Stripe Payment Processor : Know whether you need a payment processor or payment gateway?

It is a public knowledge that letting users pay online and in multiple ways increases the sales. But to actualize it, you just simply can’t ask your technology partner to write the code for it. Because they simply can’t! (at least within your budget!)

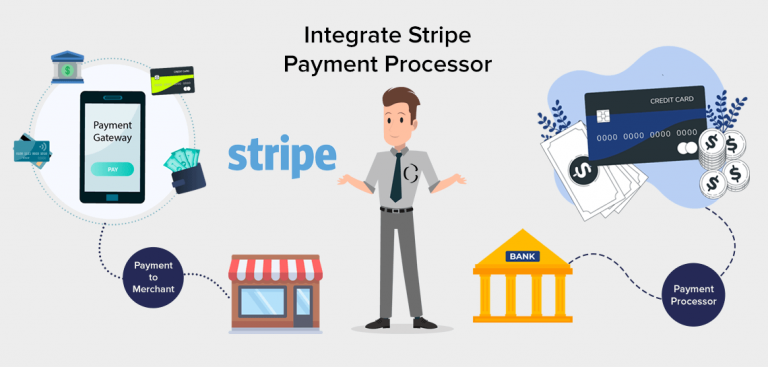

When a user pays using some sort of credit card, debit card or eWallet, a very complex process triggers, to establish the connection between total 4 actors (the customer, the issuing bank, the merchant and the acquiring bank) and to share the data between them to process the payment request. In order to write code for such a complex process, your hired app development company has to invest a lot of resources which will hurt your pocket. So, as an alternative, you can use a payment processor which is a much more affordable, reliable and easy way of accepting online payments.

Since payment processors are provided by FinTech companies and financial institutes which are dedicatedly working for streamlining the payments, it is a more feasible choice than writing own code for processing payment.

One very popular payment processor providing company is the Stripe. It enables merchants to accept payment through various payment channels. It charges you per transaction. We will learn more about Stripe in this blog. But before analysing the Stripe payment processor’s features and pros & cons, let’s wrap our minds around a very important concept.

What is the difference between the payment processor and payment gateway?

Let me keep this very simple for you.

- Jack buys some fruits from the store. He then reaches the cash counter and pays by swiping his credit card at the merchant’s point of sale system. This system is responsible for validating the authenticity of the physical card, which is by the way validated by the payment processor! ( It is just a program, sharing data between those 4 actors and validating the payment based on the reply of those actors) Jack buys a t-shirt from the online store and on the checkout window, he pays by entering details about his credit card.

- Then Payment gateway authenticates the digital information of that card and shares data with a payment processor to process the payment request. In other words, the payment gateway only authenticates the digital information; it is not allowed to process the payment request. That part of the job is only accomplished by the payment processor.

The difference between the payment processor and payment gateway leads us to very interesting learning. Which is,

What do you need? A payment processor or payment gateway?

Based on the previous learning, we can firmly say that if you are running a brick-mortar store ( not e-commerce store) and you wish to accept payment through credit and debit cards, you should opt for a payment processor.

But if you are running an e-commerce store where customers have to pay online, you should opt for both a payment gateway and payment processor.

Luckily, companies like Stripe offers both.

How Does Stripe work?

Stripe which is a payment processor and payment gateway, lets you accept most payment types including Visa, MasterCard, American Express, Discover, as well as Google Pay and Apple Pay. Not only this, it processes over 100 different foreign currencies and converts them at no additional charges.

After integrating Stripe payment gateway or payment processor or both on your system, Stripe takes control of every transaction, from the moment a customer adds his credit card details into checkout window till the money gets credited into your bank account from the customer’s bank account. But this process is not as simple as it sounds.

As soon as a customer enters his credit card details, payment gateway validates the card (via the card issuer) and if it is approved, payment gateway passes the card and payment details to the payment processor. The payment processor then checks whether the customer owns enough money into his bank account or not. If a customer has enough money to pay for his shopping, the payment processor (via the customer bank) deducts money from a customer’s bank account and adds it in merchant bank account (via the merchant bank).

What are the most useful tools and features of Stripe?

Don’t live with the illusion that Stripe only processes the payment! It does fulfil many other jobs, thanks to its groundbreaking tools and features.

» Stripe Elements:

Using Stripe Elements (a custom UI toolkit), you can customize payment form for tablet, mobile, and web.

» Invoicing

Stripe can generate custom invoices and request payment from customers. It also lets you create recurring, usage-based, tiered, promotional and scheduled payments.

» Stripe API

Stripe API allows you to accept payment from all over the globe with a single integration.

» Stripe Connect

Stripe Connect is the payment platform, designed for the larger marketplaces and their complex money movement needs.

» Stripe Relay

Stripe Relay can power mobile in-app purchases. With Relay which is an API, you can link your e-commerce platform with the app and put the Buy button.

How much you have to pay for using Stripe? OR Stripe Pricing Model

The payment fee of the Stripe is a flat 2.9% + $0.30 for every credit card transaction through the online checkout window. For every in-person credit card transaction through the terminal is 2.7% + $0.30. Payment using international cards costs an additional 1%.

Does Stripe provide military-grade security?

Yes, with its Stripe Radar tool, Stripe protects customers against frauds. Stripe Radar tool works on machine learning techniques and trains itself on data across millions of global companies to draw line between fraudulent and legitimate purchases.

Stripe allows merchants to add an additional layer of security. It’s 3D secure tool, asks customers to complete a verification step before completing a purchase. In case of any dispute transaction, Stripe provides an automated dispute handling process.

Does Stripe provide support to merchants?

In case of any query, a merchant can contact Stripe on phone, email, and live chat. Also, it’s support portal is packed with a robust amount of documentation and guide.

What are the pros of Stripe?

- Stripe lets merchants cancel the membership at any time for no additional fee.

- It is offering more features than other companies at this price tag.

- You can totally customize the Stripe, according to your needs.

- Stripe is a global payment solution.

- It gives instant access to payment processing.

What are the cons of Stripe?

- Merchant’s account can be either cancelled or frozen with little notice.

- Stripe keeps an eye on your account and processing habits.

How we can help you to integrate Stripe payment processor, payment gateway or both?

Coruscate can be your best technology partner when it comes to integrating payment gateway and processor into a mobile app and website. Whether you are going for e-scooter app development, on-demand app development, FinTech app development or e-commerce app development, we are clever enough to develop that app and add a payment gateway in it. Not only this, but we will also guide you to select the best payment gateway after studying your business requirements.

To know more about Stripe payment gateway, its features, our Stripe payment gateway integration process, our least possible fee, feel free to contact us. Our business experts will positively respond to your every query.