P2P lending app development: A comprehensive guide to start P2P lending company and to develop P2P lending app like Possible Finance which has raised $10.5 million

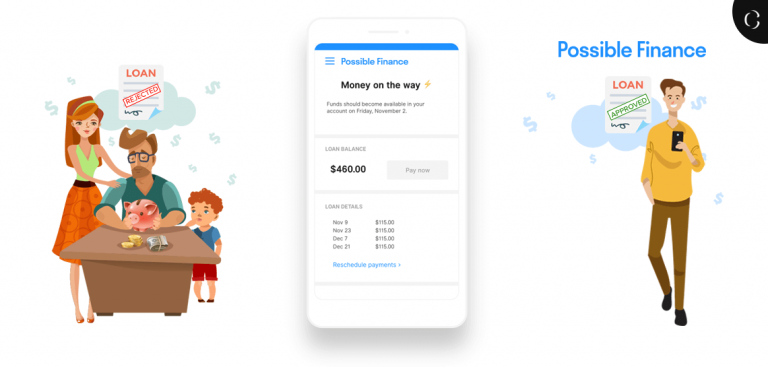

Lending money has always been a vicious cycle. The people who don’t have enough money to cover their bills and want to borrow the money, feel like a victim of abysmal credit check process, higher APR (Annual Percentage Rate), and short pay-back time-window. However, limitations of the lending industry can make you rich if you implement strategies like Possible Finance and develop a similar kind of P2P lending app.

In this blog, we will discuss how you can kick off P2P lending business and develop P2P lending app like Possible Finance which has recently raised $10.5 million.

Identifying the problems is perhaps the most fundamental step to start a P2P lending company as problems inspire people to opt for a company which offers solutions. A successful lending company always puts emphasis on practices to be the active part of user’s life through a series of positive online and offline interaction in order to know the problems they are facing and degree of those problems. Branch which is one of the most popular P2P lending companies in Africa has managed to be the only choice of African people by putting problems to bed.

Here is a list of problems people face while lending money.

- Difficult to make a monthly payment/ instalment

- Episodic loan approval

- Lending limits

- Long-winded process and operations

- Higher APR

- Dependency on credit score

If we talk specifically about Possible Finance, then two major limitations of P2P lending business which are related to credit score and APR stimulated venture capitalist Rebecca Lynn to get Possible Finance off the ground. They charge a little APR to the borrowers where payday lenders charge astonishingly high annual percentage rate – 591%. Possible Finance, in addition to charging a tolerable APR, also lend money to those users with the worst credit score or no credit score at all.

Over the duration of the relationship with users, customer experience is the elementary product of the interaction between you and your users. Your way of offering service always matters. Thus, after finding problems and solutions, make sure you create an efficient and user-friendly way to cater ultimate customer experience to be the beneficial choice of users.

Using the services of Possible Finance benefits users in so many ways. They approve the loan request of users in 24 hours, without bothering to check the credit score of users. They give extended time-window to repay the amount of loan. Their APR rate is relatively very low. They also share the user history of repayments with the credit agency to boost the credit score of the users.

To offer the ultimate customer experience and satisfy the value proposition, a robust mobile app is a fundamental need. It is known to everyone that a tiny mobile app is a driving factor behind the success of any kind of online business. It helps you to deliver core values of your P2P lending business to the customers in the most efficient and easy way.

The mobile app of Possible Finance is the best example of how an app of P2P lending company should look like and act like.

Following are the top features of Possible Finance app which you can ask P2P lending app development company to integrate into your app.

- The app doesn’t ask users to add comprehensive personal details.

- User can add the amount he wants to borrow.

- User can also select the payback date within the time period of 30 days.

- When Possible Finance approves the user’s lending request and transfers the money to the user’s bank account, he gets notified.

- The app reminds users to pay the instalments.

- In case of any issue, the user can connect with one of the customer executives of Possible Finance from the app itself.

- The app shows the credit score user has built by paying instalments on time.

- Here, it is worth to mention that apart from app features, there are a few other things which you need to consider while outsourcing a P2P lending app development project.

A P2P app is the part of FinTech app development and a FinTech app is not possible to develop without the payment integration. Possible Finance can deposit the money directly to the bank account of the users and users can pay the installments from their bank account to the bank account of Possible Finance which is feasible because of the precisely integrated payment gateway and processor in the mobile app. A property integrated payment gateway and processor allow users and you to carry out all online transactions in a very seamless way, unlike a poorly integrated payment gateway and processor.

Another vital thing you need to consider while outsourcing P2P lending app development project is related to the legal norms of the counties where you want to operate online P2P lending business. Each country has documented rules and regulations to perpetuate the online transaction. So, consider those legal norms and discuss it with P2P lending app development company to keep yourself away from legal trouble.

Additionally, deciding the app development approach is also an essential requirement to develop P2P lending app like Possible Finance. You can either opt for app cloning approach or custom-built app development approach. However, both app development approaches have their own limitations related to app performance, development cost and development time which puts you in dilemma.

We, at Coruscate, help entrepreneurs and business owners to choose affordable and swift app development approach to develop P2P lending app.

Now, in the last section of this blog, let’s discuss how you should govern the non-technical things of your P2P lending business.

How to manage the money-flow and manpower in P2P lending business.

Money and the number of working people are two crucial resources for every business. Any poorly implemented strategy to govern the money and manpower can cause a big financial loss.

Possible Finance runs its business with just 14 people of staff without clogging any business processes. They have achieved this level of efficiency with their resource allocation technique. If you want to make your P2P lending company as efficient as Possible Finance, find out all major business processes of your company and allocate only the necessary resources on each process. This will also increase revenue per employee.

If we talk about the business model of lending companies, then they earn the most percentage of their revenue from the APR. However, relying on only one revenue stream never help you to earn more. Thus, we encourage you to add a product referral feature in the app. It recommends services or products of other companies to the users of your app and if a user buys that product or service, that company pays you.

Coruscate Solutions is one of the leading P2P lending app development company. We have entertained 200+ queries related to P2P lending app development and developed 5+ successful P2P lending apps. Our teams of, developers, designers, and business experts help you to not only develop a next-gen P2P mobile app, but to study the market scope and market need, and to craft a profitable business model. With our rapid app development techniques, we deliver the app within 45-55 business days. To know more about pricing and features of P2P lending app development, visit our FinTech App Developmentpage. We also provide a free consultation. So feel free to ask for it.