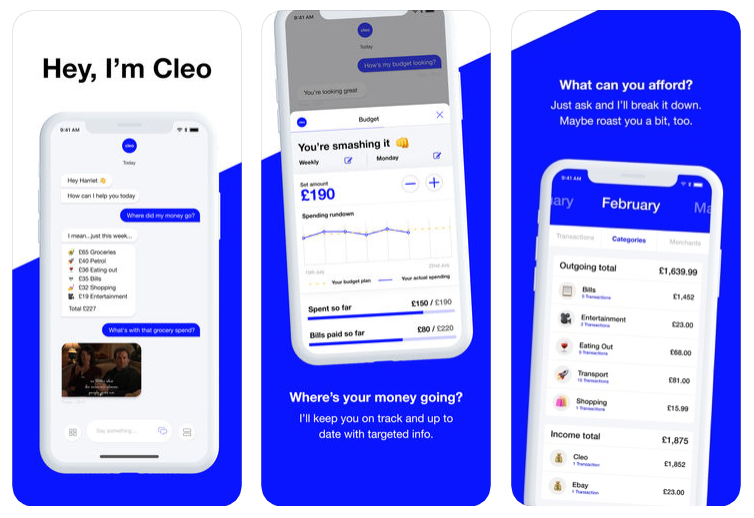

Cleo is the London-based FinTech startup which was founded by Aleksandra Wozniak and Barnaby Hussey-Yeo in 2016. It provides the AI service which tracks and manages the money. By using the AI feature of the Cleo through the Facebook messenger, and other communication channels like text message, Amazon Alexa and Google Assistance, user can simply ask the questions related his recent payments and bank accounts and Cleo’s AI-enabled chatbot presents the details of user’s spending, broken down by category, transactions, and merchant. To make users feel that they are talking with humans and not with a chatbot, Cleo’s chat window shows different emojis and GIFs and adds humor. This step of Cleo is very appreciated in the FinTech industry where everything is unexciting!

Cleo also offers Cleo Wallet to the users and recently, Cleo has launched their own app to eliminate the dependency on the Facebook messenger.

Cleo claims that they have successfully acquired 1.3 million users who have performed 5 million-plus transactions. With its new funding round which was led by Triple Point Capital, Cleo will now aim to expand its business reach in the USA where Cleo had already commenced its service last year. Cleo’s decision to enter the capital of the FinTech industry was noteworthy as Cleo has acquired around 6,50,000 users of the USA.

How does Cleo work?

Cleo asks users to add the bank details which Cleo analyses in read-only mode which means Cleo can only view the encrypted data. However, to fetch payment and bank data, Cleo hasn’t developed own module. Instead, it uses a top financial software called SaltEdge. Cleo now employs its AI brain to scan the transaction history, and to spot spending trend and user habit. For example, if a user asks how much he has spent at Sainsbury’s, Cleo replies to him the detailed spending report.

How Cleo makes sure the safety of users’ sensitive information?

Developing a safe FinTech app is a challenge for both FinTech startup and FinTech app development company. But Cleo claims that their app is extremely safe and secure. Because of Cleo’s read-only method, no one can withdraw money from a user’s account, except the user himself. They have also revealed how they access user’s transaction history. To avoid the data breaches, they never save the credentials of the users on their servers and they encrypt all remaining data like transaction history and personal information.

Features of the Cleo app which you need to know before going for FinTech app development for your FinTech startup

- Users can connect securely to their bank accounts.

- User can ask the questions related to their bank accounts and spending by typing and even by voice command.

- App’s inbuilt chatbot answers the question of users within no time. It also uses smileys and GIF to make the conversation interesting and user-friendly.

- App gives all updates of the user’s bank account.

- User can set the budget.

- The app presents most of the information in the graphical format so that users can understand the trend easily.

- User can apply several filters on their spending report.

- User can refer the app to his friends and earn up to $5.

That one next-gen feature of Cleo which helps them to make money.

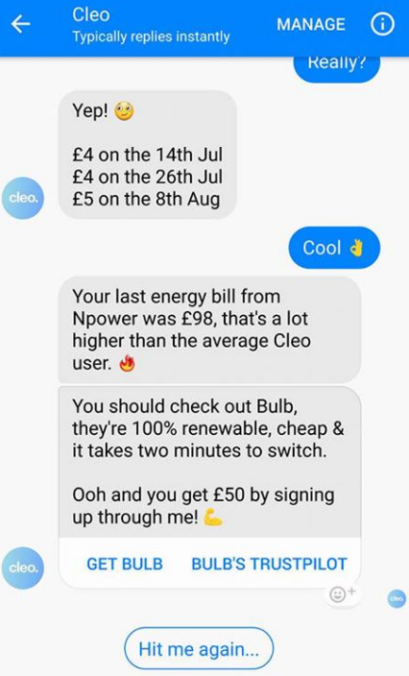

Cleo analyses the payment activity per category for every user. So, when a user pays for the same category to a service provider and the price he is paying is higher than what other users are paying for the same category, Cleo suggests user to try another service provider. If the user follows Cleo’s suggestion and tries another service provider, that service provider pays Cleo.

From the following image, you can clearly understand how Cleo makes money by saving the user’s money.

After reading so far, it is safe to assume that you are now aware of the core element on which Cleo works with awesomeness. So, now let’s discuss what is a chatbot, why you need to ask FinTech app development company to accommodate it in your next FinTech app and how Coruscate can help you?

What is a chatbot?

A chatbot or intelligent banking assistant is a computer program which is developed with AI technologies to conduct a real-time conversation with users via the auditory or textual method.

The sophistication of mobile technology had already started helping us to exchange and authenticate the transaction without human involvement. However, during the relationship-based interactions, a present of a human has always been an unalterable need. But with the advent of a chatbot, all tech giants have started putting emphasis on a chatbot that doesn’t make users feel that they are talking with a module. The current generation of Chatbot we are experiencing is capable to schedule meeting, book the cab and many other resource-sensitive tasks.

Why you have to add chatbot in your FinTech app of FinTech startup?

An AI-enabled chatbot can be your finest investment as it helps you to deliver excellent customer service and it eventually boosts your sale. Following are some more examples of how as a FinTech startup, you can derive the benefits from the chatbot.

- A chatbot works round the clock.

- It replaces a team of customer executives which means you can now save a few bucks.

- It studies the customer preferences and remembers it. It treats every customer individually.

- It organizes the advertisement campaign and cross-sells efficiently.

- It responds instantly to any query of users.

- It responds in easy-to-understand text and images.

- If needed, it can talk with customers in a different language too.

How does a chatbot work?

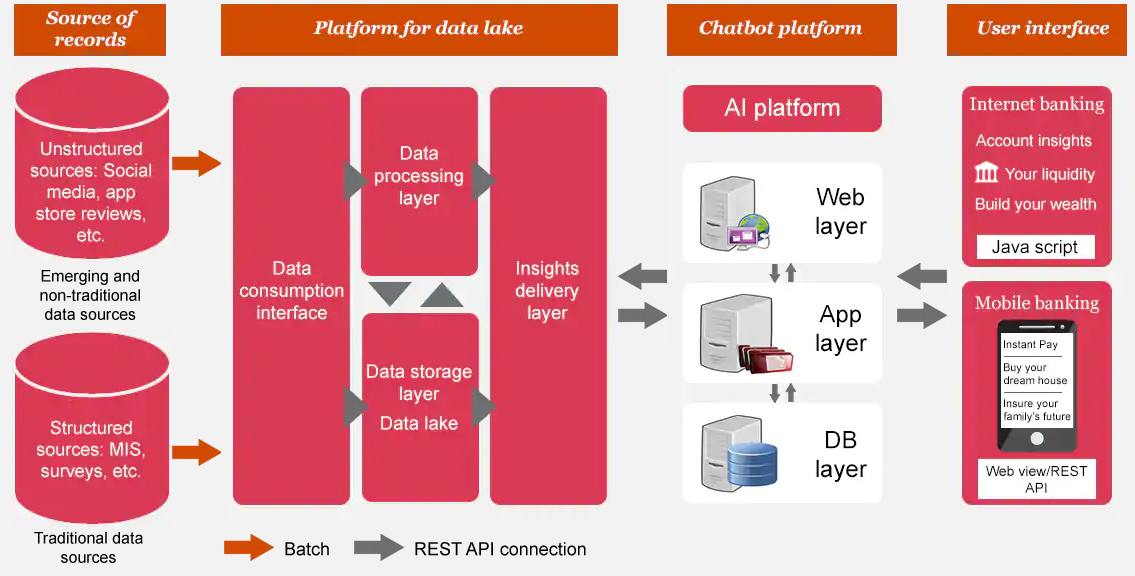

Image source: https://www.pwc.in/

How much does it cost to develop a FinTech app for FinTech startup?

Coruscate is top FinTech app development company, which develops startup ready FinTech apps. In fact, we have developed several FinTech apps and entertained many FinTech app development related queries. Our trained developers and designers build the next-gen app by utilizing the skills they have earned while working in the most challenging industry. We will not only build the FinTech app, but we will integrate features like Cleo so that you can dominate the market quickly. We have already completed successful API integration with Nordic banks and so, we can now develop a FinTech app within 45 to 55 days and under $10k. To know more about the features and ask for a free demo and consultation, visit our FinTech app development page. We will keep your FinTech startup alive even in the apocalypse!