E Wallet App Development: 5 Growth Strategies of OPay E Wallet Which Has Raised $50M

In this blog know the business strategy of OPay e-Wallet which raised $50M and cost of e-Wallet app development and FinTech app development trends.

The two very unbelievable events are actually happening: Africa becomes the hub of FinTech and investors have finally caught E-Wallet providing companies into their funding radar.

At least, looking at the news which says a Nigeria-based yet another eWallet OPay has raised $50 M, it is worth to praise Africa and business opportunity of eWallets. But like all other industries E-Wallet is a lack of hope and gloomy outlook in the eWallet app industry too.

For an entrepreneur, kicking off an eWallet providing company isn’t as easy as it sounds. He needs to take care of the market, users, eWallet app features and eWallet app development cost. Recently, many data revealed that data security and privacy are still the major concerns of eWallet app users. And as a result, almost 77% of users don’t prefer to use eWallet after installing it.

Thus, considering the urgency, we will discuss the post and pre-app launch strategies which make sure the constant flow of users. We will also discuss the business model and cost of FinTech app development or eWallet app development. But first, let’s talk about OPay.

Insight into OPay – An Opera founded eWallet only for Africa!

Africa is one of the poorest continents with the lack of employment opportunities and less literacy rate. Thus, the males of many African families migrate to other cities or even countries, leaving their families behind. These families rely only on the money they receive from the males who work hard in some other part of the world. But more than 60% of people in Africa are unbanked and don’t have access to basic banking services which can enable them to send and receive money.

This whole situation fuels the eWallet ecosystem in African countries. And as a result, many robust eWallet apps have emerged in Africa, like M-Pesa, Dusupay, and Paga which raised $10M in 2018.

Talking about OPay, it was founded by Norway-based browser company Opera in 2018. But rather than launching it globally, they decided to make it accessible in African countries only as, at that time, the business opportunities of such eWallet were high in Africa than any other parts of the world.

OPay is very successful in Africa. In just one year of its operation, OPay has acquired more than 120 million users and 40,000 active agents. On top of this, OPay has recently seized a whopping $50 million of funding from the investors like Sequoia China, IDG Capital, and Source Code Capital.

OPay supports the Opera’s growing businesses, a motorcycle taxi service app ORide and a food delivery app OFood. Users who are using ORide or OFood can pay for the order and fare straight from the OPay.

The way OPay app works, tells a lot about eWallet app development and design-related understanding of the OPay team. They have integrated all important features in the app in such a way that to use those features, users don’t need to scratch their heads. They also have put more emphasis on security and privacy of the eWallet app where every data of users is sensitive.

Latest news on OPay and Flutterwave’s integration of Alipay as an e-wallet that shows the growing scope of e-wallets – Updated on 5th Aug 2019

The fintech startup Flutterwave partnered with the Chinese e-commerce company Alibaba’s Alipay to make the digital payments available between Africa and China. The company is a B2B payment service company founded in Nigeria. It was founded with a motive of offering the African companies ease of payments to other companies on the continent and worldwide.

Alipay is a digital wallet platform that surpasses PayPal payments in the year 2013. It claims to have a global network of more than 1 billion active users. A large part of Alipay’s network is in China. It is noteworthy why Flutterwave integrated it for the payment activities of around $200 billion in China-Africa trade.

Flutterwave’s Alipay collaboration also traces a course of the risen appearance of Chinese companies in African tech. In July, the Chinese owned company Opera raised $50 million to boost its growing West African digital commercial network. This network comprises browser, payments, and ride-hail services. The funds are mostly for OPay which is an Opera-owned and Africa-focused mobile payments startup.

OPay is going to use the capital to increase its digital finance business in Nigeria which is said to be the most crowded nation and largest African economy. OPay is also going to assist Opera’s thriving business network in Nigeria. This covers motorcycle ride-hail app ORide and OFood delivery service.

However, the major question is still unanswered; how OPay acquired 120 million users in just one year? To answer this question, we will discuss the pre and post app launch strategies which you need to follow, like OPay.

Pre and Post eWallet app launch strategies, inspired by OPay

If you are an entrepreneur or any financial institute, wanting to develop an eWallet app like OPay, it is advisable to identify the fact that the eWallet app isn’t like any other regular app. Many modules and features of the eWallet app demand an exceptional amount of mobile app development knowledge with the ability to satisfy all legal norms. In addition to a code-heavy mobile app, business planning including app marketing and deciding business model are also very crucial.

On top of all these, an eWallet mobile app requires constant modification and evolution as the basic structure of any FinTech app, including eWallet app is developed while satisfying the legal norms which are, of course, not idle in nature.

► Building a feature set

The feature set is nothing but the description of functionalities that you desire to have in your eWallet app. A feature set exhibits how many features you have to ask the eWallet app development company to integrate into your app to justify the core purpose of the eWallet app.

Considering the fact that the cost of eWallet app development highly depends on the number of features you want to add to your app, building a feature set is very important. Not only it helps you to not miss out any important feature, but it also gives you an idea about FinTech app development cost.

Following are the few features of the OPay app which you can consider.

- User can log in with a mobile number only.

- The user profile is well documented. User can edit all personal details and bank details.

- The user profile also contains the history of transactions.

- With just a single click, the user can know how much he owns in the eWallet.

- Paying for goods is again very easy. User can pay by either scanning the code or by typing the merchant mobile number.

- User can send money to his friends and relatives from the app itself.

- The user gets rewards and cashback frequently.

- All important activities pop up in notification bar to keep the user updated.

- In OPay app, they have integrated ORide and OFood service.

- User can talk with customer executive from the app itself.

► Integration to banks

It will take some more years to have eWallet which is as capable as a bank. For now, eWallet apps depend on the brick mortar banks. Any transaction which users make through eWallet cannot reach to successful state without the API service of the bank. Thus, an eWallet app development company has to integrate APIs of all potential banks in order to allow users to pay from any bank to any bank.

Coruscate Solutions is among a few eWallet app development companies which have successfully achieved API integration with Nordic banks.

► Business model

Crafting a profitable business model is perhaps the most fundamental need. But when it comes to the eWallet industry, there is a lack of business model innovation seen everywhere.

Most of all eWallets are making money from the commission they get when a user pays for goods and services to a merchant. This is why they are not only seeking more users but more merchants too.

However, a few companies like OPay allows users to send and receive money internationally and charges a healthy percentage of transaction fee which is another revenue stream of them.

Some e-Wallets like M-Pesa, letting users pay via SMS and charges different fees even for this historic method of payment!

OPay, on the other hand, has added its two very purposive services, ORide, and OFood into its eWallet just for the sake of more revenue streams.

Overall, the scope of business model innovation in eWallet business is very limited. However, by adding more features into your app, you can generate more revenue.

Connect with our business expert and app scientist to know the legal ways to double your revenue from eWallet.

► User engagement

An eWallet app stores very sensitive data of the users in an online environment and so, people generally don’t prefer it over banks.

To address this issue, all eWallets app providers pay more heed to the security and privacy of the eWallet app and burn the candle from both sides to win the trust of users. They even regularly offer them cashback and other rewards.

Talking about the OPay app, it is equipped with encrypted data storing method and compliant with PCI DSS.

So, if you don’t want to suffer from less user engagement, hire an eWallet app development company that is clever enough to develop a user interactive and secure eWallet app with reward and cashback features.

► Satisfying Legal Norms

As stated earlier, when a government changes rules regarding the online transaction, some business logic of the eWallet app is needed to rewrite because your eWallet is dealing with money and the government of every country seems lethal about it!

So, app rewriting is the only choice. But app rewriting is a challenge if your hired eWallet app development company didn’t bother to share the source code ownership with you. In such a situation, your business effects to a great extent as you may require to stop all business operations.

We, at Coruscate, share the 100% source code ownership with the owners. We even remain the business partner of our FinTech app development’s clients for a very long-time period and if needed, we rewrite the app while making sure that their business keeps running smoothly.

So, after reading so far, if you count yourself in and want to develop an eWallet app like OPay, here is the least possible cost of eWallet app development.

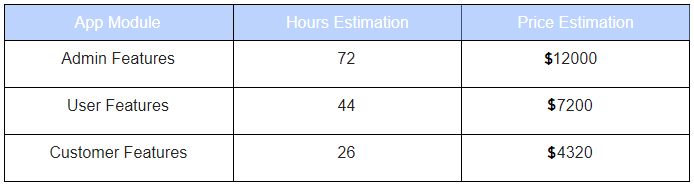

How much does it cost to develop an eWallet app like OPay or OPay clone app?

Coruscate Solutions is the top FinTech app development company, having noteworthy knowledge in eWallet app development too. Daily, we are entertaining numerous FinTech and eWallet app development related queries. We accommodate 200+ highly skilled developers and designers who know all possible ways to develop a secure eWallet app. Since we have already achieved successful API integration with Nordic banks, the time and cost to develop the eWallet app are reduced significantly.

We can now develop an eWallet app within 45-55 business days and under $10k. To know the detailed pricing structure, refer the following image.

To know more about any kind of FinTech app features and ask for a demo, contact us today.