FinTech app development: Develop True Balance Clone app for people having limited financial power and enjoy a large user base

Before 11 years, when the great recession wreaked havoc on the global economy, the trust was ruined and people wanted better options. The aftermath of this environment created a great opportunity for FinTech startups to come in and satisfy the needs of the market. As of now, 32 FinTech companies are enjoying unicorn status and the total valuation of these companies is more than $94 billion.

As the FinTech industry continues to explode, more and more entrepreneurs are jumping into the most profitable business segment. And these entrepreneurs are pushing the boundaries of the FinTech industry by not adopting the conventional business strategies. They innovate the business model, they offer ultimate customer support, they expand their business quickly and most importantly, they utilize the best technologies.

In this blog, we will learn about a Korean FinTech startup, True Balance, which is deriving a lot of benefits from the very potential Indian market. We will study business strategy as well as app features of True Balance. We will also explore the top technologies available for FinTech app development and cost to develop True Balance clone app.

Insight into True Balance – A Korean FinTech startup, dominating the Indian market

➡️ True Balance Founders

True Balance is the eWallet which allows users to access utility bill payment as well as many other financial products. It was founded by Cheolwon Lee, Jay Yi, and Martin Lee in 2014.

➡️ True Balance Services

During the initial days, True Balance was working as a tool to help users find their mobile balance and pay for it. But soon, the ambition of True Balance founders has travelled further and so, they have integrated many other financial services in True Balance. Today, True Balance works as the eWallet. Using True Balance app, users can pay their mobile and electricity bills. Users can borrow money from True Balance while buying any product digitally. They have also recently introduced an e-commerce shopping service on the True Balance app.

➡️ True Balance Milestones

True Balance is practising its business in 4 markets, but India is its most commercially successful market. True Balance claims that they are having 60 million registered users only in India and most of their users are living in small Indian cities. True Balance also confirms that their army of local agents contact first-time internet users and help them to understand the benefits of using eWallets. Thanks to their in-person marketing tactic and large user base, this Korean startup clocks 300,000 digital transactions in India, every day.

➡️ True Balance Funding

Recently, True Balance has closed its Series C funding round with $23million. This funding round was led by seven Korean investors – NH Investment & Securities, IBK Capital, D3 Jubilee Partners, SB Partners, Shinhan Capital and existing partners IMM Investment and HB Investment. In its previous funding round, True Balance has raised $38 million.

➡️ True Balance Future Plan

According to one of the founders, Charlie Lee, they will use this cash injection to bulk up the offering in the app. Adding features to purchase bus and train ticket, digital gold and cooking gas cylinders have already been in their wishlist.

They are also planning to expand their e-commerce store. Because, if they expand their e-commerce store, they can lend more money to users and earn more profit. Lee added in the statement that they are really looking forward to be India’s top FinTech company by 2020 by reaching 100 million digital touchpoints.

And surprisingly, he didn’t mention a plan to cover metropolitan Indian cities under business boundary. Meaning, people in India 2 and India 3 who have limited financial power are the ‘true’ target audience of the True Balance.

So, after knowing every single thing about True Balance, let’s discuss the top features True Balance app is having.

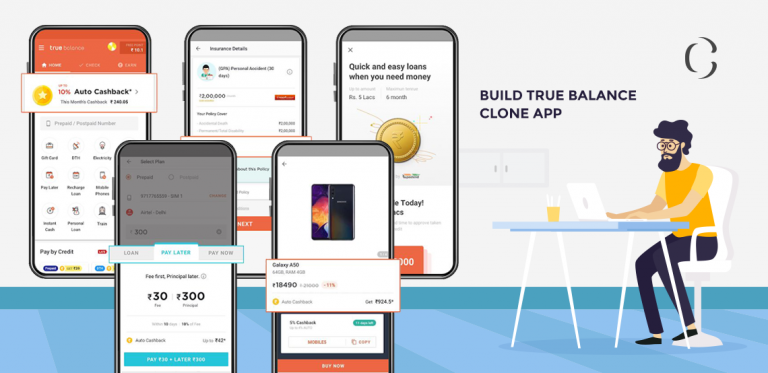

Top features of True Balance app we provide with True Balance clone app

For better understanding, features have been listed out based on the different True Balance services.

➡️ Postpaid bill payment & prepaid recharge

- The app shows users their rental, unbilled and outstanding amount.

- The app notifies users to remind them of the due dates.

- Users can easily pay for mobile recharge across 10 operators and 22 circles.

➡️ Gas & Electricity bill payment

- The app has an easy interface so that people from India 2 and India 3 can use the app easily.

- The app supports bill payment for 52 electricity boards and 9 piped gas billers.

➡️ DTH Recharge

- The app shows all plans and also lets users select the preferred plan which an app remembers.

- The app supports DTH recharge for all popular operators.

➡️ Balance check and Balance alert

- Users can check their mobile balance from the app.

- Users can also check a separate balance for single/dual SIM.

➡️ Instant cash loan

- Instant cash loan feature enables users to acquire a personal loan from 500 to 5000 rupees with a term of 1-4 weeks.

- The app shows users the interest rate and amount in a very well-documented way.

- The app reminds users to pay-back before the due date.

- Users can also get a personal loan up to 50000 with 30% APR.

➡️ Insurance

- Users can buy insurance in just a few steps. The app shows them different types of insurance such as biker insurance, daily commute insurance, and personal accident insurance.

➡️ PayLater

- Users can buy or use any service and pay in 3 easy instalments, within 20 days.

- The app reminds users to pay the instalment to avoid penalty.

After reading so far, if you are wondering how you can outsource your FinTech app development project and develop the True Balance clone app, here is the ultimate guide you can follow.

How to successfully outsource FinTech app development project?

Developing a FinTech app has always been a complex task. Since all business processes of a FinTech startup revolve around the money, even a small error in the FinTech app can lead your FinTech startup to a dead end. So, it is advisable to outsource your FinTech app development project to only a genius app development company. A genius app development company always understands your business requirements and designs & develops the app based on it. They also utilize the best technology to develop FinTech app so that you can successfully attract more users.

It is also recommended to hire FinTech app development company which is clever enough to identify the suitable payment gateway/processor and add it to the app. Here, it is worth mentioning a difference between a payment gateway and payment processor. A payment processor is used in a physical point of sale system. It reads the debit/credit card and transfers the amount from the buyer’s account to merchant account. Whereas, a payment gateway is used to accept payment online. It processes the digitally entered credit/debit card details and shares it to payment processor which then transfers the amount. Meaning, in an eWallet app, you will need both, a payment gateway and payment processor.

You should also take a FinTech app development company’s additional services into account. Because developing a FinTech app doesn’t make you a profitable FinTech startup. You should also get government approval, you should also define the workable business model and you should also run the marketing campaign.

So, to outsource the FinTech app development project successfully, you must always opt for a FinTech app development company which develops FinTech app using all the latest technologies, integrates most suitable payment gateway and payment processor, helps you get government approval and define a profitable business model.

Top suited technologies for the FinTech app development

Before discussing the top suited technologies, it is worth to know the benefits of developing a FinTech app using the right technologies.

Benefits of using the right technologies in FinTech app

The latest, as well as hand-picked technologies, make analysis seamless. You will get all data related to your startup including the user behaviours on the screen. A right technology actualizes the proper environment for fraud detection algorithm to work. That means, the fraud detection algorithm detects more frauds and prevents unnecessary troubles or loss. Moreover, by using the right technology, FinTech app development company can develop a scalable mobile app which works effortlessly even when the high-traffic.

Security has been a major concern for FinTech startups. But there are certain technologies available in the market which give military-grade security to the FinTech app. No intruder can enter the network and hijack

sensitive user information.

Which are those top technologies?

FinTech app development companies always distribute technologies in – front end technologies and back-end technologies.

Talking about the front-end technology, they generally use LAMP, Ruby on Rails, Java, Scala and Python. Amongst all of this, Python is the best technology for front-end. It leads to fewer error rates and with its ready-to-go solutions, many common problems of the FinTech industry can be easily solved.

For the back-end, they use a mix of SQL and NoSQL storage option. They also put Memcache/Redis as well as MapReduce/Hadoop to work. Additionally, they use many revolutionary APIs and payment processors/ gateways.

How Coruscate can help you to develop True Balance clone app?

Coruscate is the top FinTech app development company which has entertained many queries related to FinTech app development including eWallet app development.

Our well-trained developers and designers have already earned expertise to work with all the latest technologies. Using these technologies, they always develop one of the most futuristic and disruptive apps.

Our team of business experts helps startups to get government approval as well as they guide them to craft the most profitable business model.

With our rapid app development technology, we can develop a FinTech app within 45-55 business days and under $10k.

To know more about the app features, ask for a FinTech app demo and discuss your custom requirements, feel free to contact us.

FAQs related to FinTech app development

1) How can an app owner make money from the True Balance clone app?

There are several ways an app owner can earn profit from eWallet like True Balance. He can charge users fix processing fee for using his app to do the payment. He can also take the commission from the business partners who list their services on the app. And for the sake of earning more money, it is a fundamental requirement to add multiple services in the app.

2) How to deal with the government?

There isn’t any way to deal with the government, except following rules. When you first approach a FinTech app development company, you should discuss government rules related to FinTech startups with the company so that they can develop your app in such a way that it does not work beyond the expectation of the government. Also, you need to be prepared to update your app with the minor change in a government rule.

3) How much do you have to pay for using a payment processor/gateway?

Stripe is the widely used payment processor/gateway. And the payment fee of the Stripe is a flat 2.9% + $0.30 for every credit card transaction through the online checkout window.