Apple rolls out Apple Card: Know features of Apple Card and how NFC technology doubles the usage rate before going for FinTech app development

Apple’s CEO Tim Cook said in the last earnings call that Apple Card would arrive in August, and it is finally here!

Apple has redefined the FinTech industry by rolling out the credit card named Apple Card that strengthens users’ ability to pay for goods and services in a very hassle-free way. However, Apple hasn’t made it accessible for all. As of now, only those users who have signed up to be notified about the release of Apple Card are getting the opportunity to apply for the card straight from the Apple Pay app. They are even getting the option to order a physical Apple card.

Here, it is worth to mention that Apple will fully roll out their card later in August and it will require the latest version of OS (IOS 12.4 and up) to operate.

Apple isn’t the sole player who distributes credit card with the mobile app to the users. There are other financial institutes and FinTech startups like Revolut have already set the example of creating best shopping experience in the world with the robust FinTech mobile app and a smart credit card that connects with the mobile app and makes spending trackable. Then why everyone is talking about Apple Card? What is the big deal with Apple Card? Is it just hype or it is actually going to transmute the FinTech market landscape? Let’s find out.

What is the big deal with Apple Card?

The ‘thing’ Apple has rolled out today, has already had existence on our planet earth. And Apple knew it. So, rather than shaking it up, Apple brought innovation in the software part – Apple Pay app. They have redesigned the app and accommodated some of the most unique features into it. Following is the list of new features Apple has introduced. If you are an entrepreneur and planning to develop a FinTech app, then you have to chew over this list.

- One of the most prominent features of the Apple Card – enabled – Apple Pay app is the live heat map. As you can see in the following image, the clever mechanism gives users the live heat map of spending in different categories. The colour of this virtual card shifts according to the different kind of things you pay for. For instance, if you are paying at a restaurant using Apple Card, this virtual card on the mobile app screen takes on an orange hue. And when you pay for entertainment-related items, the card gets a mixture of orange and pink colour.

- In addition to the live heat map feature, Apple has also delivered a new reward program. Now, you can get cashback based on the percentage of the purchase you make in three categories. These three categories are Apple store (3% cashback), Apple Pay purchases (2% cashback) and paying through Physical card (1% cashback).

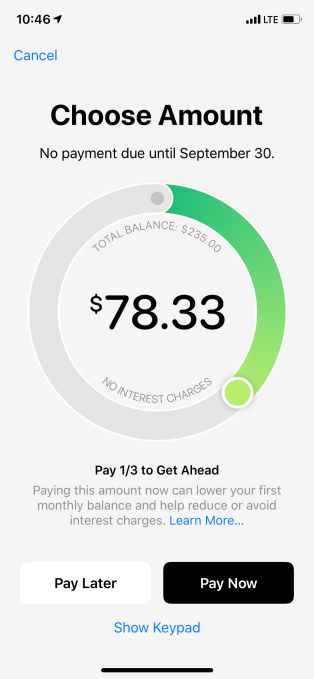

- The payment interface is also unique. They have designed it in such a way that it helps you to not pay interest or pays interest as minimum as possible. On the circle-shaped interface, it arranges 1-3 markers which exhibit the payment you need to pay off minimum, minimum with no interest and in full.

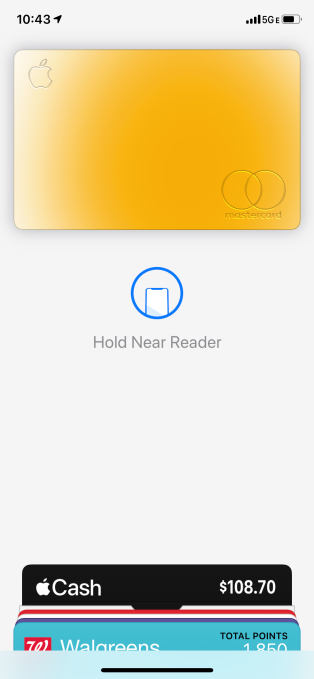

- Like all other products, in Apple Card too, they have successfully imposed the feel of the next-gen feature! To activate the Apple Card, users just need to take their mobile phones near to the cards. With the NFC technology (which is there in both Apple Card and iPhone), users cannot only activate the card, but they can pay without even touching the card. Watch the following video that presents the process to activate the Apple Card, to understand how NFC technology offers ultimate convenience to the users.

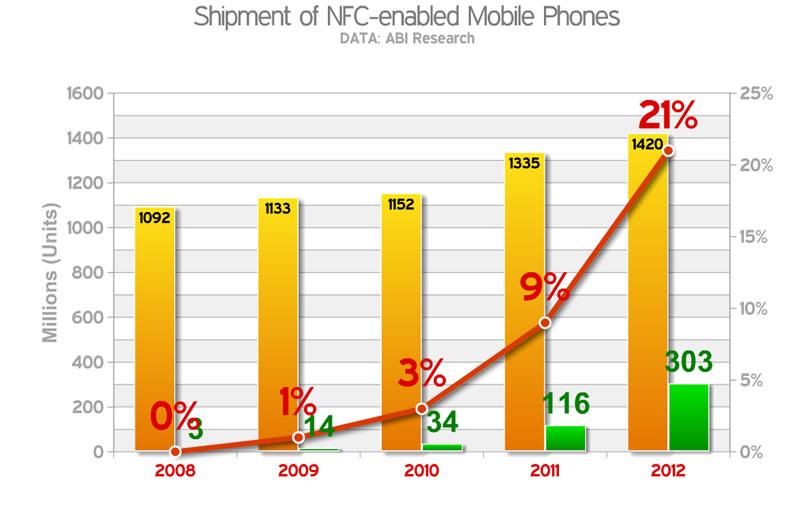

- After reading so far, hopefully, you successfully manage to find out that one unique Apple Pay’s attribute which is neither a feature nor a flawless UI, but a technology which makes features work. Yes, we are talking about NFC technology. It is one of the most noticeable technologies, fueling many top FinTech apps. You can also develop NFC enabled FinTech app to have 50% more usage rate than your competitors.

What is NFC technology?

NFC (Near Field Communication) technology is the communication protocol that establishes the connection between two electronic devices. In the FinTech industry, the use of NFC is flashy. It enables users to pay via phone by just taking it near to the merchant’s point of sale system. Most popular eWallets such as Apple Pay and Google Pay are armed with the NFC technology.

However, mobile phones should have an NFC chip inside to make contactless payment work. But it is no longer the major concern for NFC-enabled payment app owners as the majority of mobile phone manufacturers assemble mobile phones which are equipped with NFC chip.

Why you need to develop NFC enabled Fintech app like Google Pay and Apple Pay?

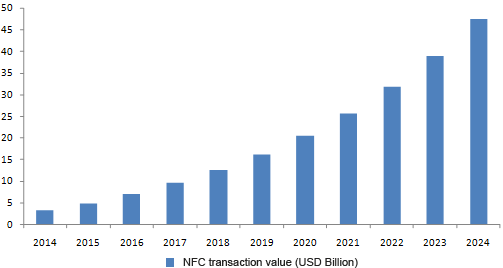

Following image clearly depicts that NFC transaction value is going to reach $50 billion in 2024. Do you know why? – Of course, because of its unique characteristics. You can also derive many benefits from these unique characteristics.

» More security

In the FinTech industry, security is still one of the major challenges. Many people still not prefer to use some sort of eWallet apps to make a payment over security concerns.

Meanwhile, NFC technology has risen as a ray of hope. It can make the online payment environment safer with its exclusive abilities.

An NFC -enabled eWallet communicates with the merchant’s payment system only when a user unlocks it and selects the payment card. If your hired FinTech app development company integrates secure thumbprint or facial recognition method to unlock the eWallet, it becomes more secure. Additionally, merchant’s point of sale system or NFC chip-integrated mobile phone connect with only a single device at a time. This mechanism makes sure that some nearby customers don’t pay for another’s purchase, accidentally.

» Convenient

If the underlying purpose to build FinTech app is to provide seamless user experience while paying for goods and services, there isn’t any better option available than NFC technology enabled FinTech app. It helps users to get rid of carrying multiple cards. It also enables users to pay without taking out cards. If the app is feature-packed, a user can even track his spending and make strong financial decisions. NFC is versatile. Users can pay from the NFC enabled eWallet to reserve the restaurant seat, buy the movies passes, book the train tickets and many more.

So, now when you know the benefits of having contactless payment feature via NFC technology in your eWallet app, let’s talk about how much does it cost to develop FinTech app which is compatible with the NFC technology.

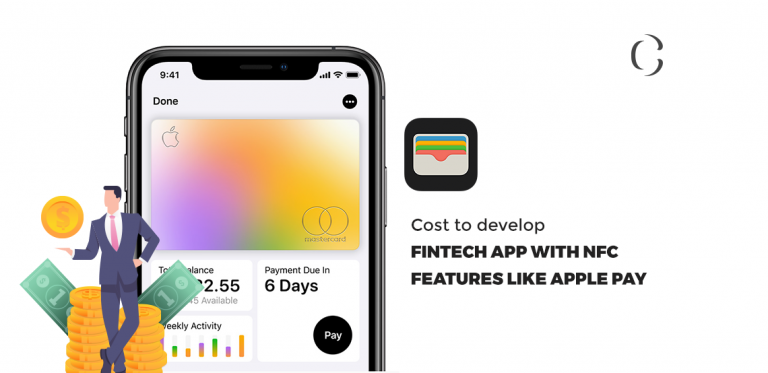

How much does it cost to develop FinTech app with NFC features?

Coruscate is the top FinTech app development company which entertains numerous queries related to FinTech app development. Our developers and designers have already earned expertise to develop the most scalable and money-making FinTech apps. We even have successfully achieved an API integration with Nordic banks.

With our rapid app development technique, we can develop your FinTech app within 45-55 business days and under $10k. However, FinTech app development is not a single time process. You need to rewrite the app or update the app every time the government makes changes in the legal norms.

To know more about FinTech app features, and ask for a free demo with consultation, contact our app scientist and business expert.