Want to Keep up With The Changing Banking Trends? Hire Fintech Developers for best Banking Solutions

With the advancements it brought to various industries, even the banking industry is not left untouched by the sparkling effects of technology. When people hear about Fintech they are compelled to think about the latest mobile app which can help them pay for their things without even swiping a card.

The Important Finance Industries Disrupted by the Fintech App Development

The Fintech startups are getting their breakthroughs by using the brand new applications for their business. Recently, N26, a fintech startup made it big raising a series D round of $300 billion. The company is now being valued at $2.7 billion. N26 has proved how providing effortless but pleasing banking to the customers pays off in the end!

The new trends in banking bend towards being customer-oriented. Providing services is just not enough, the user should feel the experience. Engaging customers is the new style of business. The customer anticipates this elegance to come naturally to you. They are unable to digest when something doesn’t work out according to their taste. They want you to challenge all odds and emerge victorious like a hero.

HOW DID N26 GROW IN BANKING BUSINESS

To understand is more important than to have knowledge about something. Everyone has knowledge of how to do a banking business. But, to understand how to make a difference is what takes you forward.

Working of N26 is simple and smooth. They do it the customer’s way. By making the banking painless and uncomplicated, people at N26 turn their customer’s most frustrating experiences into a sheer delight.

N26 brought a change in the traditional world of banking which operated in a physical world. They made an effort towards reducing the piles of paperwork. They focused on the survey conducted by Viacom which showed that almost 90 percent of people across US, Germany, Switzerland and Austria didn’t want to visit banks and have accepted technology for their day-to-day functioning. People wanted their work to be done at the tap of a button.

N26 worked on their technology to provide a trouble free and happy banking experience. They are currently live in 24 European countries with 2.3 million customers. Are you pondering over how they could manage to come this far?

The interesting features that N26 adopted to build the fintech mobile app provide you with all the answers.

» Signing up made simple: They made it possible for a person to sign up with only some pictures of ID proof that is required for the process. For the face-to-face identification, they made it possible through a video call in the comfort of your home.

» Login with Face ID: Login was made simple but absolutely secured with Face ID. No other person but you could open the account. So, it’s really safe.

» Unbeatable Control on your account: Security is most desired when it concerns money.They provided the in-app card settings that could be used for setting payment limits , locking your Mastercards and disabling abroad payments. All this, just at your fingertips.

» Letting Multiple accounts under one login: In the app, N26 lets one create upto 10 accounts under one ID, so that you can manage your finances easily. Transfering money in these accounts in just a simple drag and drop.

» Creating own peer-to-peer money transfer: They have created a peer-to-peer money transfer system for their customers to transfer money using just an email or phone number.

Isn’t is mind-boggling for your customers to find such awesome features in your app. You could think of some more features to make your app stand out in the killer competition. It did strike a cord inside you, didn’t it? Now, you must be wondering about the cost to build a mobile app for your fintech startup and where to hire fintech developers.

What’s new with N26 a Fintech Company?Updated on – 19th July 2019

Recently the Fintech startup N26 has raised $170 million a few months after raising $300 million. Though it is technically a new round of funding, they are considering it as an extension of the previous round. All the previous investors are involved in this round of funding too. They are – Insight Venture Partners, GIC (Singapore’s sovereign wealth fund), Tencent, Allianz X, Peter Thiel’s Valar Ventures, Earlybird Venture Capital and Greyhound Capital.

The company has raised its valuation by 30% and with this new funding, N26 has now officially reached $3.5 billion. The company is said to have raised $670 million as a total amount till today and is one of the highest valued Fintech startup in the world. N26 has recently launched its challenger bank in the US. They are also planning to expand to Brazil in the coming months. The company wants to launch more products to make it simpler for their clients to manage their money. The features that they are offering are based on Spaces. They are the sub-accounts that allow you to separate your money in various pools and ultimately share Spaces with other people.

While talking about the future of N26 CEO Valentine Stalf declared that there are different card colors and they are trying to differentiate the premium tier and mid-tier cards. People will be able to attach different cards freely to different Spaces. They are trying to build more flexible bank account for the users to live and think their way.

While talking about the new design update, Stalf said that the visuals in the app timeline would be changes and it will be made smarter. They wish to integrate customer support and integrate transactions which never works before. They are trying to launch the functions and infrastructure like starting a customer service interaction directly from a transaction, straight to live chat.

Stalf also told TechCrunch about their opportunity to build a bank that has more than 50 million users all over the world.

At Coruscate, we have made it our mission to help startups like you expand and spread far and wide. We provide a supreme solution for all your technology-related problems which is also cost efficient. Our partnership can help you in developing your idea into a full-blown mobile app. We strive to build the bridge between success and you. We have developed many such fintech mobile apps and have helped a lot of companies to prosper. Give us a call to discuss further. We always aspire to deliver a product exceeding your expectations.

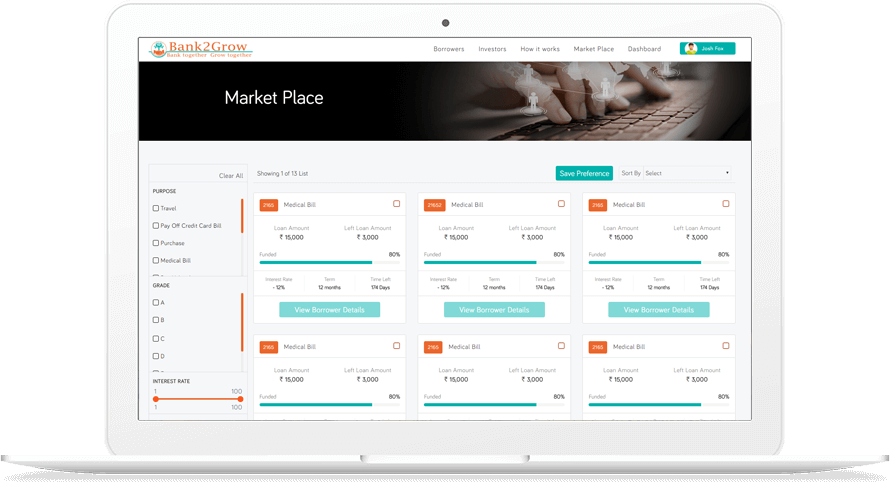

Our Recent Work:

» Bank2Grow

How Our Application Helped A P2P Lending Company With Customer Acquisitions?

Also Read :

» How Use Of AI In Fintech Enables P2P Lending For Better Customer Experience?

» How FinTech is evolving with money transfer service?

» How Business Intelligence Plays Game-Changing Role In Fintech Companies?