FinTech app development: How much does it cost to develop a stock trading app like Robinhood or Robinhood clone app?

Want to build Stock trading app? We provide Robinhood clone app solution. In this blog read about Robinhood and it’s success journey.

If you are still paying $7 to $10 per trade while using some sort of stock trading app, you might not have heard about the Robinhood stock trading app! It is the app which was built around one single promise – free stock trading. However, there is a major catch here and you have to know about it if you are an entrepreneur and planning to hire FinTech app development company to develop a stock trading app like Robinhood.

Fortunately, we have covered it for you in this blog, along with the features of Robinhood app, it’s funding details, success story and cost of FinTech app development.

So, without any further due, let’s proceed.

Insight into Robinhood, a stock trading app

Robinhood Markets Inc is the American financial services company which is headquartered in Menlo Park, California. It was founded by Baiju Bhatt and Vladimir Tenev on April 18, 2013. The company offers a robust app named Robinhood that enables users to invest in public companies and exchange-traded funds without paying a commission. Robinhood is a FINRA – approved broker and it also holds the business operational licence from U.S Securities and Exchange Commission.

According to recent news, published in Techcrunch, Robinhood has now been authorized by the Financial Conduct Authority to operate its stock trading business as a broker in the UK. Robinhood also announced Wander Rutgers as the president of Robinhood International and he will lead the U.K business of the company.

However, Robinhood’s journey into the European market is anticipated to be not as successful as the American market as another free stock trading app, Freetrade, has already been performing well in European countries.

Robinhood – Timeline

Though many other stock trading apps like Robinhood have intensified the market, Robinhood still holds the throne of being the top stock trading app. It has educated people to trade efficiently. In fact, many entrepreneurs got an inspiration to develop such revolutionary FinTech app from the working model of the Robinhood app and its success story. So, even if you are having cold feet over a thought of jumping into FinTech industry with a stock trading app, here is the business story of Robinhood which may inspire you!

- In December 2013, Hacker News published the first article about Robinhood and it soon went viral. As a result, many other leading online media houses like Techcrunch, VentureBeat and TheStreet wrote about Robinhood and made it live on their websites.

- In just 30 days, the company acquired 100,000 users.

- In mid-to-late February 2014, both founders of Robinhood were interviewed by CNBC and Bloomberg TV.

- By September 2014, more 500,000 users requested to join Robinhood.

- As of January 2015, Company announced that almost 80% of their users were millennials.

- As of February 2017, Robinhood traded more than $30 billion.

- In April 2017, Robinhood raised $110 million at the valuation of $1.3 billion.

- In January 2018, Robinhood introduced commission-free cryptocurrency platform.

- By February 2018, 3 million users were using the Robinhood service.

- In May 2018, Robinhood closed yet another successful funding round – $336 million series D, at the valuation of $5.6 billion.

- In July 2019, Robinhood raised more $323 million at the valuation of $7.6 billion.

A very profitable business model of Robinhood which you can also follow

Here is the fun part!

Unlike any other business, Robinhood didn’t follow the trend and crafted their own business model which is admirable in so many ways.

Robinhood generates the majority of its revenue from its premium service – Robinhood Good. This premium service which costs a minimum $10 per month, gives double buying power and access to after-hours trading.

Robinhood is also making money through users’ money. Meaning, it collects interest on the unused amount users usually keep in their Robinhood accounts.

And the catch we are talking about in the first paragraph is finally here. Robinhood is commission-free and it should be. But the way it survives while not taking the commission is really interesting. Whenever a user invests using Robinhood app, top trading firms like Apex Cleaning and Two Sigma pay money to Robinhood. Which means users are not purchasing the shares from the stock exchange but from these trading firms.

Why it is a safe bet to develop a stock trading app like Robinhood

With the thriving startup culture, more and more companies are going public. This new ecosystem has boosted stock trading in recent time. According to a Bankrate Money Pulse survey, around 48% of Americans own stocks and trade stocks fairly often.

However, the conventional stock trading methods occupy a list of disadvantages. In contrast, a stock trading app like Robinhood offers many advantages such as lower fees, more control and flexibility, access to online tools, and options to monitor investments in real-time. Because of this many advantages, it is very obvious that you will not be the victim of a thin market problem if you hire FinTech app development company, develop a stock trading app and deploy it in the market.

But FinTech app development isn’t as easy as it sounds. You along with FinTech app development company have to pay heed to so many things and the feature set is one of them.

In the next section of this blog, we will discuss top features which you have to accommodate into your stock trading app. But to make this learning rational, we will study the user journey of Robinhood.

Features which you have to integrate into your Robinhood clone stock trading app. Or User journey of Robinhood

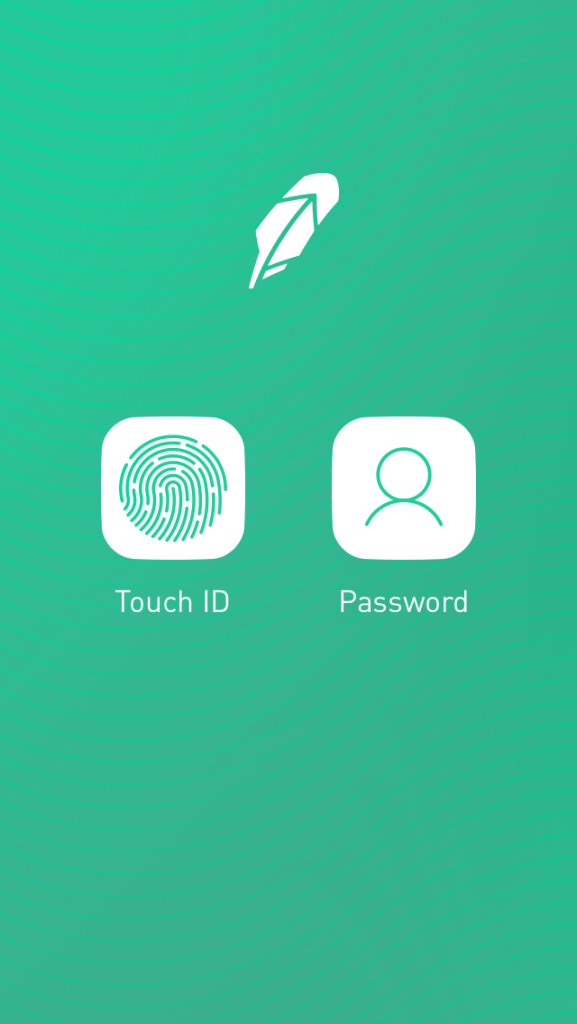

- When a user opens the app for the first time, it asks him to set app locking mechanism – either a touch id or password.

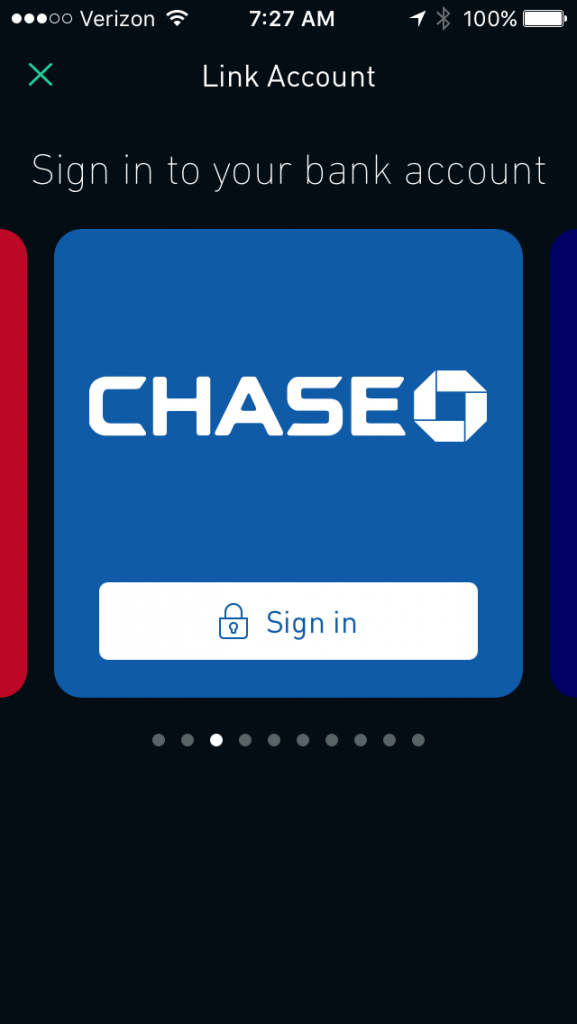

- The next thing the user has to add to the app is the bank details. User can add money from his bank account to the Robinhood bank account. He can even schedule the periodic deposit into Robinhood account.

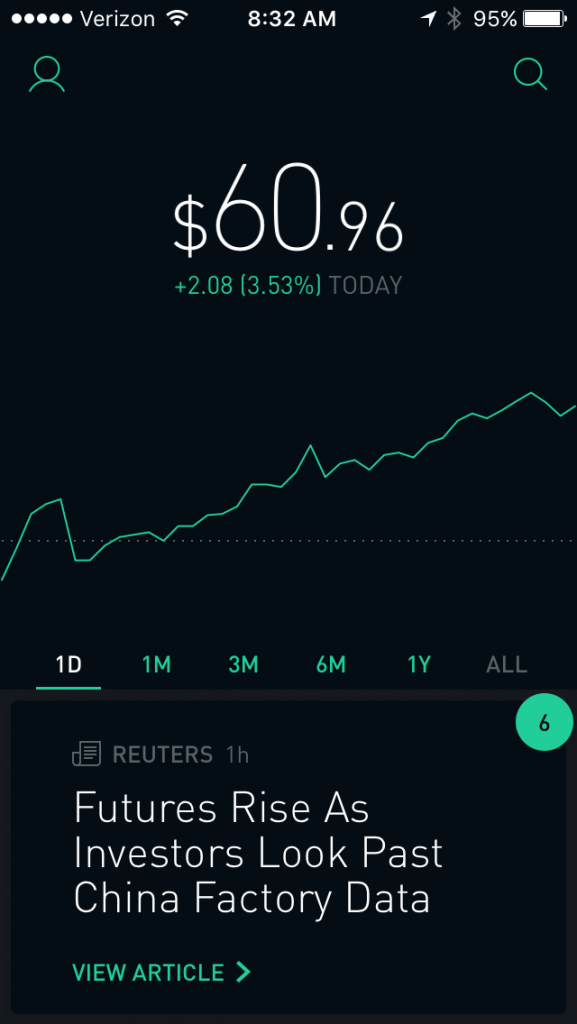

- After adding all these details, the account is now ready and it looks like the following image. It shows you the money you own in the Robinhood account and the money you make every day. From the same window, the user can also view his previous stock trading activities and earning details.

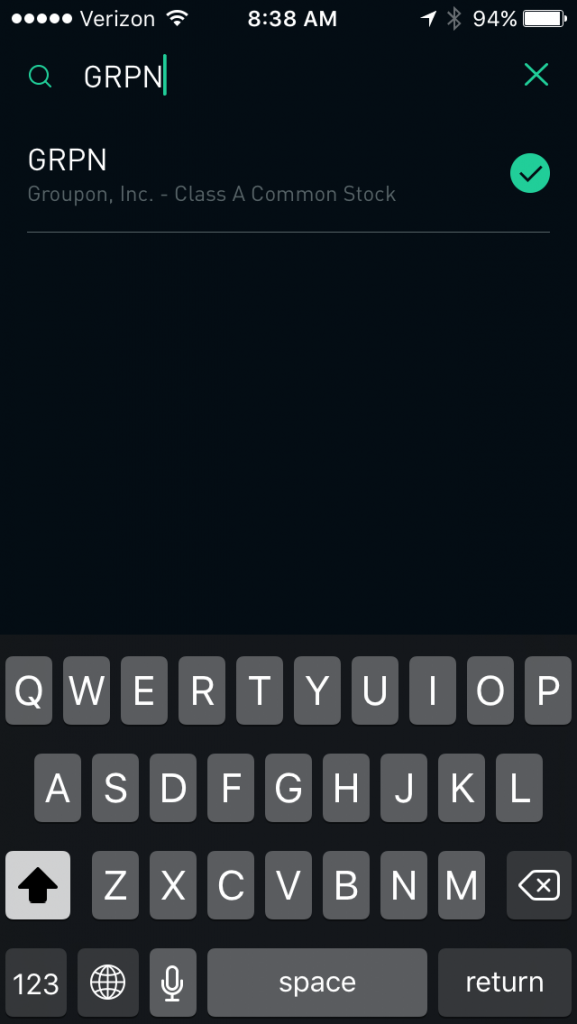

- User can search the specific stock by clicking on the search button.

- Now, when the user clicks on the stock, it presents all details of that stock like following. Without switching to another screen, the user can buy that stock from this screen itself.

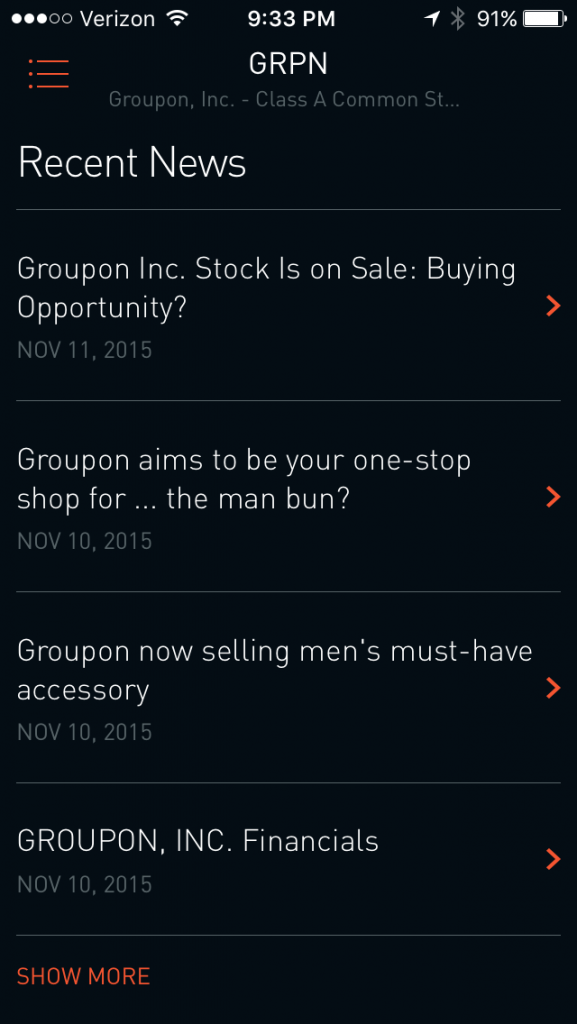

- By scrolling down, user can explore a page which contains all recent news on the stock user has just searched for.

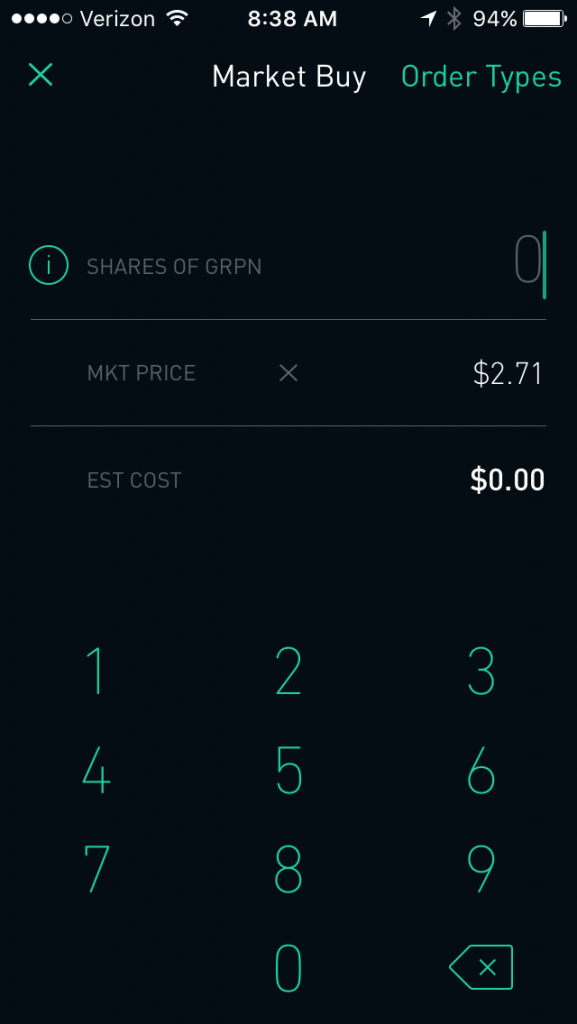

- As soon as the user clicks on the buy button, it lands him on a Market Buy page. Here, he can select the number of shares he wants to buy.

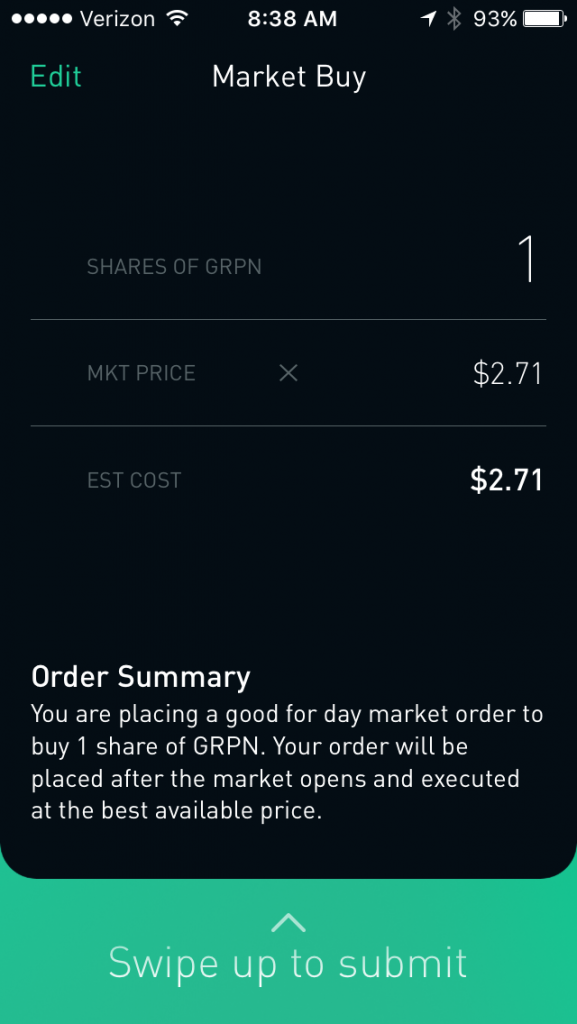

- When the user types the number of the shares he wishes to buy, it shows him the cost of it. To confirm the purchase, he just needs to do swipe up.

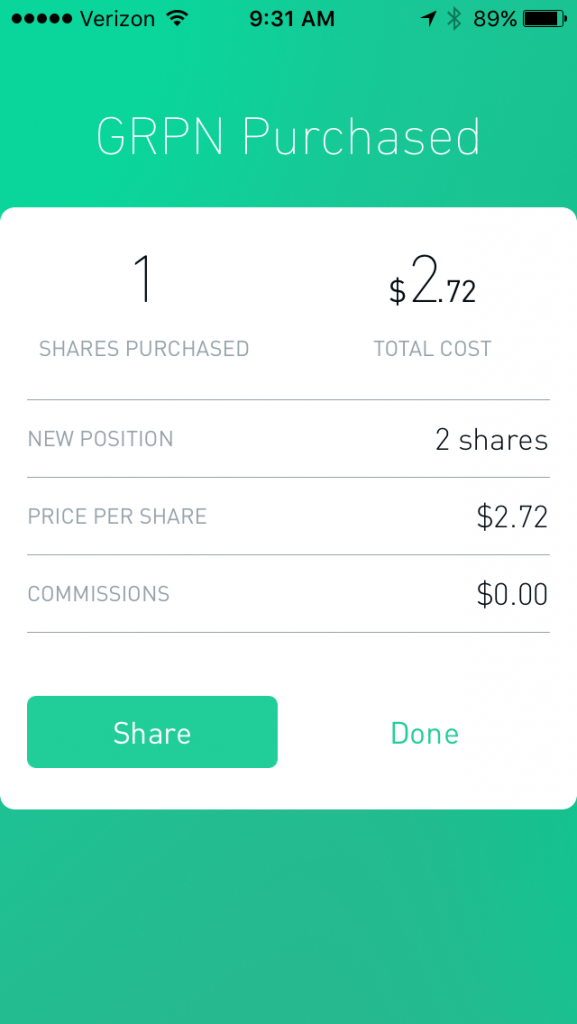

- User can buy the stock before the market is open. Robinhood will submit your request and purchase the shares for you automatically when the market opens. When the market is not open, the app’s background appears black, and when the market opens, it looks like the following screen.

How much does it cost to develop a stock trading app like Robinhood?

Coruscate is the top FinTech app development company which entertains numerous amount of queries related to FinTech app development such as eWallet app development, p2p lending app development and stock trading app development. Our highly qualified developers and designers will satisfy all your needs in the best possible way and develop one of the most robust stock trading apps. We even have successfully achieved API integration with Nordic banks.

With our rapid app development technology, we can develop and deliver your FinTech app within 45-55 business days and under $10k.

To know more about the stock trading app features and ask for a free demo with a free consultation, contact our app scientist and business expert.