The post-lockdown journey of popular e-scooter apps at a glance

It was not a long time ago when e-scooters were a controversial topic in almost every country and their future was also hung in the balance. And then came COVID-19 and the obligation of social distancing gave a whole new angle to the controversy and the debate changed completely.

The UK is the most suited example, as the UK authorities had occasionally cautioned and turned a blind eye to employing e-scooter legally on the pavements, now felt the urgent need to plan the fast-tracked trials to legalize the e-scooters on the streets of the UK.

Certainly, the fear of community transmission of the virus and the need for social distancing is going to stay for years to come within the community. And the new normal will eventually need new tools that follow personal distancing for people to stay safe while seeking to commute.

Of course, the global lockdowns were one of those darkest times before dawn for micro-mobility startups. But in that darkest time, micro-mobility startups have struggled a lot to keep the business in operation.

For example, Swedish startup VOI shut down operations in all but six of its markets. Berlin-based e-scooter startup Tier Mobility postponed its launch in Rome, pulled out the business Malaga and Turin, and scaled back across all the other markets. US-based startup Lime pulled out from Europe completely.

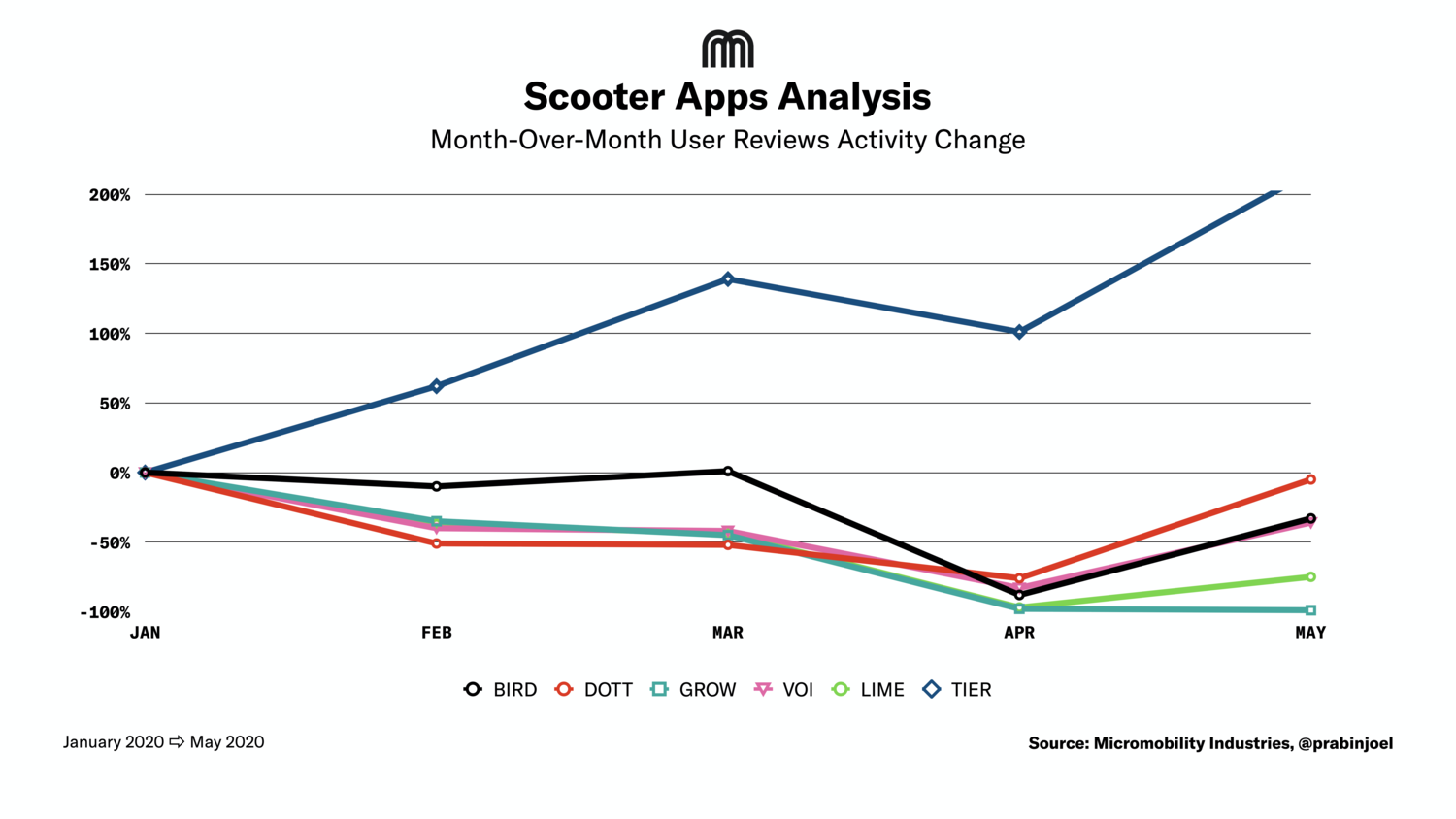

But now, as lockdown norms have been relaxed and cities started moving again, the great bounce-back of micro-mobility startups begins, and micro-mobility app store activity showed tentative signs of recovery in May. So, let’s see how micro-mobility businesses have resumed their business across the globe.

➤ Usage:

Dott scooter usage has jumped back to pre-lockdown levels in all its markets i.e. the number of rides taken by people on 11 May is the same as the rides taken on 9 March and then the usage went even higher.

Tier’s operations remain shut down in Italy and Spain, but the overall usage combining all its markets is not too bad, certainly, not the number the company was hoping for in May.

Meanwhile, VOI has seen a surge of 50% in the usage compared to last May.

Lime has stopped operations in all its markets and saw a 100% drop in usage.

Bird has stolen the market as usual and seen record-breaking demand and doubled its usage compared to its pre-lockdown levels.

➤ Special services for front-line warriors:

Several micro-mobility operators across the world rolled out special schemes for essential workers to use their fleet as an act of kindness with the benefits alike marketing ploy.

Tier offered free rides for up to 15 minutes at a time to front-line workers to help them travel safely.

Dott partnered with 70 healthcare organizations and essential shops to help their staff in safe transit.

Voi has increased the number of fleets near hospitals in all its markets. It also offered free rides to healthcare workers in Berlin, Lyon, Oslo, Paris, and Stockholm.

Lime partnered with the AP-HP hospital system in Paris to offer free rides for healthcare workers.

➤ Fresh investments and fundings:

Whatever the lockdown has cost to micro-mobility operators, but it didn’t stop some of the operators to raise the fresh capital or expand their businesses in the new cities.

Tier has launched its services in five new cities including Trondheim in Norway and Uppsala in Sweden, and now the company is planning to launch its services in 3 cities of Germany in the coming months.

VOI has also expanded its business in Trondheim – Norway, and Zurich – Switzerland in the last two months.

Lime has recently launched its services in Krakow and Rome.

Dott has expanded its services to the city of Warsaw and is further planning to launch its services in several Italian and German cities in the coming times.

Lime raised $170 million funding in early May, just a week after the company made an announcement of laying off 13 % of its workforce. It is the biggest round of funding made post-lockdown.

Bird has also managed to raise $75 million onto its Series D round funding.

Bolt raised funding of €100 million after lockdown for R&D.

All of the giant e-scooter operators across the globe are planning to launch its services in the UK as soon as the fast-tracked trails get over hoping for green signal to e-scooters in the UK.

➤ Developments in user-behavior with new normal:

E-scooter users are taking more distant rides and spending more time on the fleet than the times before the pandemic hit. Also, the e-scooter companies reported more journeys began and end in residential areas. This data suggests that the micro-mobility is now being used more for utility than for recreational moments.

Tier has observed a 20% global increase in its average ride duration.

Lime has noticed 25% longer rides on average in Europe with increased distance traveled per minute. The company has also witnessed an average of 15% hike in the number of rides per day in Europe.

VOI has observed almost doubling the duration of trips (avg. of 18 minutes) made by people in Sweden, and an increased number of trips per week.

➤ App store ratings and reviews:

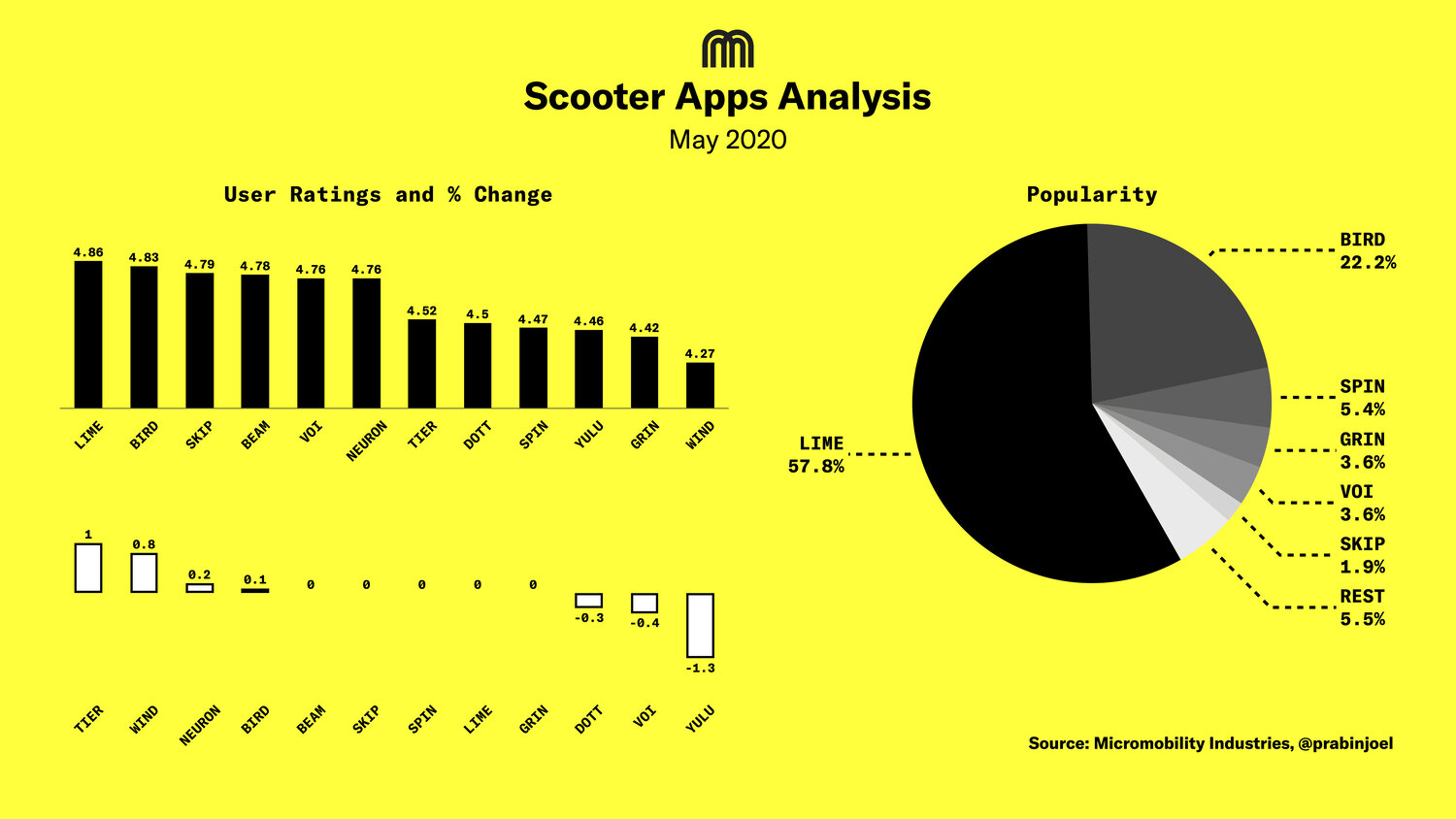

The most increased number of app store reviews reported by Lime (787%), followed by Bird (452%). Latin American e-scooter operator Grin is the only app with decreased app reviews (-49%).

The five operators Bird, Grin, Lime, Spin, and Voi combined accounted for more than 90% of international app store reviews in May, where Lime received highest reviews (57.8%), but Bird accounted the highest growth in in-app store comments (29.5%), followed by Lime (25.8%).

Lime reported the most reviewed app in several European markets, including France, Germany, Italy, and Spain. VOI also accounted for the highest activity in its home country, Sweden (60%). Dott came in a close second to Lime in France with 33.2% compared to Lime’s 48.3%. In the USA, Bird stole the top spot with 42.4% over Lime’s 39%.

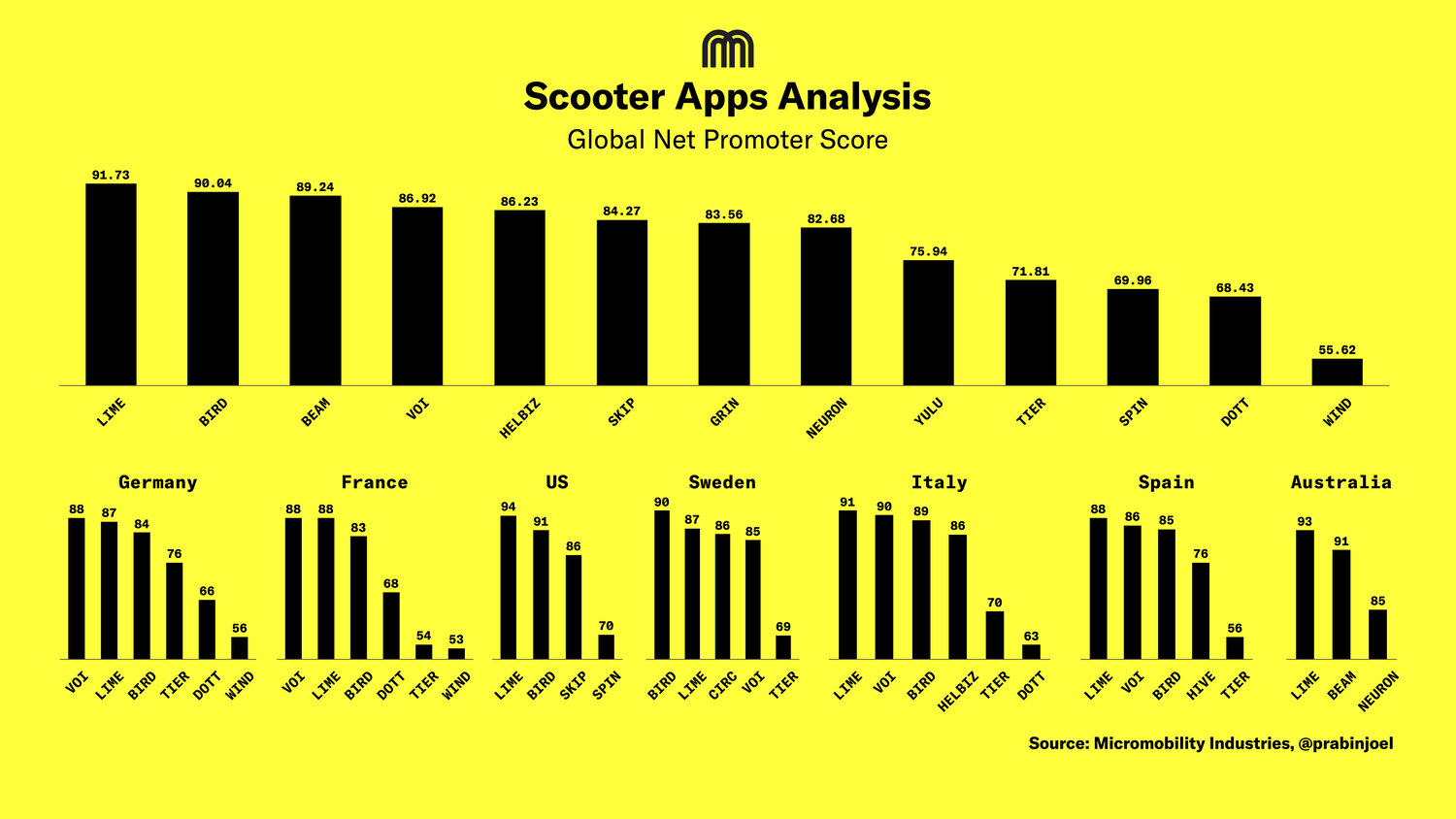

➤ Net Promoter Score (NPS):

NPS is a system to quantify customer loyalty in numbers. NPS is typically calculated by asking customers to rate their level of satisfaction on a scale of 0-10.

Lime accounted for the highest rate of user satisfaction in May (4.86/5), followed closely by Bird (4.83/5). Tier witnessed an increase of 1% in the rate of user satisfaction, followed by Wind (0.8%), While Yulu saw a decline of -1.3%, followed by Voi (-0.4%).

Which made Lime (91.73) having the highest global NPS in May, followed by Bird (90.04).

Although Lime ranked the top in customer experience at a global level, in some key European markets, local players surpassed Lime. For example, in Germany and France, VOI scored higher NPS than Lime. While both Bird and Lime scored higher than VOI in its home market Sweden.

Though NPS scores don’t change more frequently, Tier found an exception as its rating did go up by 3 points compared to April.

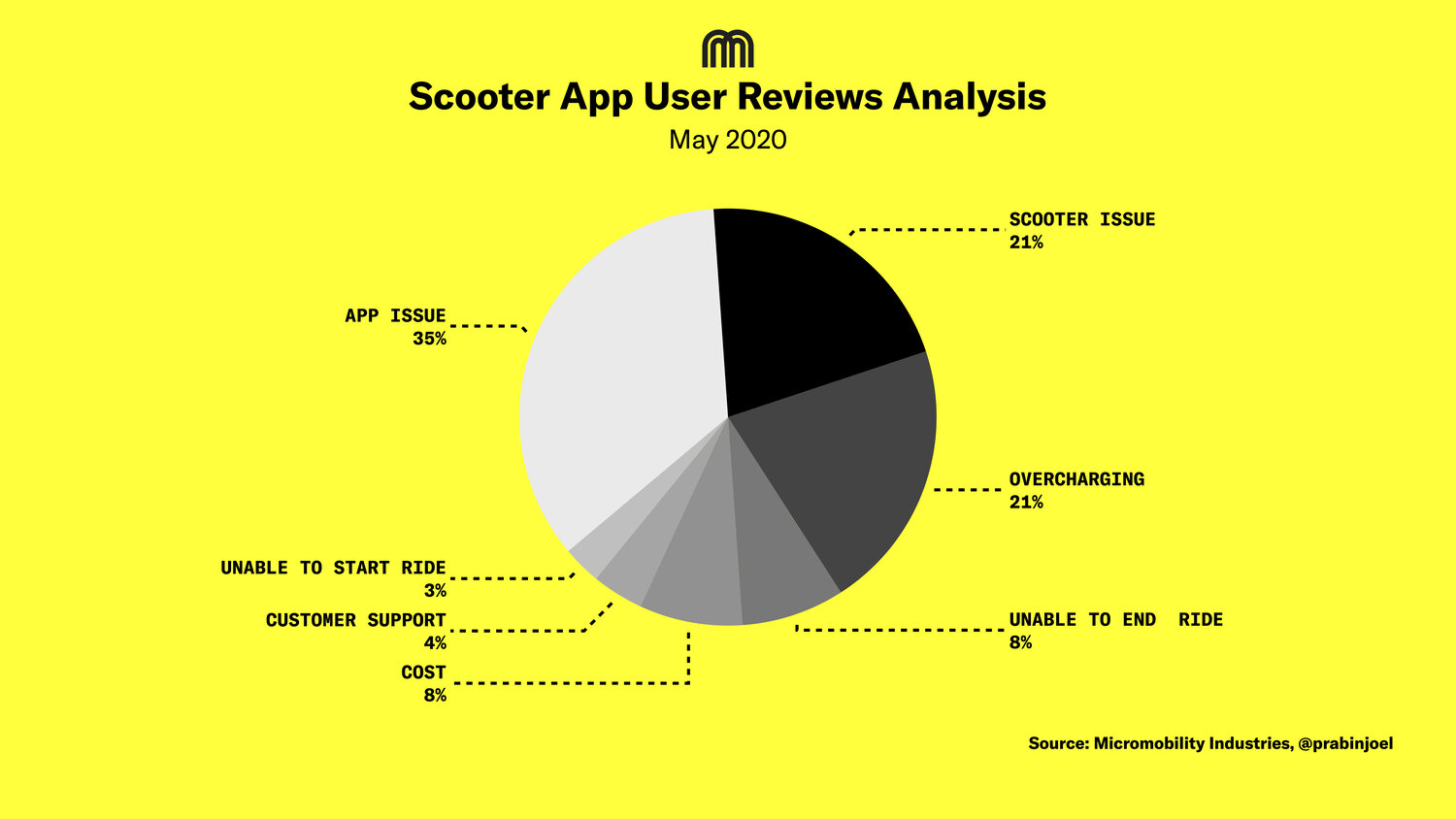

➤ User-reported issues:

Issues with the app (35%): Users reported usual trouble with signup, time to load, app-permissions, payment setup, etc., in the app.

Hardware issues (21%): Hardware problems hiked by 8% compared to April (13%). The common complaints with fleets came due to the lack of timely maintenance.

Issues while riding (11%): Many users complained about unable to lock or unlock their fleets to start or end their rides.

Overcharging (21%): The complaints of operators overcharging the users increased by 7% compared to April. Multiple users are also dissatisfied with operators that charge extra for holds.

Customer support (12%): A few users reported having trouble with the company’s customer care services.

Want to start your e-scooter business from scratch?

The answer to this question is one and only – Coruscate. It is the leading e-scooter app development company with a 100% success rate. Our white label solution – Rohak will help you to set up your e-scooter business from scratch and fulfill each and every requirement of your business with its harmonious combination of the latest technology and amazing features.

Contact us anytime to know more about our development process and discuss your business or ask for a demo and get the customized e-scooter mobile app via ROHAK.