How Use Of AI In Fintech Enables P2P Lending For Better Customer Experience?

Today you are using artificial intelligence every day even if you don’t notice it. Virtual mobile assistants, chatbots, and others – all these technologies are already integrated into a large number of mobile devices. But apart from the fulfillment of common tasks,AI in fintech makes the process of lending fast and efficient, cutting down both expenses as well as manpower. Even more importantly, it does not allow the personal bias of the credit officer cloud credit decisions.

AI can help you deal with financial issues as well, and you can do it successfully. How AI in Fintech can be applied and other Financial Services? Our goal is to find out it.

Loan documentation used to be a bulky process but now lenders are employing artificial intelligence that makes the process not just faster but also error-proof and secure.

AI can process the applications within seconds, making the approval process truly scalable. This also reduces the chances of default and higher risk loans as it benchmarks the market data to categorize loans with higher chances of default.

hus, AI in fintech makes the process of lending fast and efficient, cutting down both expenses as well as manpower. Even more importantly, it does not allow the personal bias of the credit officer cloud credit decisions.

Artificial intelligence also helps firms to fine-tune their systems and therefore, prevent them from hackers and cyber-attacks. Moreover, artificial intelligence algorithms have the ability to automatically identify the necessary data and segregate it from the bulk of information.

AI is a critical enabler in digital P2P lending. It has replaced the branch-led model with a credit algorithm that is impartial and structures its decisions only on the basis of cold hard data.

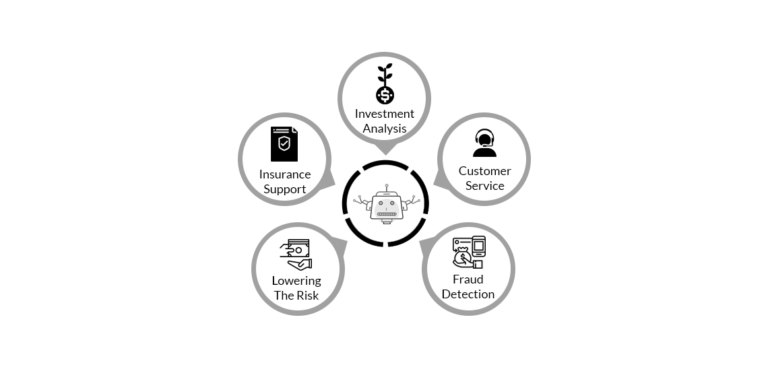

Capabilities of AI in Fintech

There are a few main ways how to use AI today in the financial world. We list all of them.

1. Advanced Customer Service

The process of communication between employees of financial services and an ordinary customer is rather easy – it can be done with the help of online chat or smartphone.

As a rule, such specialists can really help you solve main issues, but we cannot exclude human factor – people can make mistakes, and also it can be difficult sometimes for them to give you a right piece of advice. That is where AI can come to the rescue. Today in customer-support interaction between two technological solutions can be offered.

2. Fraud Detection

This subject is very topical since we all want to keep our funds safe, right? And artificial intelligence can be the first technology that will help us do it. The matter is that AI-based fraud prediction system can learn millions of possible fraud attacks, memorize them and analyze.

Moreover, this system can work round the clock, any fraud attack will be blocked quickly. Apart from this, the system learns the way how customer acts, and the detects the differences from a habitual manner.

While integrating AI into your financial services it will protect your customer from any unwanted attacks, and it will be an added bonus to your service.

3. Lowering the Risk In P2P Lending

P2P lending organizations can also benefit from AI since they can analyze the behavior of customer and detect all potential risks in cooperation with a customer.

When a customer plans to borrow money, nobody knows how reliable he or she is. So here, AI in financial services plays a great role. This AI-based system will help to verify it. In addition, neural networks will scan all documents of the borrower to avoid any possible fraud cases.

Thus, the process of documents verification can be automated completely, and it will lower the number of possible errors and failures.

4. Improved Insurance Support

Many insurance companies already start using AI in their working and financial process. AI can help assess the level of damage if something happened to the car insured or house. It means that AI makes it possible to increase the level of customer service in the insurance field as well and prevent new incidents. AI-based chatbots can also be used in this field to give good recommendations to customers. AI enhances your service significantly.

5. Enhanced Investment Analysis

Here AI can become a very useful addition for hedge funds. Such funds are created for rich investors that are looking for good sources to invest their money. AI in financial services can automate this process and make it more secure and precise.

In the nearest future, AI will be used as a tool to work with stock exchange operations since it will automate the whole process in the future. Hence, AI in financial helps to make predictions regarding upcoming prices and perform analysis of the market. Investors can find more opportunities that will work with AI – it will bring more profit for them.

Conclusion

As we can see, AI has a great potential to be used in your financial services. Technologies are developing and artificial intelligence becomes something common for us. The financial area can really benefit from AI and smart chatbots will tell you how you should spend your money wisely and how you can make money with bots?

Actually, AI will simplify our life and make all financial processes more secure and faster. Hence, it is the best opportunity for lending startups to develop P2P lending app or fintech apps. What are you waiting for? Let’s have a call to shape your idea in form of application.